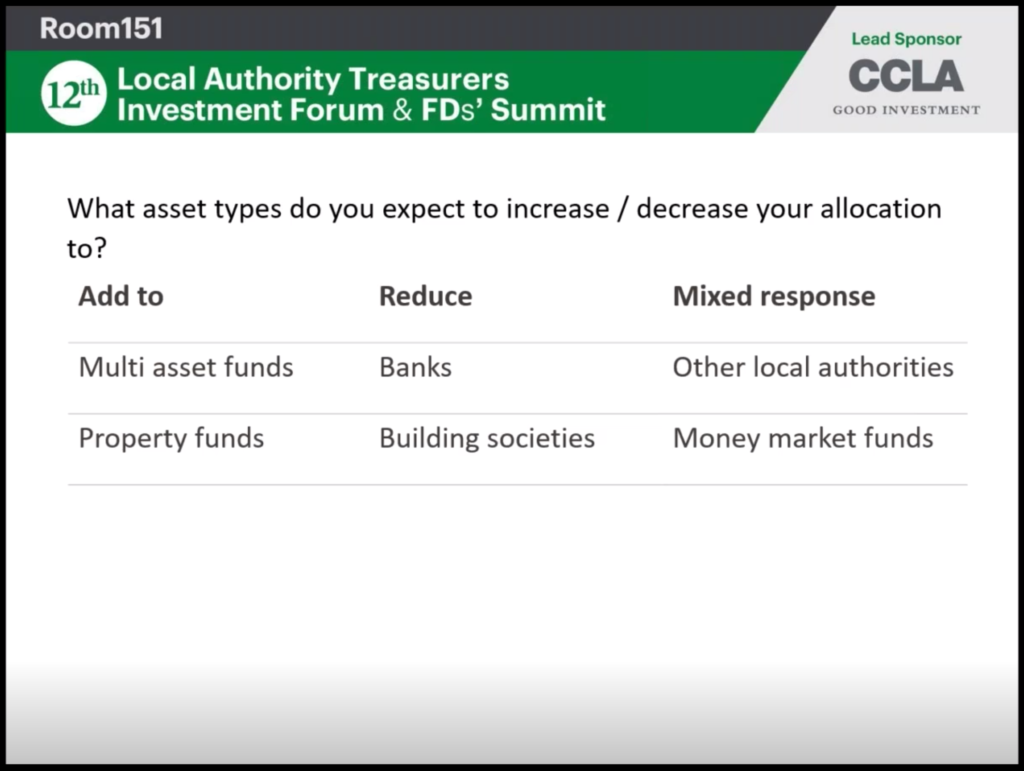

Treasurers expect to see their investments in multi-asset funds and property funds increase during 2021 against a backdrop of pessimism about the yield that can be achieved on council assets in the year ahead.

The news comes from results of a Room151 and CCLA survey delivered at this year’s Local Authority Treasurers’ Treasurers Investment Forum (LATIF).

The survey revealed treasurers said they would reduce balances in banks and building societies.

Meanwhile, respondents—130 treasurers and 151 officers—offered mixed views about investing with other local authorities and money market funds.

John Kelly, director of client investments at CCLA, delivering the survey results, said investment in multi-asset and property funds were “excellent choices”.

He said respondents were split evenly over local authority peer-to-peer lending and money market fund investments.

“I suspect it’s a case of pressures on asset base, pressures on spending and looking to see that those assets that give the least return are reduced first,” he said.

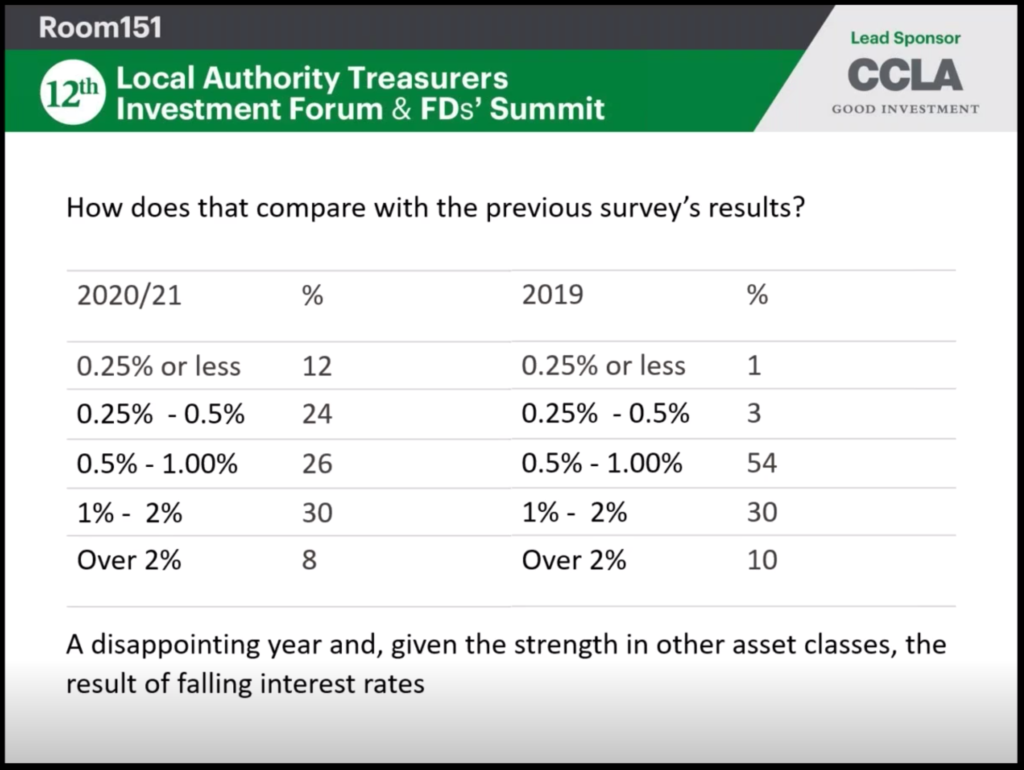

On yields, Kelly said it has been a “pretty flat year”. In 2019 only 4% of respondents earned 0.5% on investments or less. That jumped to more than a third of respondents, 36%, in 2020-21. Last year more than half respondents, 54%, made 0.5-1%. This year that figure halved to 26%.

“But what’s happened there,” said Kelly, “is that people are focused not just on capital volatility but income volatility too and diversified portfolios where income can be a little bit more predictable.”

For the past two years, around one in ten earned more than 2%. “There’s this persistent group who managed to earn a little bit more,” said Kelly. “Not dramatically more, these are challenging times.”

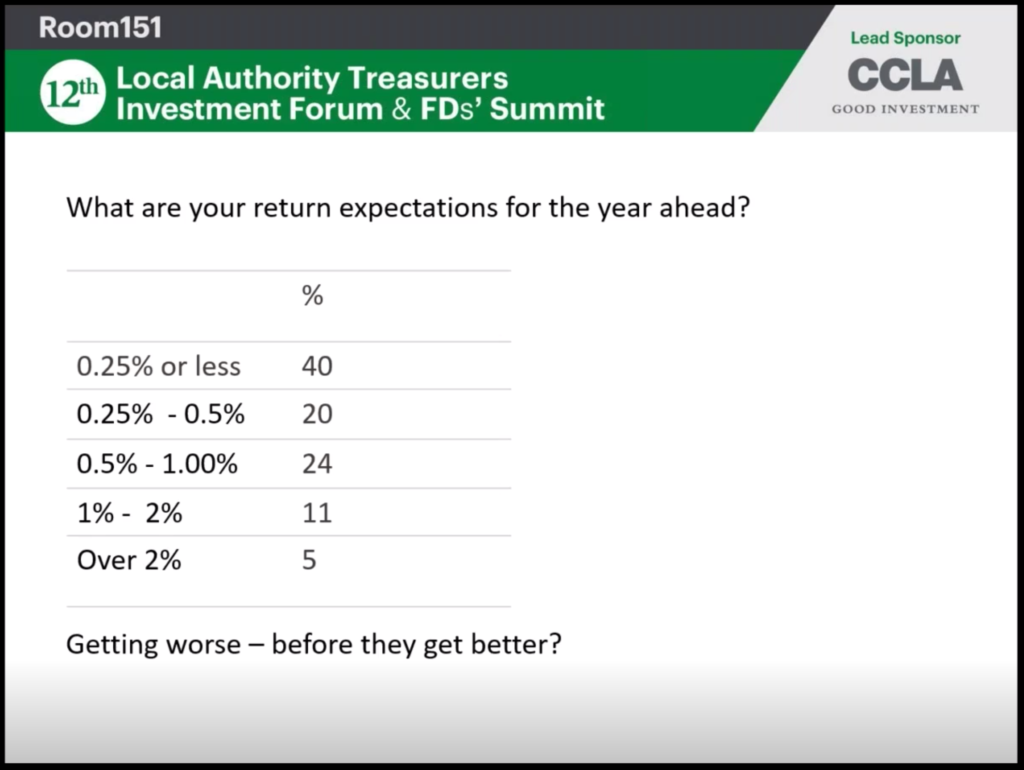

However, respondents forecast a worse year ahead: 60% expect returns of 0.5% or less. Only 5% expect earnings above 2%.

“This is an environment where [respondents’] own forecast is that rates are going to stay low,” said Kelly. “These unhelpful returns are not going to change any time soon.”

Most respondents, 65%, said they expect the value of assets to fall in 2021, while around a quarter expect their portfolios to hold the same value. Fewer than one in ten expect their asset values to rise.

“That must be spending driven,” said Kelly. “We don’t think it’s investment related. Our views for this year are quite optimistic. We are expecting gains from equity prices, we expect property to be back into positive territory. Only bonds are a worry.”

FREE monthly newsletters

Subscribe to Room151 Newsletters

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel