Against a backdrop of negative real returns on cash many corporate and local government treasurers are looking for alternative solutions, writes Rory Sandilands.

Short-dated corporate bonds which are relatively close to maturity can help investors to capture attractive yields with minimal interest-rate sensitivity, low portfolio volatility and good levels of liquidity.

The unique characteristics of short-dated bonds offer investors an opportunity to access a lower-volatility segment of the broader investment-grade fixed income market.

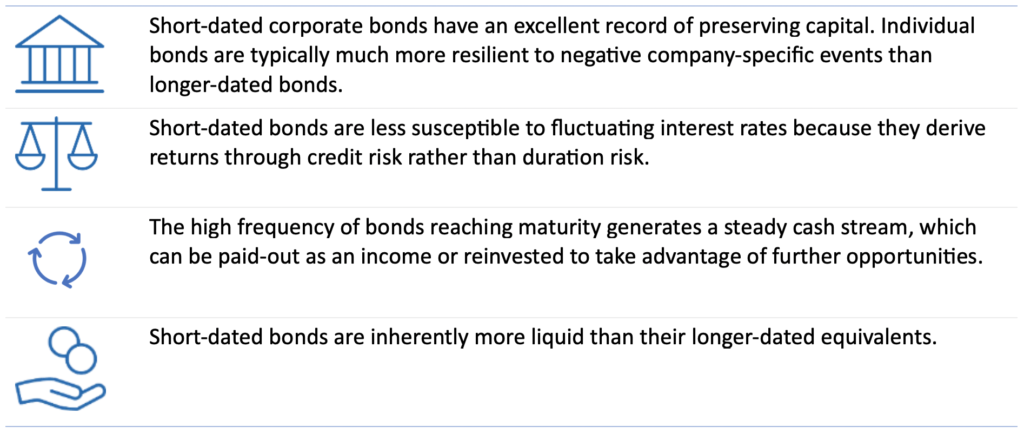

Why consider short-dated investment grade bonds?

Short-dated bonds have a record of generating attractive risk-adjusted returns. Key characteristics are:

Short-dated investment grade bonds can be attractive to a diverse range of clients, including treasurers seeking enhanced returns above cash; pension schemes undergoing de-risking; life and general insurers; and wealth management clients focused on preserving capital.

Short-dated investment grade bonds can be attractive to a diverse range of clients, including treasurers seeking enhanced returns above cash; pension schemes undergoing de-risking; life and general insurers; and wealth management clients focused on preserving capital.

12th Local Authority Treasurers Investment Forum & FDs’ Summit

NOW A VIRTUAL EVENT + ZOOM151 Networking

Jan 21, 22 & 23, 2021

Our approach

We believe it is beneficial to adopt an active benchmark-agnostic approach with a global remit. This provides a wide opportunity-set, while offering flexibility to allocate between the best opportunities in the global short-dated fixed income market. Rigorous analysis that prioritises fundamental credit research has resulted in an approach which helps avoid defaults.

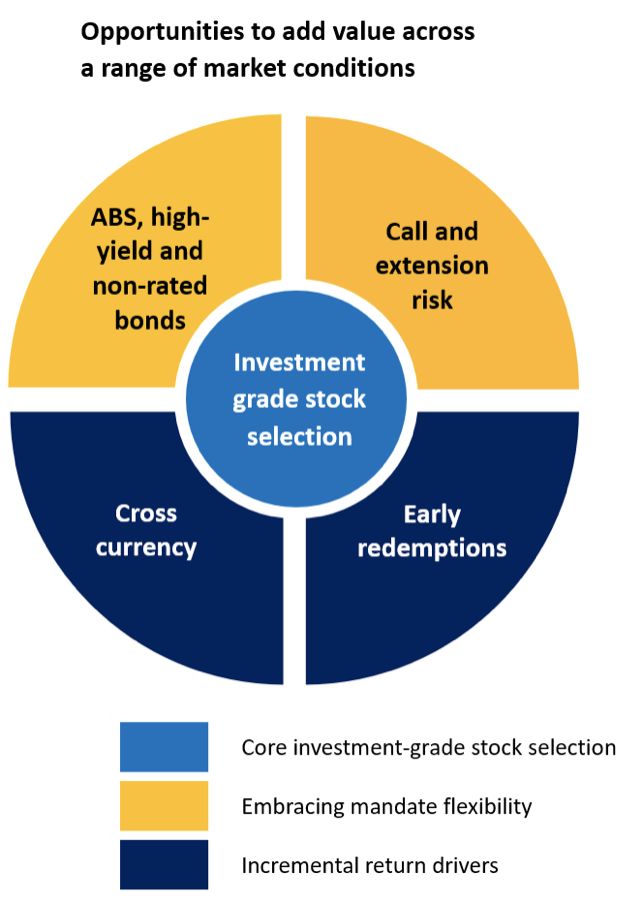

We are active, high-conviction managers who seek to exploit long-term and short-term market opportunities and inefficiencies. We seek to add value in multiple ways, each of which can take priority at different stages of the market and economic cycles.

We are active, high-conviction managers who seek to exploit long-term and short-term market opportunities and inefficiencies. We seek to add value in multiple ways, each of which can take priority at different stages of the market and economic cycles.

Our primary source of added value is through investment-grade stock selection. As a team we believe that avoiding default risk is key in buy-to-maturity portfolios. We favour companies with clearly visible credit profiles over the short-to-medium term. A major consideration is the ability to refinance upcoming maturities.

We have some flexibility to take advantage of opportunities in high-yield and non-rated bonds and asset-backed securities. This can help us to diversify the portfolio and offers the potential to enhance the yield.

We also seek to add incremental value from other non-core areas. For example, we believe that taking a measured exposure to bonds with extension risk can materially increase yield, with sufficient spread compensation for the risk taken.

Another area in which we can add value is in cross-currency opportunities, where a global approach opens-up a larger and more liquid opportunity set, which can increase diversification and potentially yield. We also seek to benefit from opportunities to enhance returns through the early redemption of bonds on favourable terms.

Room151’s Monthly Online Treasury Briefing

November 27th, 2020

Money market funds and deposit accounts

Register here with a .gov.uk email address

Our experience and analytical skills give us the confidence to manage high-conviction portfolios of our best ideas. We fully embed the analysis of environmental, social and governance factors into our traditional financial analysis, a key consideration when evaluating issuers.

The result is a portfolio of around 100 issuers, diversified by sector and geography, with all bonds of less than four years to expected maturity and a significantly lower carbon footprint than the underlying index. Although globally diversified, the portfolio is hedged back to sterling for UK-based investors and is available through a daily priced UCITS fund structure.

Rory Sandilands is an investment Manager at Aegon Asset Management.

Rory Sandilands is an investment Manager at Aegon Asset Management.

For more information about the Aegon Short Dated Investment Grade Bond Fund please contact Alex Ross on alexandra.ross@aegonam.com or visit www.aegonam.com.

FREE monthly newsletters

Subscribe to Room151 Newsletters

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel