Sponsored article: It’s been an uncertain end to a crazy year, but one thing is clear: Low rates are here to stay.

A global recession, rising COVID cases and uncertainty about vaccines and politics make for a difficult investment landscape.

Bond yields and cash investment rates are near record lows and in some cases are negative (UK 10y gilts currently 0.34%, US 2y T-bills at 0.18% and German 2y bunds at -0.74%). The Bank of England cut interest rates in March of this year to 0.1%, their lowest ever level and the outlook for very low rates doesn’t look like changing in the foreseeable future.

Many major central banks have recently shifted towards even more aggressive policy easing measures. For example, at its latest meeting the Bank of England expanded its QE programme by £150bn for another year.

12th Local Authority Treasurers Investment Forum & FDs’ Summit

NOW A VIRTUAL EVENT + ZOOM151 Networking

Jan 20, 21 & 22, 2021

What does this mean for local government?

Local government faces unprecedented challenges—reduced income combined with increased demands across a range of major issues including adult social care, vulnerable children and young people, public health, climate change, local economic recovery and investing in local communities which require a whole new way of thinking.

The Covid-19 crisis has precipitated further financial constraints and investors need to make their assets work much harder, juggling liquidity requirements against the need for higher yields. Investors also need to take into account their short-term cash flow requirements, the general outlook for short to medium-term interest rates and the creditworthiness of investment counterparties whilst also avoiding taking on inappropriate risks.

Money market funds have historically been the liquidity vehicle of choice as they have usually offered better returns than holding cash or Treasuries. But that is hard to offer when the Fed is pushing rates down to zero, as it did in March. Rock-bottom rates will mean that short-term funds will be able to offer little if any return.

Highly rated government bonds have also provided one of the less risky asset classes for investors, but the risk/reward balance is currently very asymmetric with global government bond indices already near their highest risk levels, which implies significant loss potential if yields rise.

Simply buying and holding bonds is not a reliable source of returns in the current environment as bonds are no longer inherently defensive or reliable for portfolio risk diversification. Conventional bond funds focus on the income earned from holding bonds and trying to predict the direction of interest rates or other macroeconomic variables.

Room151’s Monthly Online Treasury Briefing

November 27th, 2020

Money market funds and deposit accounts

Watch the recording here

Pure relative value – a possible solution

In contrast to this, a pure “relative value” approach to bonds focuses on specific pricing inconsistencies between closely related securities to deliver consistent volatility-controlled returns that are independent of the level of bond yields and direction of interest rates, with minimal correlation to broader market fluctuations and no exposure to credit or equity risk. For investors seeking alternatives to near zero or negative yielding cash and conventional government bond investments, relative value strategies can significantly enhance returns without increasing the major sources of risk.

Kerry Duffain, institutional client solutions, UK, Fidante Partners.

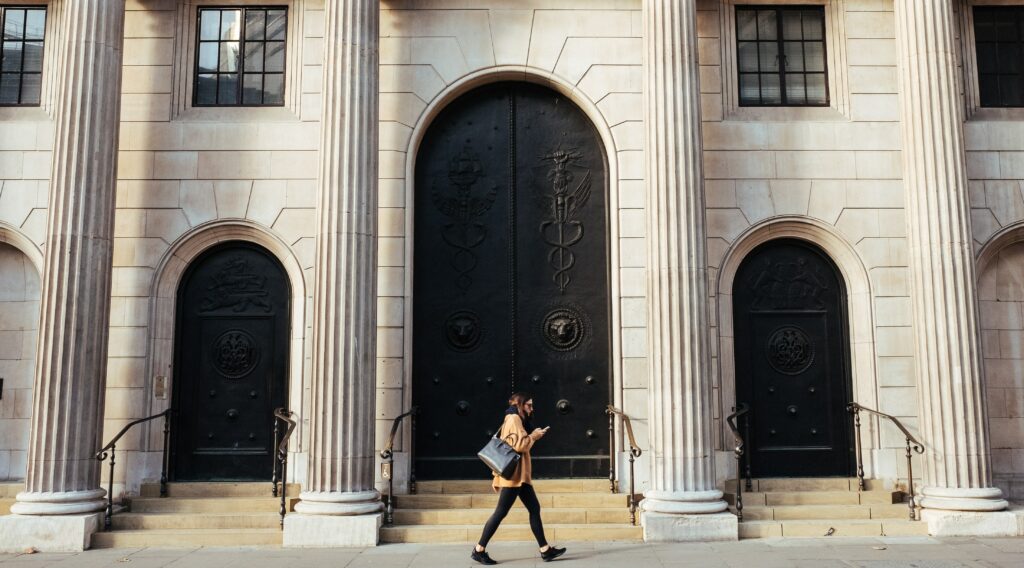

Photo: Robert Bye, Unsplash

FREE monthly newsletters

Subscribe to Room151 Newsletters

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel