St Helens Council has “never faced a more challenging funding position” as it reported an overspend of £4.505m for financial year 2022/23.

The overspend will reduce the council’s level of reserves accordingly, which a revenue and capital outturn report for 2022/23 acknowledged was a policy that was “not sustainable”. “Actions to eliminate this and replenish reserve levels form a key part of the council’s medium term financial strategy,” the report said.

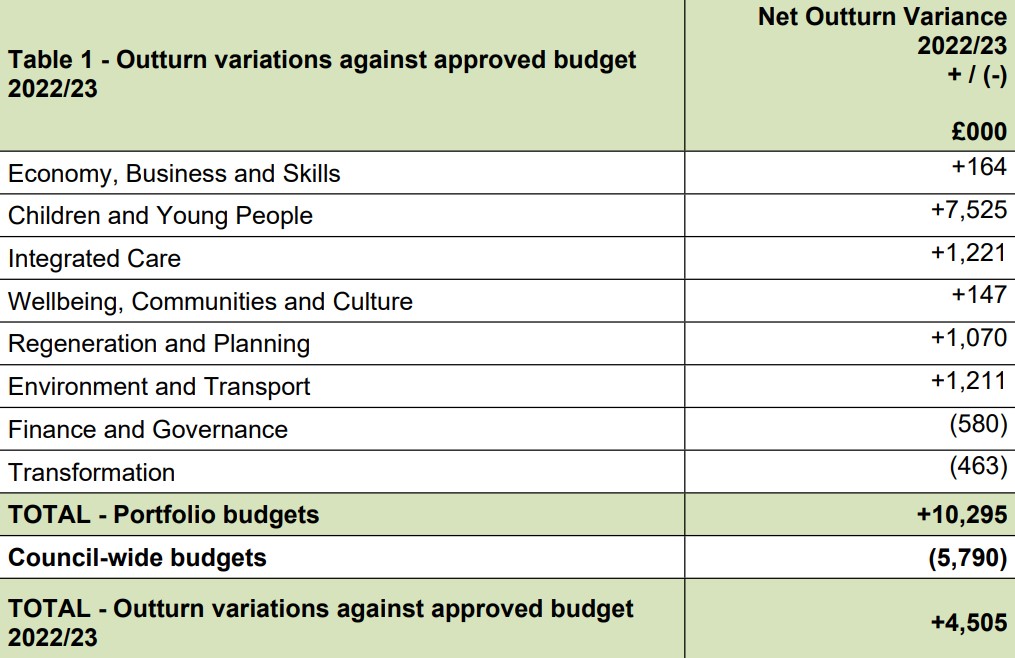

St Helens’ net portfolio spend was above budget by £10.295m, but offsets of £5.790m were achieved in council-wide budgets.

The report noted that the one-off variations that had helped mitigate the overspend included treasury management activity where additional borrowing to fund capital expenditure was deferred, while favourable bank rate movements increased market returns on investments. Although no new borrowing was undertaken by St Helens Council during the year, some may be required in 2023/24, according to the report.

There were also variances attributable to the settlement of the 2022/23 local government pay award of £3.171m, as well as those relating to increased energy prices totalling £1.469m.

The budget for 2022/23 included the planned delivery of £6.044m of budget savings, but £3.842m were either forecast to be unachievable or there was a delay in full implementation; £2.429m of which had no identified mitigations. Some £2.144m of these related to the reduction of placement costs for children looked after within children’s services, the report said.

The overall pressure for the children and young people portfolio in 2022/23 was £7.525m.

Inflationary pressures also had an “enormous impact” during 2022/23, the report noted, and are “likely to continue to be felt in 2023/24 and beyond”.

The financial outlook is of concern, according to the report, which said the challenging funding position the council finds itself in has largely been driven by “more than a decade of austerity and cuts in government funding”. The report added: “Given the current inflationary and wider economic environment, the crisis engulfing social care amid continually increasing demand, and the legacy of the global pandemic, 2023/24 is likely to be another financially difficult year.

“These pressures, coupled with the requirement to deliver £12.353m of savings in 2023/24, will require robust financial management.”

15th Annual LATIF & FDs’ Summit – 19 September 2023

250+ Delegates from Local Government & Investment

The report, credited to Cath Fogarty, executive director of corporate services and Noel O’Neill, interim director of finance, recommended that there to be no reductions to any directorate budgets in 2023/24 arising from the outturn position for 2022/23.

The council’s financial procedure rules and budget strategy stipulates that any overspend in one year is funded by a corresponding reduction in the relevant departmental budget in the subsequent year, but the report said this should be overridden “given the likelihood of extreme pressures on departmental budgets in 2023/24 and the significant overspend position in 2022/23”.

—————

FREE weekly newsletters

Subscribe to Room151 Newsletters

Follow us on LinkedIn

Follow us here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel