Dan Bates crosses his fingers for “no nasty surprises” in this week’s funding settlement but argues the “bigger prize” is post-Covid financial certainty.

Thursday (17 December) should be the day that the 2021–22 provisional settlement is announced. It will be the second consecutive one-year settlement necessitated this year by the Covid-19 pandemic, following on from last year’s Brexit general election.

However, the significant impacts of the pandemic, the uncertainties associated with Brexit, combined with years of reduced funding and social care demand pressures have left local government in a precarious financial position. Two councils have issued s114 notices in recent times, and a number of authorities are in discussions with government about capitalisation directives as they seek longer-term budget balance.

Short-term survival, medium-term stability and long-term fairness

With the settlement this week, the MHCLG must surely be seeking to provide some stability for local government in the short-term to minimise the risk of further Section 114s. Beyond this, longer term financial sustainability across the sector should be a precursor to finally implementing genuine fair funding and achieving the Government’s stated and important objective of ‘levelling up’.

To achieve all of the above in the current financial and economic climate will be tricky but there are a number of things that government might do, starting with the settlement, to set off in the right direction.

A small but significant step might be to drop the spin around the use of “spending power” which uses higher than inflation increases in council tax to give the illusion of a more generous settlement. This might strengthen the working relationship between central and local government around a shared acknowledgement of, and determination to address, the difficult financial position. In any case, the spending power metric fails to stand up to a more than cursory analysis as I will point out in a bit.

What to expect from this year’s settlement

The spending review has set out many of the aspects of this year’s settlement and there shouldn’t be too many shocks. Government has rightly focussed on the short- term goals of support to address the pandemic and the announcement of local government Covid funding for next year will undoubtedly be welcomed.

The main elements of the settlement will include:

- Indexation of revenue support grant and baseline funding levels which will see modest inflationary increases to government funding;

- Council tax referendum criteria which should see up to 5% increases for councils with social care responsibilities and 2% for district councils;

- Additional £300m social care grants (although only half of this is new money);

- Announcement of additional £1.55bn of further Covid support as well as £762m to cover 2020–21 council tax “irrecoverable losses”, further local council tax support grant and guidance on :deficit spreading”;

- A reduced new homes bonus which will include a reward for 2021–22 and only two legacy payments. More than anything else, this might result in an unanticipated spending power shock, particularly to some districts.

With the exception of the new homes bonus reduction, MHCLG has sought to maintain an element of short-term stability, albeit with three quarters of the heralded 4.5% increase in spending power coming from the council taxpayer.

Medium term certainty

Arguably the greater risk to financial sustainability for local government sits in the medium term and much of this arises from uncertainty.

This is where, in my view, the government needs to do a better job. Financial planning is difficult when funding pressures exist, but this is made many times harder by a lack of clarity in respect of structures, processes and mechanisms.

To this end, implementation of the fair funding review should not only lead to multi-year settlements but also end the dithering about the future of new homes bonus and rates retention. Further clarity on devolution and local government reorganisation would also help.

Without wishing to open a whole new can of worms, a clearer position on PWLB lending that unequivocally allows authorities to support good post-Covid regeneration projects that might include elements of commercial yield would be another bonus.

Fair Funding review the key to levelling up

So, if this year’s settlement avoids shockwaves and supports councils to survive until the fair funding review brings more certainty in the medium term, then the longer-term objective must be fairness. This has been recognised more widely by the government as evidenced by frequent policy references to “levelling up”. However, if it is serious in this respect then it needs to recognise that the existing funding system does quite the opposite to levelling up. To prove this, my analysis uses the government’s favoured metric of spending power.

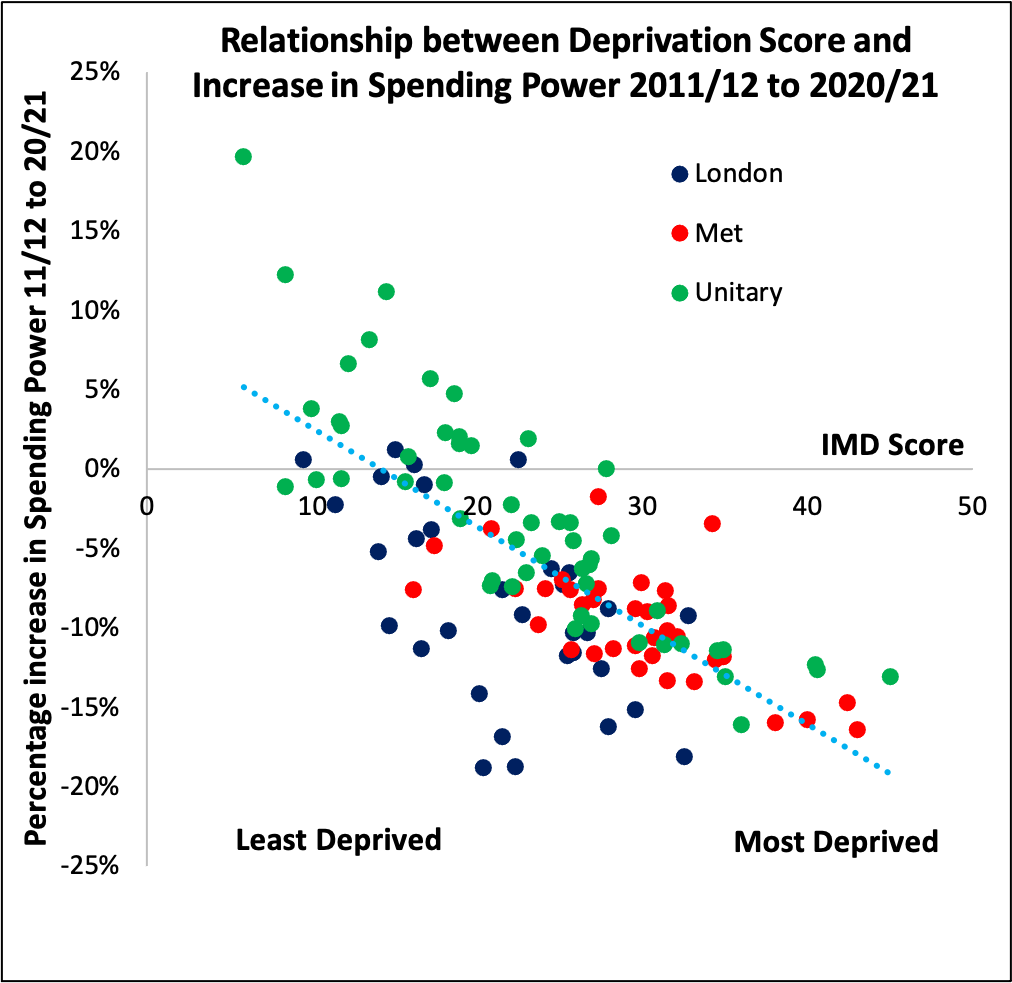

The analysis in the scatter chart (above) shows that there is an inverse relationship between deprivation and spending power changes over the last ten years. It is those authorities with the highest levels of deprivation (as measured by indices of multiple deprivation) that have suffered the biggest reductions in spending power.

The significant redistributions shown in the analysis have been brought about by administering roughly equal percentage cuts in central funding (particularly between 13/14 and 15/16) as well as consistently applying council tax criteria to all authorities. This had the effect of significantly higher cash funding reductions to high needs authorities as well as much higher cash increases to low needs authorities with larger council taxbases.

This year’s settlement will further widen the gap shown in the analysis as three quarters Spending Power increase that comes from council tax will again disproportionately benefit high taxbase authorities.

Levelling up of this position can only be achieved through the fair funding review by the reintroduction of formulae which distribute funding according to assessed needs and by equalisation which seeks to redistribute resources to take account of differential abilities to raise tax locally. Funding formulae were an arguably necessary part of the settlement until they were abandoned in 2013–14. Whilst those of us involved in the process argued about the relative importance of deprivation, sparsity and council tax, most accepted the system as reasonably fair.

So hopefully this week’s settlement won’t contain any nasty surprises. The bigger prize, though, would be a commitment by government to deliver post-Covid, longer term certainty and stability through a renewed focus on a fair funding review which targets genuine ‘levelling up’.

Dan Bates provides the financial resilience service for Pixel Financial Management, a consultancy specialising in local government funding and financial management. He is also part of an expert consortium consultancy LGimprove, focussing specifically on local government excellence.

Photo by Simon Rae on Unsplash

FREE monthly newsletters

Subscribe to Room151 Newsletters

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel