Borrowing from the Public Works Loan Board (PWLB) continued its rising trajectory in May amid signs that some treasurers are moving from internal borrowing and short-term loans into long-term financing.

Borrowing from the Public Works Loan Board (PWLB) continued its rising trajectory in May amid signs that some treasurers are moving from internal borrowing and short-term loans into long-term financing.

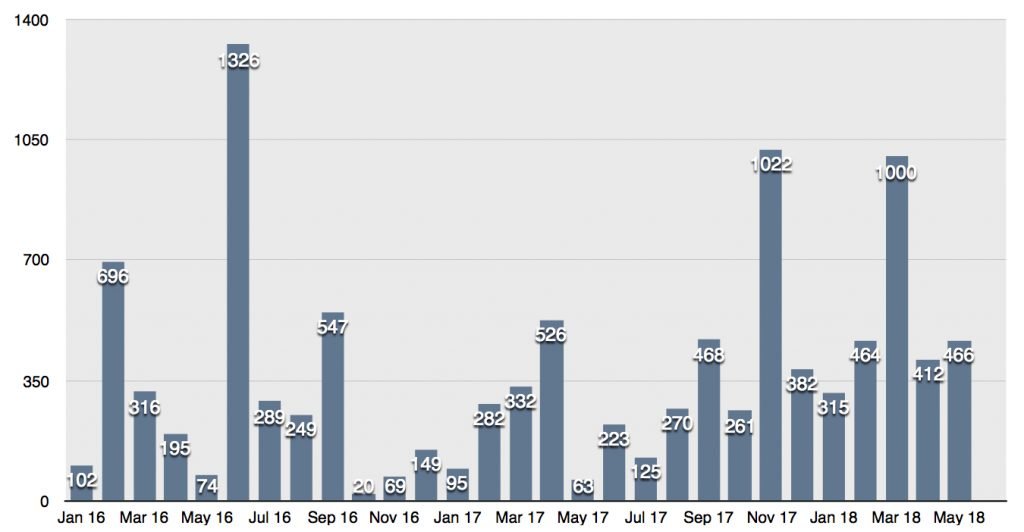

Last month saw deals with PWLB reach a combined £466m, not as high as the £1bn in March but continuing the trend that has seen councils increase borrowing since May 2017 when loans from central government totalled just £63m.

May’s PWLB borrowing revealed Runnymede to be the biggest customer of government debt taking a hefty £160m.

Observers believe some councils are using long-term borrowing to replenish cash stocks to back reserves and get ahead of a potential rise in interest rates.

One observer of the market told Room151 that some councils are “taking internal borrowing long”. However, it remains too early to say whether there is a large shift underway.

David Chefneux, a director at Link Asset Services, agreed with the “mixed” picture. He said: “Some authorities continue to run with internal borrowing positions and some, sighted on interest rate risk, are taking the opportunity to borrow from PWLB.”

Chefneux added that authorities who borrowed internally are beginning to find their reserves are not backed by money in the bank prompting a change in tack. “And that’s why some are borrowing to ensure that reserves are backed by cash,” he said.

However, Chefneux was at pains to point out that the need to address reserves would vary depending on the individual council and the expenditure programmes they may have underway.

Christian Wall, director and head of local government at consultants PFM, agreed that dwindling reserves and interest rate risk have both put pressure on councils to rethink and had caused some to move from short to long-term borrowing. But he added that many councils were still considering their position, possibly prompted by a reluctance to part with cash for interest payments.

“If we were going to see a rush, I think that would have happened already,” said Wall. “If you are unsure, I think it more likely than not that that the decision will be put off again because you have to fund the interest payments. Better to keep money available than fund interest payments.”

Mark Horsfield, a director at Arlingclose, wrote in a blog this week: “Our clients have largely avoided longer term fixed rate borrowing throughout this decade by utilising so-called internal borrowing alongside much greater use of short-term loans to plug gaps in cash flow.

“But there are increasing instances where further internal or short-term borrowing is inappropriate.”

Horsfield warned that making a switch to long-term borrowing required a considered approach, especially over timing.

“A decision on the timing of borrowing should not overlook the relatively high levels of day-to-day volatility in underlying bond yields upon which PWLB rates are based,” he wrote.

“We should not be blasé about overlooking the importance of getting the timing of execution as good as we can simply because interest rates are generally defined as being low.”

This week Dan Bates, an analyst with Pixel Finance, said usable council reserves had risen by an average of 4.66%, after looking at the accounts of 150 councils. Bates suggested the figure could be a sign that council finances were “stabilising”.

Runnymede took £160m from PWLB in five chunks: £20m for 50 years at 2.45%; £40m for three years at 1.68%; £40m for 48 years at 2.46%; £40m for 47 years at 2.45% and £20m for 49 years at 2.4%.

Spelthorne District Council, thought to have set a record for a local authority property deal when it acquired a BP site for £360m, borrowed a further £9m from PWLB across 50 separate loans. In February Spelthorne’s PWLB borrowing topped half a billion.