Sponsored article: Nick Edwardson of Aegon Asset Management looks at the assets that provide the “most attractive opportunities”.

We believe that asset allocation is the primary driver of investment returns and that the best way to manage risk is by diversifying across a wide range of lowly-correlated investments.

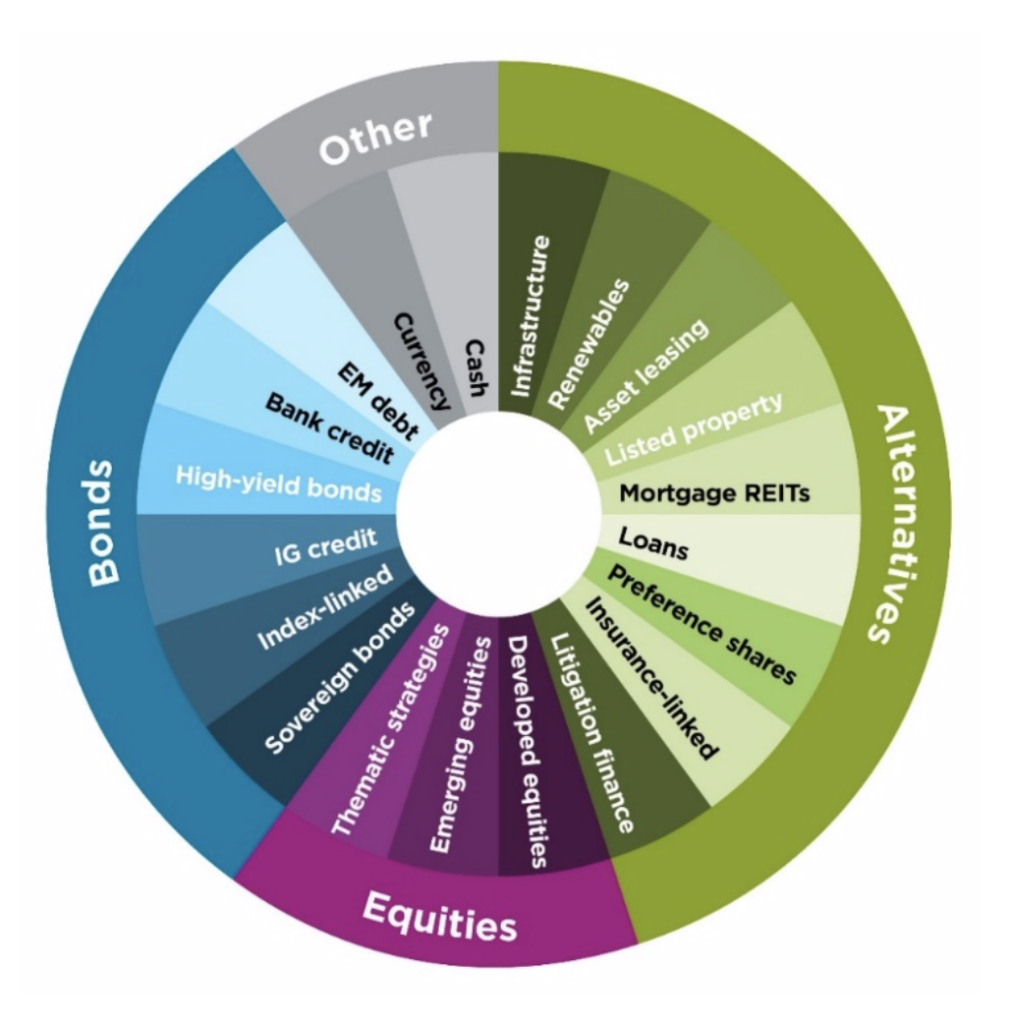

Our diversified income and diversified growth strategies bring together a wide range of investments that form the “building blocks” of our portfolios. Many of the most attractive opportunities are in the alternatives space.

When defining “alternative” assets, the obvious question to ask is “an alternative to what?” For most institutional investors this means equities or bonds, what we may call traditional investments.

Holding alternative assets that are less correlated with movements in bond or equity markets is key to our multi-asset approach. Assets such as infrastructure, renewable energy and real estate can offer some of the greatest potential diversification benefits, due to their low correlations with traditional assets.

Many alternative assets are very “bond-like”, in that they generate an income over many years, although through dividend payments rather than coupons. This income is often backed by underlying contractual cash flows and some have a measure of inflation protection.

In the remainder of this article I will highlight three examples of alternative assets that we invest in across our multi-asset portfolios.

Infrastructure

The building and management of hospitals, schools, transport networks and utilities were once confined to the public sector. Squeezed government budgets following the financial crisis have brought many of these opportunities to the private sector.

For investors, large infrastructure projects can generate long-term income, often with surprisingly low risk, thanks to government-backing via public-private partnerships. Furthermore, the diverse nature of many of these businesses—often with exposures to a range of sectors and geographies—only adds to the diversification benefits we can achieve on a portfolio level from holding such assets.

Renewable energy

Renewable energy companies primarily invest in wind and solar power generation. Having acquired or built wind or solar farms they provide investors with an income stream that is often partly linked to government-backed, inflation-linked payments.

The revenue split for these projects is typically around 50% regulated inflation-linked payments and 50% wholesale power prices. They share good qualities with other utility investments, through predictable revenue streams and a defensive, non-cyclical positioning.

Growing public pressure for renewable energy sources has led to a flow of government aid, most recently the European Green Deal. Such support has only further enhanced the stability of returns and dividend growth we see in many of the renewable holdings we own.

Real estate is an income-generating asset that typically provides a high initial yield plus the potential for income growth and capital growth. Our multi-asset portfolios invest through listed property companies, typically structured as real estate investment trusts (REITs).

These provide indirect exposure to global property markets with daily liquidity, should we need to tilt the portfolio towards different regions or sectors. These are essentially investment vehicles that purchase properties such as offices, shopping centres and student accommodation and rent them out.

We currently favour residential, data centre and healthcare REITs, all of which have had ample demand given recent working-from-home trends and increased pressure on healthcare systems.

Key to our goal of delivering attractive risk-adjusted returns is an understanding of the ever-changing relationships between the assets that we hold. Correlations between different sub-asset classes change over time, so the diversification benefit is not fixed.

We believe that active management and the freedom to allocate flexibly across a wide range of asset classes and geographies gives us the best opportunity to deliver attractive risk-adjusted returns for our clients. Investing through listed securities also provides an attractive level of liquidity.

Nick Edwardson is senior investment specialist at Aegon Asset Management.

Photo by Karsten Würth on Unsplash.

FREE monthly newsletters

Subscribe to Room151 Newsletters

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel