The government’s proposed strengthening of its intervention powers and new guidance to limit borrowing from the Public Works Loan Board (PWLB) are “credit positive” for the local government sector, according to an analysis by Moody’s Investors Service.

Moody’s said it came to this view because the proposed changes “increase central government oversight and control over local authority borrowing and the types of investment undertaken by individual local authorities”.

The intervention powers over council finance were part of the Levelling Up and Regeneration Bill announced in May, which will give the government the ability to issue “risk-mitigation directions” to a council following a “trigger event”, such as a section 114 notice.

The analysis stated: “This is credit positive as it will limit greater exposure to commercial risk in the sector and further debt growth.”

Alongside the intervention powers, the study revealed that the treasury’s new guidance to restrict councils’ ability to obtain loans from the PWLB would decrease borrowing by authorities.

Zoe Jankel, vice-president and senior analyst at Moody’s, told Room151: “These powers will continue to decrease borrowing by some local authorities that had planned to borrow to fund commercial investments over the medium term.

In the last financial year, the PWLB lent an approximate total of £8.2bn to local authorities, with the principal outstanding balance of total PWLB lending standing at £90.7bn. The overall statutory lending limit was increased in May to £115bn from £95bn.

After new PWLB lending terms were introduced in November 2020, there was a deceleration in the purchase of land and existing buildings by local authorities, which includes commercial property (see Chart 1).

Chart 1: purchase of land and property by councils in England (£m, % of total expenditure on fixed assets)

Source: DLUHC/Moody’s Investors Service

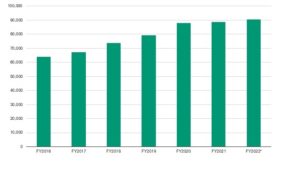

The pace of debt growth has also slowed significantly since 2020 (see Chart 2).

Chart 2: local authority borrowing (excluding TfL and GLA), £m, England

Source: DLUHC/Moody’s Investors Service

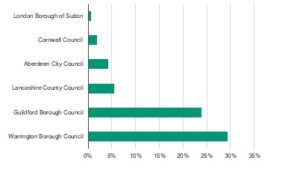

The analysis added that commercial investments represent a high share of the net budget of some of the authorities rated by Moody’s. For instance, interest and investment income comprised just under 30% of Warrington Borough Council’s net budget in the 2020 financial year (see Chart 3).

Chart 3: Interest and investment income as % of net budget (FY2020 data)

Source: Moody’s Investors Service analysis

Jankel added: “Once the new powers have been constituted, then the government will be able to compel individual local authorities to divest of specific commercial investments, outside of the section 114 process.

“This would lead to a loss of commercial income for these local authorities. However, we don’t know which local authorities might be forced to do this, or if these powers will be used in practice.”

—————

FREE weekly newsletters

Subscribe to Room151 Newsletters

Room151 LinkedIn Community

Join here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel