In the wake of Woking’s high amount of borrowing and resultant financial failure, Nathan Elvery outlines what a stable and responsible level of borrowing should look like.

I recently wrote an article, ‘The warning signs of financial failure’, to stimulate a debate within the financial leadership of the local government sector. As we consider the fallout from the recent government intervention at Woking Borough Council, and the issuing of yet another section 114 notice in the sector – this time for an unaffordable level of borrowing – I will outline five key points in this article that set the foundations for a good level of borrowing. This should help ensure your own council borrows in a proportionate and financially robust and responsible manner.

Leadership

Where a strategy based on a high level of borrowing is being pursued does the leadership of the council understand the associated risks of such a strategy and is this widely acknowledged? Is the financial strategy understood by the leadership of the council? Does sound financial management form a regular part of the leadership agenda? Is this properly aired, debated, and understood by the leadership of the council? Are difficult decisions owned collectively and implemented effectively? Does the section 151 officer sit at the ‘top table’?

Financial management

CIPFA’s Prudential Code for Capital Finance in Local Authorities objectives are to ensure, within this clear framework, that the capital investment plans of local authorities are affordable, prudent and sustainable. The prudential code has enabled the local government sector to benefit from the flexibility of ‘borrowing freedoms’ and move away from the controlled capital borrowing regime of 20 years ago; this is a privilege we need to continue to nurture. The code should be followed at all times. Consider this code for driving your capital investment plans in the same way as you would observe and comply with the Highway Code when driving your loved ones on holiday.

Governance of financial decision making

The level of risk and/or financial exposure demands an appropriate level of rigour, challenge, and scrutiny. Where you are pursuing a strategy based on a high level of borrowing do you have in place a well-trained, well-supported and dedicated group of members and officers to enable such a strategy to be achieved successfully? Does your council support a dedicated committee to focus exclusively on this strategy on behalf of your local communities? Does the financial modelling incorporate robust tests such as interest rate rises, and commercial income falls, for example? Are your external auditors closely involved in reviewing the planned strategy?

15th Annual LATIF & FDs’ Summit – 19 September 2023

250+ Delegates from Local Government & Investment

Experience

Recent examples have shown the critical importance of the experience, skills and knowledge of the s151 officer within any council and the importance of ensuring this officer has the support of the council. Where an officer is new to the role it is vitally important to ensure this person has a mentor or coach and is linked into the wide network of peers, who can provide support and advice. The s151 officer role can be a lonely place, but it does not have to be. It is particularly important when dealing with technical aspects such as minimum revenue provision (MRP) that good advice is commissioned and complied with. As we have seen, it is vital to ensure that these calculations are correct and form a fundamental part of the MTFS and any future budget planning as well as the financial control environment for the council.

Financial Resilience Index

CIPFA’s Financial Resilience Index is a comparative analytical tool that is intended to be used by chief financial officers to support good financial management. The index shows a council’s position on a range of measures associated with financial risk, highlighting where additional scrutiny should be required. Section 151 officers should use the index in their annual report to the council setting out the proposed budget for the year and medium-term financial strategy, in preparing their statements of the robustness of the budget and the adequacy of reserves. Critically, s151 officers should set out their plans in the MTFS to reduce the high risks which are evident in the index.

Within your own authority consider the early introduction of the following additional key reporting measures as part of your capital investment strategy and plans:

- proportionality of debt;

- the proportion of capital assets invested to return a profit; and,

- the proportion of debt borrowed from outside central or local government.

These additional measures will help inform your members and help ensure you do not risk overstretching your organisation.

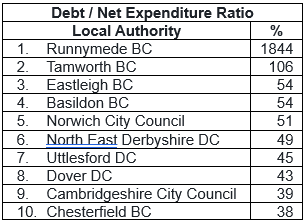

One of the key indicators from CIPFA’s Financial Resilience Index is ratio of interest payable and net revenue expenditure (excluding HRA). The district and borough councils with the highest ratio are shown in the table below.

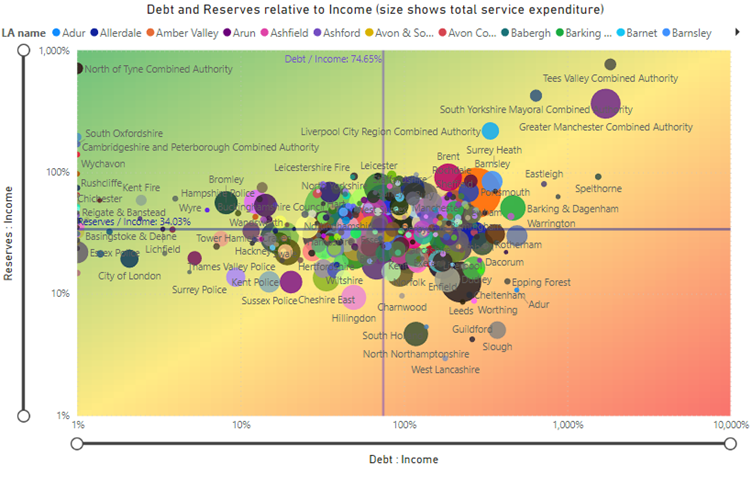

Borrowing must always be proportionate, and Woking Borough Council is an extreme example of what happens when this principle is ignored. The following diagram shows the debt and reserves relative to income for the local government sector.

The diagram shows the differences and challenges facing the sector over the coming years and until local government is adequately funded on a long term and sustainable basis, there are likely to be more section 114 notices in the future.

Nathan Elvery is past president of the Society of London Treasurers and the Association of Local Authority Treasurers. He is founder and managing director of Imagine Public Services.

—————

FREE weekly newsletters

Subscribe to Room151 Newsletters

Follow us on LinkedIn

Follow us here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel