Last week’s shock increase in the Public Works Loan Board (PWLB) lending rate could make it harder for councils to achieve strong credit ratings after ratings agency Moody’s dubbed the move “credit negative” for the sector.

In a surprise move last week, the Treasury announced a whole percentage point increase in the rate of borrowing from the Public Works Loan Board (PWLB).

Responding to the move this week, Moody’s said the short-term impact would affect the operating performance of councils due to increased interest costs.

SAVE THE DATE – LATIF NORTH

March 25th, 2020, Manchester

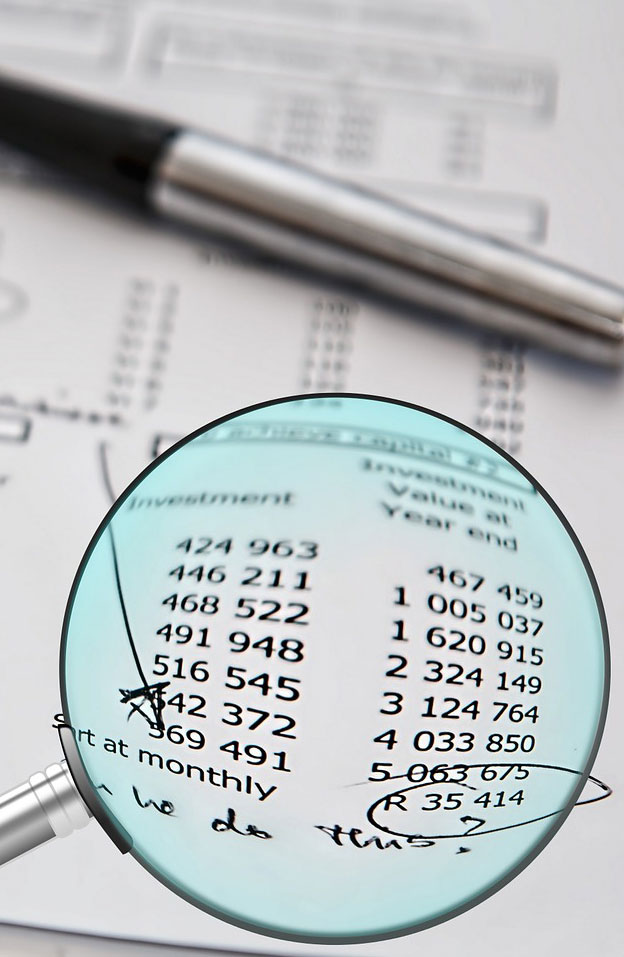

Council treasury investment & borrowing

It said: “We consider this to be credit negative for the UK local authority sector, as it will increase local authorities’ cost of capital on new borrowing in the short term.”

However, the ratings agency’s note said that in the longer term, the rate hike might reduce debt accumulation by local authorities, “particularly for speculative commercial projects with marginal returns”.

Moody’s said that although councils are likely to seek financing from other sources, it expects the PWLB to remain the sector’s main source of finance.

The latest government figures show that, at the end of 2018/19, PWLB loans made up 76% of council borrowing.

Last week, Room 151 reported that private sector and institutional lenders are set to take advantage of the increase in the PWLB rate by offering lower-priced options.

Fears were also raised about the future of regeneration and housing projects following the hike in the PWLB rate.

But Moody’s said it believes councils are likely to continue with planned projects and swallow the higher borrowing costs.

It said: “The majority of capital expenditure in the sector is on infrastructure which fulfils traditional statutory service requirements, such as housing, highways, street lighting and waste facilities.

“We do not expect the sector to cancel or postpone the majority of these projects as they fulfil important statutory duties.

“The rate hike will therefore negatively affect the operating performance of local authorities, as interest costs will increase. “

But the agency said that in the longer-term, higher interest costs could have a positive impact by making borrowing to invest in commercial property less attractive.

It said: “We consider commercial property projects to be risky for local authorities, since they are predominantly 100% debt funded and increase their exposure to economic volatility.

“However, the increase in the cost of capital may deter the rapid take-up of commercial risk in the sector by reducing their financial viability.”

The credit negative warning will not necessarily reduce the ratings of local authorities, but will be one factor the agency takes into consideration in future.

Last month, Moody’s issued long-term (stable) Aa2 ratings for Cornwall Council and Guildford Borough Council.

Commentary included in the Cornwall rating said that “a material increase in the debt burden or a weakening link between Cornwall Council and UK government, including its funding agency, the Public Works Loan Board (PWLB) could lead to a downgrade”.

However, both councils received a strong rating because of “a high likelihood that the government of United Kingdom would intervene in the event that it was to face acute liquidity stress”.

The Room151 Weekly Newsletter covers local government treasury and pension investment, funding, development, resources and technical finance. Register here.

The LGPS Quarterly Briefing focuses purely on pension fund investment. Register here.