Urgent actions such as ceasing non-essential spend are required at Medway Council to prevent a currently forecasted overspend for financial year 2023/24 exceeding the reserves available to the authority.

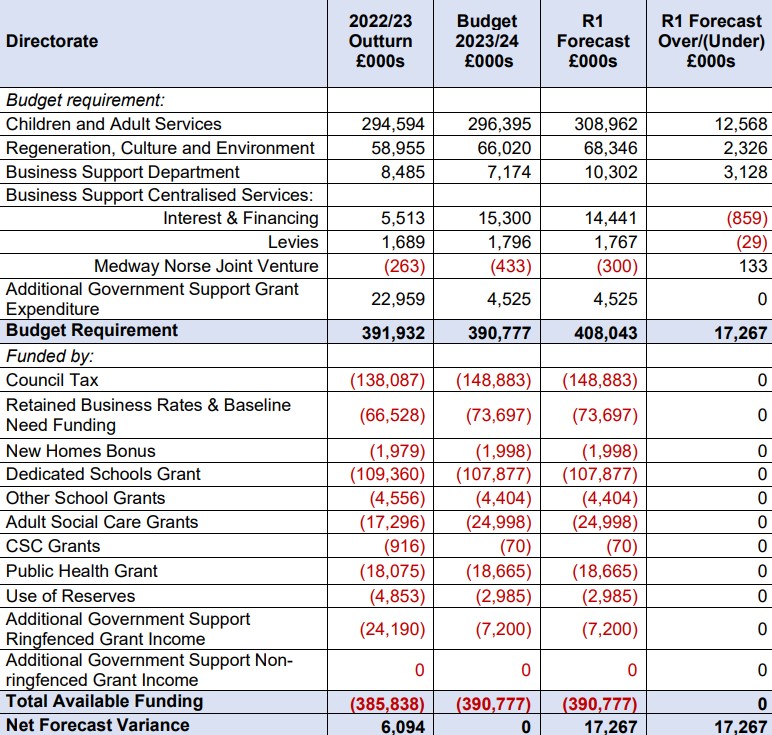

The first round of revenue budget monitoring for 2023/24 at the council projects an overspend of £17.267m for the year, which exceeds the general reserves available by more than £7m.

As reported, the council’s general reserves currently stand at £10.084m – only a fraction above the minimum balance set by its section 151 officer – following a net overspend of £6.094m in 2022/23.

Katey Durkin, Medway Council’s chief finance officer, painted a gloomy picture in the first revenue budget monitoring report for 2023/24, which is to be discussed at a cabinet meeting next week (8 August).

If nothing changes, the council will not be in a position to fund an overspend on the scale of that currently projected, Durkin said.

“Both the 2022/23 outturn and 2023/24 forecast expenditure will place an unprecedented burden on general reserves, which is not affordable in the immediate term or sustainable over the longer term,” she added.

Durkin noted that Phil Watts, Medway Council’s chief operating officer and section 151 officer, would be legally required to issue a section 114 report if it became apparent that the expenditure of the authority is likely to exceed the resources, including sums borrowed, available to it to meet that expenditure.

Although no timeframe was put on when this situation might be reached, Durkin’s report implied that a section 114 notice could be prevented. It will, however, be necessary for the council’s senior managers and elected members to implement “urgent actions” to bring expenditure back within the budget agreed by full council “or as a minimum to within that which can be funded from general reserves”, Durkin said in her report.

She said that the cessation of all non-essential spend, including reviewing spend on non-statutory services, should be considered.

In addition, the authority’s capital programme should be curtailed, reduced or refinanced “where it impacts on the revenue budget”, she suggested. Finally, Durkin recommended a review and rationalisation of land and building assets.

In a risk management assessment included in the report, the possibility of the council overspending against the agreed budget is currently considered “very likely”, which would have a “catastrophic” impact. The revenue monitoring process is designed to “identify and facilitate management action to mitigate the risk of overspending against the agreed budget”, the report stated.

Also considered “very likely” is a “diminution of the scale and quality of services that the council is able to deliver”, should the overspend be unable to be funded from reserves.

Against this background, the report also considers it “very likely” that further demographic pressures may surface across social care services above those assumed in the budget, and that there will be further increases in the number of children requiring support, with the complexity of needs growing.

15th Annual LATIF & FDs’ Summit – 19 September 2023

250+ Delegates from Local Government & Investment

Indeed, children’s and adult services is forecasted to account for the majority of the overall overspend in 2023/24, at £12.568m.

The adult social care forecast is an overall pressure of £9.208m, reduced to £7.576m with management action. As in recent years the overspend largely relates to placement costs in locality services, the report noted.

The disability services forecast is a net overspend of £4.911m, falling to £3.279m as a result of ongoing targeted review work projected to achieve further cashable savings of £1.632m. Supported living is the largest area of overspend, forecast at £2.510m.

The older people forecast is an overspend of £3.099m, reflecting the “significant pressures” that were seen throughout 2022/23, the report noted.

The children’s services forecast is an overspend of £3.375m.

—————

FREE weekly newsletters

Subscribe to Room151 Newsletters

Follow us on LinkedIn

Follow us here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel