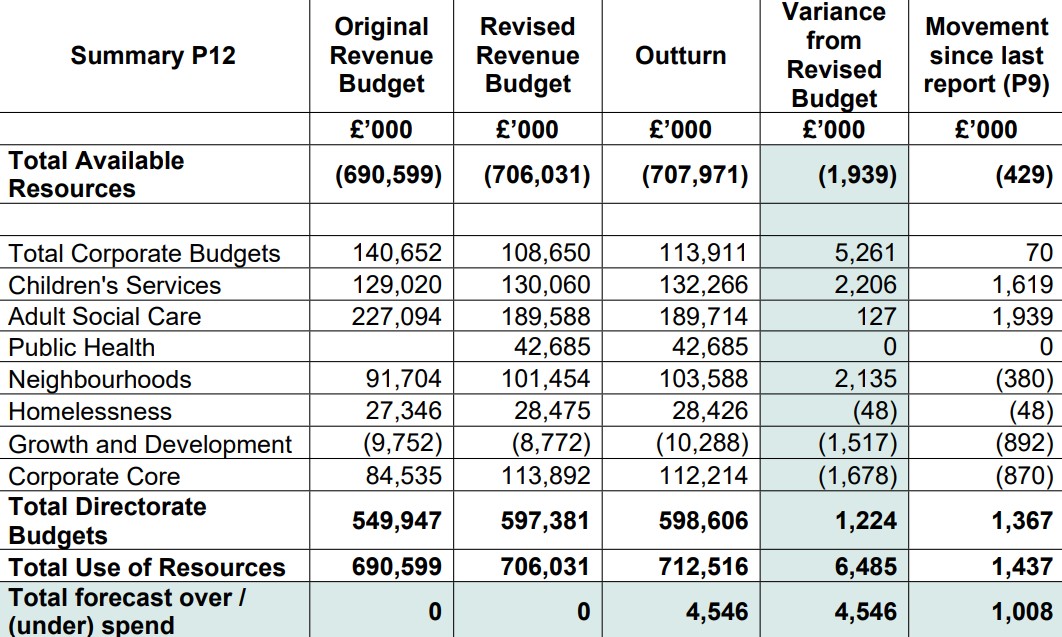

Manchester City Council has reported a £4.5m overspend against its budget for financial year 2022/23.

The figure represents a significant decrease from the forecasted overspend of £20.1m reported in September, based on the authority’s July position.

A report prepared by deputy chief executive and city treasurer Carol Culley stated that the improved position reflects both actions taken by the council to manage the budget pressures, and the reduction in utility costs from the higher levels forecast during summer 2022.

The £4.5m overspend will be funded from the council’s general fund revenue reserve. To ensure this reserve is maintained “at a prudent level”, a £7.266m transfer from the authority’s budget smoothing reserve to the general fund will take place.

When the 2022/23 budget was set, Manchester City Council noted that the Bank of England was expecting inflation to peak at around 5% in the spring of 2022 and average 2.3% for the year. Inflation peaked at 11.1% in October 2022 and has remained above 10% since. A higher-than-expected pay award, worth an average of 7% and a more than doubling of energy costs placed “significant pressure” on the council’s budget, Culley reported.

The authority said the main drivers of the $4.5m overspend were the pay award variance, pressures on children’s safeguarding services, home to school transport demand and price pressures, and lower than budgeted for parking income, driven by changes to commuter behaviour.

An overachievement of investment income and underspends across the corporate core partly offset these pressures, Culley said in her report.

The overspend for 2022/23 has also increased by £1m since the last reported position in February 2023, driven largely by emerging pressures in both adult and children’s services.

A balanced budget for 2023/24 was approved by the council in March 2023, and an early update on the forecast position will be reported at an executive meeting in July.

A budget shortfall of over £40m remains for 2025/26, Culley noted, after the application of c£18m of smoothing reserves and alongside uncertainty about the future funding settlement. The scale of the gap was set out in a medium term financial strategy report in February 2023. “The council continues to follow a prudent budget strategy of utilising any unused resources to smooth the impact on future years and reduce the level and severity of cuts required,” Culley’s report concluded.

Overspend in services

Children’s services overspent by £2.2m, although the service had returned £2m of funding to the budget smoothing reserve at the start of the year, according to the report. “There has been a worsening of the position in the final quarter of £1.6m due to an increase in the number of placements in high-cost settings as well as inflationary pressures on some of the allowances paid to carers,” it stated. “The remainder of the overspend was driven by increased costs of home to school transport which has been affected by an increase of eligible children, as well as driver shortages and fuel inflation increasing costs.”

There was an overspend of £127k in adult services, which includes a total of £1.9m of increased pressures which have emerged in the final quarter of the year. “The pressures are driven by a significant increase in the (cost or volume) of placements for people with a learning disability placements, an increased number of providers accepting the fee uplift and agreeing to pay the real living wage (partly in reflection of the inflationary pressures in the market), and an increase in the bad debt provision as the cost of living crisis impacts people’s ability to pay for care,” the report stated.

15th Annual LATIF & FDs’ Summit – 19 September 2023

250+ Delegates from Local Government & Investment

A full review of long-term care budgets to reflect the outturn position will be carried out to understand the impact and realign the budgets for 2023/24, Culley said.

Neighbourhoods overspent by £2.1m, partly offset by staff underspends. Growth and development underspent by £1.5m, mainly due to higher-than-expected rental income from the commercial estate, partially helped by a one-off return of back dated rents following the acquisition of Wythenshawe Shopping Centre. This was an improvement of £0.9m since the last report.

Corporate core underspent by £1.7m overall, an improvement of £0.9m since the last report, while directorate savings for 2022/23 totalled £7.8m.

Schools and housing

The dedicated school grant (DSG) in-year position underspent by £1.092m and after taking account of the deficit carried forward from 2021/22 of £2.509m, the overall deficit at the end of the year was £1.417m.

The report noted ongoing DSG pressures relating to the high need block (HNB) grant that supports vulnerable children. The HNB ongoing gap is estimated to be £5.690m in 2023/24 and £16.631m 2024/25 pre recovery plan actions. The service is working through a three-year HNB recovery plan, focusing on managing demand and identifying efficiencies to help combat these pressures.

The ringfenced housing revenue account (HRA) budget had planned to draw down £13.2m from reserves to contribute to the costs of the capital programme, the report noted. However, the outturn position only required that £10.125m was drawn down from reserve due to a net underspend of £3.075m. The overall total HRA reserves are c£104.4m, of which £36.5m are ringfenced and £68m is the general reserve. “Going forward there continues to be pressures in respect of ongoing inflationary increases that are higher than rent inflation, and increased costs of works to assess and alleviate damp and mould,” the report stated.

Carol Culley was recently appointed as one of the commissioners at Woking Borough Council, after the authority was placed under government intervention by levelling up secretary Michael Gove.

—————

FREE weekly newsletters

Subscribe to Room151 Newsletters

Follow us on LinkedIn

Follow us here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel