Partner Content: Robert Evans explains how CCLA Investment Management has managed its deposit funds through the recent unprecedented market conditions.

Much has been written in recent weeks on the ill-fated UK “fiscal event” set out on 23 September and its impact on the value of sterling and the UK fixed interest markets. The pressure on some UK pension funds was so extreme that they reached breaking point with the Bank of England having to intervene to restore orderly market conditions so that no pension fund defaulted.

In this update, I will explain how CCLA has managed the £3.5bn of investments within its three deposit funds through this “once in a generation” market turbulence and how the funds will invest over the coming months.

Tightening monetary policy

After 18 months with interest rates at historical rock bottom levels, even at times flirting with the prospect of moving negative, markets and then eventually central bankers came to terms with the fact that the inflation outlook was no longer benign as the world moved out of the pandemic shutdowns. Initially, we witnessed a slow but steady increase in money market rates as the prospect of rate increases moved into the forward-looking projections. In response, we made a number of long-dated investments to lock in on those enhanced rates which were on offer.

The Bank of England began tightening monetary policy in December 2021, when the Monetary Policy Committee (MPC), which sets policy to meet the 2% inflation target, voted by a majority of eight to one to increase its Official Bank Rate by just 0.15 percentage points, to 0.25%. Around that time, we were directed by perhaps the most hawkish member of the MPC, Michael Saunders, that “it is likely that any rise in Bank Rate will be limited given that the neutral level of interest rates remains low. Provided we do not delay too long, it should be a case of easing off the accelerator rather than applying the brakes”.

This very slow, but steadily increasing projection for interest rates, continued to offer some attractive opportunities to make longer-dated investments. However, this picture changed in February 2022 as energy and commodity prices skyrocketed in response to Russia’s invasion of Ukraine.

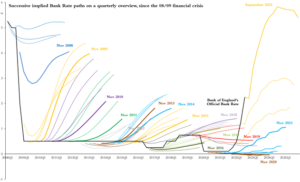

Since the invasion began, inflation expectations have consistently been revised upwards, we have seen hikes at every MPC meeting since and, crucially, expectations for future interest rates have continued to accelerate (see Chart 1). In February we took the decision to limit the longer investments made by our funds and bring our average durations down. We then hastened this approach as the economic conditions and inflationary environment over the year deteriorated.

Chart 1

Source: CCLA/Bloomberg as of 14 October 2022

Fund management approach since the Fiscal Event

The COIF Charities Deposit Fund and Public Sector Deposit Fund (PSDF) follow the Financial Conduct Authority’s UK Money Market Fund Regulations (MMFR) and are classified as Low Volatility Net Asset Value (LVNAV) funds. Within this regulation, LVNAV funds have a regulatory limit of 20 basis points for the difference between the market value of its assets per pound and the constant value of £1. In constructing the MMFR, the intention of politicians and regulators was to force fund managers to take less risk and increase the liquidity of the MMF products. They believed the new 20 basis point “collar” would achieve this.

However, the inclusion of the collar actually added a new event risk; when there is a sudden exorbitant movement in interest rates, it could lead to the fund moving out of its collar, causing the value of a deposit/investment to become variable. This is a situation all managers of LVNAV funds need to try to ultimately avoid, as Fitch Ratings has previously noted, that a breach in the collar would be viewed as a ratings event and any change in either fund’s AAAmmf status would likely make the fund far less attractive to depositors/investors.

After the then chancellor made his pro-growth strategy announcement, we observed an unprecedented rapid repricing of interest rate expectations. At one point, rate increases were projected even before the November MPC meeting. We, as fund managers, were concerned that we were unable to predict where this repricing would stop and no real ceiling was evident. As we were unable to judge whether a three-month investment, for example, represented good value, our investment approach was to hold fire. We were reluctant to take on any significant duration risk until some stability and certainty returned.

In addition to our concerns surrounding investment values, these sudden changes in interest rate expectation presented sterling money market fund managers with an issue not experienced under the current regulatory regime. Despite the fact that we had deliberately been lowering the Weighted Average Maturity of the funds, as described above, the turbulent money market repricing meant the yields on our investments, made prior to the fiscal event, no longer reflected the new interest rate environment.

As there was such a high degree of uncertainty, and in line with fund policies, CCLA made the decision that we would limit the maximum tenure of fund investments to just one week to keep the funds comfortably within their collar. Shortly after the immediate uncertainty subsided, CCLA relaxed this restriction to allow for one-month investments. This approach has served the funds well and the difference between the market value of its assets per pound and the constant value of £1 has receded markedly, but it is still a little higher than typically one would expect.

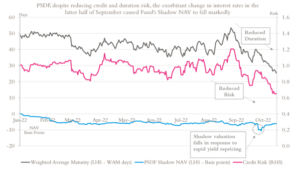

While these restrictions have meant the funds have not taken opportunities to trade at very attractive levels, sometimes in excess of 5.50% in the one-year tenures, CCLA’s approach has been consistent with our low-risk strategy of putting security and price stability always above yield. Chart 2 sets out how we have reduced both duration and risk within the PSDF over recent weeks, as well as the movement in the shadow NAV:

Chart 2

Source: CCLA as of 14 October 2022

Over this heightened period of volatility, other money market funds with large institutional client bases have seen substantial flows both in and out as their clients have had to cover margin calls resulting from volatility in other investment markets. Many of these funds are the same as those that saw huge outflows at the start of the Covid-19 pandemic. We are in the fortunate position that our funds benefit from a church, charity and local authority client base not usually susceptible to sudden cash flow requirements caused by market volatility. This is why our fund sizes have not seen any unusual movements; we look at our client base as a strength, as it means our funds are less likely to need to sell assets to raise cash in stressed markets.

We will not hesitate to raise interest rates to meet the inflation target. And, as things stand today, my best guess is that inflationary pressures will require a stronger response than we perhaps thought in August.

Room151’s Monthly Online Treasury Briefing

October 28 2022

Online

Public sector delegates – register here

The coming months

While there still is extreme uncertainty surrounding the future path for interest rates, the one certainty is that they will remain on an upward trajectory for some months to come. The next MPC decision is on 3 November and the Bank of England appears to be laying the groundwork for a bumper hike. Governor Andrew Bailey said on 15 October: “We will not hesitate to raise interest rates to meet the inflation target. And, as things stand today, my best guess is that inflationary pressures will require a stronger response than we perhaps thought in August.”

As the funds have been limiting longer-dated investments for some time now, they are well structured to react quickly to any outsized increase in Bank Rate. Using PSDF as an example, at the time of writing, 72% of the fund will be reinvested in the next month with 87% of the fund maturing within the next 60 days. Fund yields are also being further enhanced by the maturity of a number of the lower yielding investments made in late 2021 and early 2022.

While we continue to witness large volatility in interest rate projections, our investment approach will remain focused on keeping the fund’s duration lower than in recent years. However, we may look to make some investments into early January to ensure the fund is strongly positioned for what looks like a difficult and complicated year end for markets.

While 2022 has been a year unlike any other when it comes to market volatility and shocks, I hope this update highlights how the continuation of our low-risk approach to fund management, always prioritising security and liquidity over yields has helped to protect fund valuations and keep the funds in a strong position as we approach the year end.

Robert Evans is senior portfolio manager (cash) at CCLA Investment Management.

Disclaimer

This document is a financial promotion and is issued for information purposes only. It does not constitute the provision of financial, investment or other professional advice.

To ensure you understand whether a CCLA product is suitable, please read the key investor information document and the prospectus. CCLA strongly recommends you seek independent professional advice prior to investing.

The Public Sector Deposit Fund (PSDF) is a UK short-term LVNAV Qualifying Money Market Fund.

In addition to the general risk factors outlined in the prospectus, investors should also note that purchase of PSDF shares is not the same as making a deposit with a bank or other deposit taking body and is not a guaranteed investment.

Although it is intended to maintain a stable net asset value per share, there can be no assurance that it will be maintained. Notwithstanding the policy of investing in short-term instruments, the value of the PSDF may also be affected by fluctuations in interest rates. The PSDF does not rely on external support for guaranteeing the liquidity of the fund or stabilising the net asset value per share. The risk of loss of principal is borne by the shareholder. Past performance is not a reliable indicator of future results. The value of investments and the income derived from them may fall as well as rise. Investors may not get back the amount originally invested and may lose money. Any forward-looking statements are based upon CCLA’s current opinions, expectations and projections. CCLA undertakes no obligations to update or revise these. Actual results could differ materially from those anticipated.

Investment in a CCLA managed fund is for public sector eligible investors only.

The CCLA managed fund is authorised in the United Kingdom and regulated by the Financial Conduct Authority as a UCITS Scheme and is a Qualifying Money Market Fund. CCLA Investment Management Limited (registered in England and Wales, number 2183088, at One Angel Lane, London, EC4V 4ET) is authorised and regulated by the Financial Conduct Authority.

—————

FREE weekly newsletters

Subscribe to Room151 Newsletters

Room151 LinkedIn Community

Join here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel