The pandemic has seen council investment balances climb steadily while demand for PWLB funds fades. David Chefneux looks at the figures.

The latest data released by MHCLG (Ministry for Housing, Communities and Local Government), detailing investment and borrowing positions to the end of December 2020 continues to show local authority investment balances totalling circa £50bn and also highlights the continued slowdown in PWLB borrowing prevalent since last March.

The quarterly borrowing and investment tables provides individual data for all English, Scottish and Welsh authorities and also provides useful summary tables and trends.

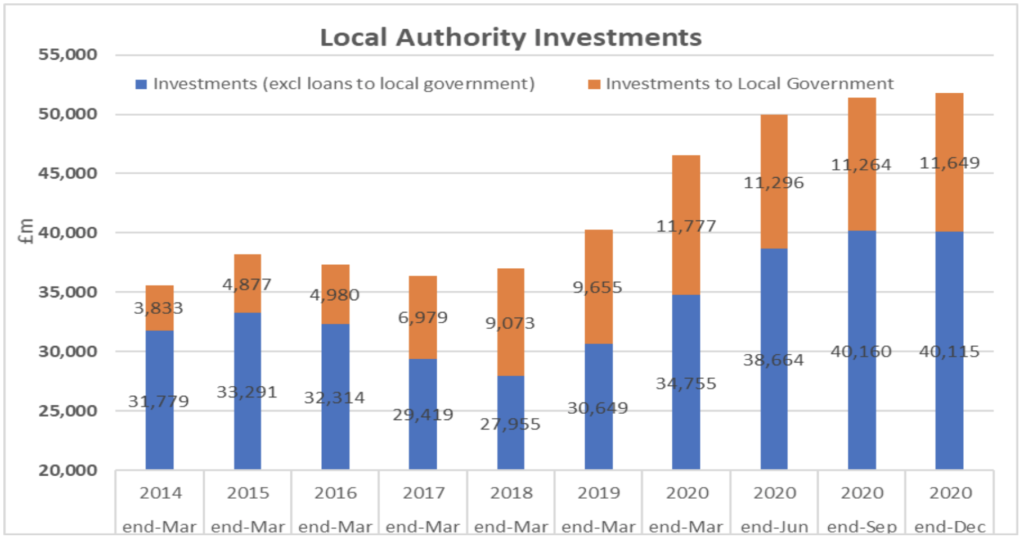

Having ranged between £35bn-£40bn between March 2014 and March 2019, investment balances increased to £46.5bn by March 2020 and £51.7bn by the end of last year, according to the latest data published and summarised in the table below.

Reasons for the increases will be many and varied, especially in the current circumstances around the coronavirus pandemic, which will have restricted the ability of councils to fully deliver capital investment programmes and also resulted in additional Covid funding being passported through public sector bodies.

Evidence

The uncertainties surrounding the current position are further evidenced by analysis of investments by type which show 29.2% of investments (£15.1bn) being held in liquidity accounts such as the DMADF facility and money market funds. This compares with 19.5% (£9bn) at the same time last year.

Investment balances across Scotland show a slightly different position in the last quarter. Balances stood at £2.9bn in total, which although £200m above the same time last year, represented a decrease of £650m on the quarter to the end of September 2020. Balances across Wales also fell in the third quarter of 2020 by circa £200m, but also remained above levels of a year ago.

Although, again, there will be wider considerations to take into account impacting current market positions, uncertainties around timing for cashflow will be having an impact on the potential for investing for longer periods and thus an increasing trend to keep cash liquid.

It will be interesting to see how the December figures compare with the end of March 2021 position, which will be released by MHCLG in June. This will also be reflected in balance sheet positions reported over the months ahead, as part of the year-end accounts process.

As noted, with investment balances being higher in many cases and the rephasing of capital programmes, this will likely be reflected in increased levels of reserves for many, at least on a temporary basis, and possibly some over-borrowed positions for a small number of councils.

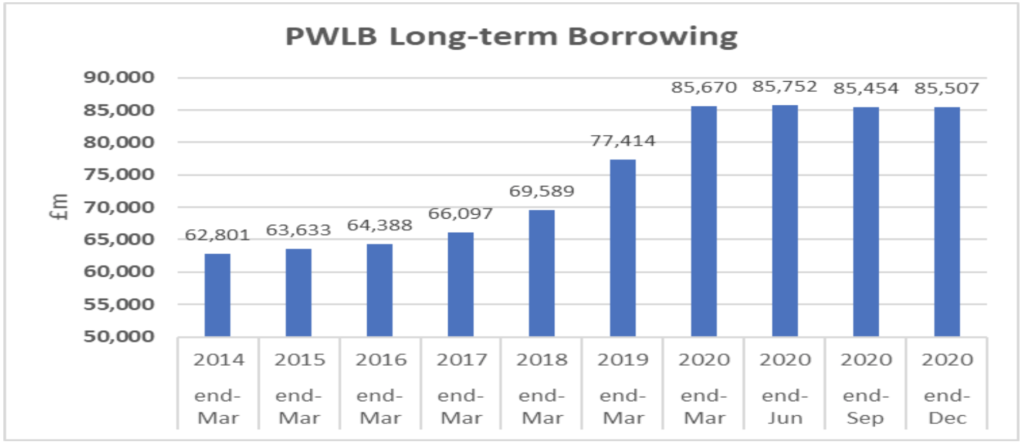

PWLB

The latest data on borrowing continues to show a significant slowdown in PWLB borrowing, which is no doubt influenced in part by the temporary investment positions reported above. Total borrowing from the PWLB stood at £85.507bn at the end of December 2020, compared with £85.670bn at the start of the financial year.

In addition to PWLB long-term borrowing, inter-authority borrowing accounted for a further £13.6bn at the end of December 2020 and represented 8.8% of total borrowing outstanding.

David Chefneux is director of Link Market Services at Link Asset Services.

Photo by Hello I’m Nik ???? on Unsplash

FREE monthly newsletters

Subscribe to Room151 Newsletters

Room151 Linkedin Community

Join here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel