David Chefneux writes the global recovery, market volatility, inflation trends and quantitative tightening will all be big issues in treasury risk management.

With the holiday season in full swing (although looking outside at the time of writing, the weather tells a different story!), soon many will return and attention will turn to the second half of the financial year and focus away from year-end accounts and on towards the remainder of the year and medium-term financial planning for the uncertain years ahead. So, what lies ahead for the world of treasury management in the coming months?

The last eighteen months have clearly been unprecedented due to the impact of the global pandemic. On the expenditure side, capital programmes have in many cases been delayed or re-profiled, priorities have changed and funding streams become less certain.

16 September 2021

London Stock Exchange or ONLINE

13th Local Authority Treasurers’ Investment Forum

Room151’s flagship annual conference. Free attendance for local government treasurers and section 151 officers.

Visit our conference page for more information

Lead sponsor CCLA

Public sector treasurers can register here

As an example, analysis across Scotland shows that capital financing requirement’s rose in total by less than 2% last financial year, following increases of 4%-6% in recent years.

Provisional data seems to indicate that overall external borrowing actually fell compared with the position a year ago, albeit internal borrowing increased. According to MHCLG data covering all authorities across the UK, PWLB borrowing ended the 20-21 financial year only £100m higher than the previous financial year at £85.77bn.

All signs in the last year, or so, of limited appetite for new borrowing, combined with additional financial support pumped into the system by central government and other sources, which has supported liquidity and cash balances throughout challenging times for the public sector. MHCLG data released this month shows that investment balances across local authorities in England, Scotland, Wales and Northern Ireland topped £56bn at the end of June 2021.

Future movement on borrowing rates will therefore be a key issue to watch in the months ahead, as capital programmes kick back into gear as the recovery hopefully continues and cash outflows potentially increase more strongly in terms of capital investment. So what are the T’s and C’s to keep an eye on?

Transitory, tightening and taper tantrums?

One of the main discussions around financial markets in recent months has been the resurgence in inflation across not only the UK, but also elsewhere across the global economy.

Inflation in the US is currently running at 5.4% and in the UK, the Consumer Prices Index (CPI) rose by 2.5% in the 12 months to June 2021, up from 2.1% in May and above the MPC’s 2% target.

There has been much debate as to whether the rise in inflation is transitory, linked to the re-opening of economies, increase in demand for goods and services, supply constraints and also the base effect of comparing current inflation with data from a year ago, when economies were in lockdown and demand/prices were low.

Time will tell whether the recent inflation increases are transitory, as many forecasters currently expect, and therefore begin to ease as we head into 2022 and back towards central bank forecasts.

Inflation and recovery in economies is leading some central backs to begin the debate about if, and when, to begin tightening and reining in some of the financial support that has been added to global markets through quantitative easing (QE) programmes over the last ten years. During this time, the Bank of England has been a significant purchaser of government gilts and this has helped to keep yields low. What will happen if, or when, the reverse starts to happen?

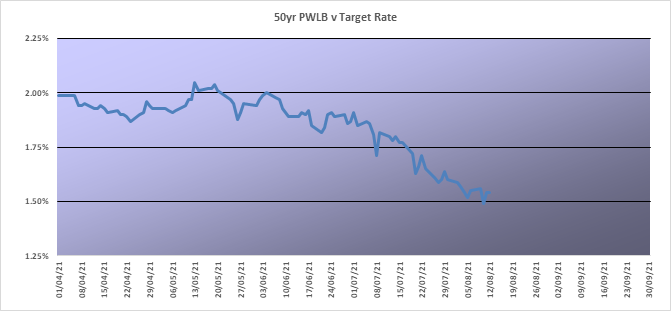

US Treasury and UK Gilt yields did start to rise earlier this year, reaching a peak in mid-May, but surprisingly have eased back steadily since then, with 50-year PWLB rates hitting a low point of 1.49% on the 10th August as shown below.

All a bit odd that yields have fallen recently, as inflation concerns have risen, but market volatility can create opportunities as well as risks, depending where you sit on long-term borrowing requirements and decisions. New loans taken from PWLB for the month of July alone were back above £1bn.

Chief financial officers and treasury teams will therefore need to keep a careful eye on the pace of the global recovery, market volatility, inflation trends and central bank discussions around possible quantitative tightening and manage risks accordingly.

Consultations, Consultations, Consultations?

Earlier this year CIPFA consulted on both the Prudential Code and Treasury Management Code, with a view towards updating both to reflect the changing environment to which they applied.

Feedback on the consultation has already been released and CIPFA intends to publish revised codes in December 2021.

MHCLG has also announced plans to improve the Local Authority Capital Finance Framework. The policy paper states the aim is “to provide both universal oversight and a way of enabling targeted intervention where necessary.

“This seeks to put in place an approach which sets expectations for all, deters local authorities from excessively risky investment and borrowing practices, and provides the levers for directly addressing issues when appropriate”.

MHCLG therefore plans to engage with stakeholders on individual proposals, so further consultations are likely later this year. In addition to a further review of guidance relating to minimum revenue provision, MHCLG also plans to improve data collection so they are better sighted on potential risks and also constrain some of the risks associated with complex capital transactions through new guidance.

Once again, chief financial officers and treasury teams will need to keep a careful eye out for any consultation exercises, so that any implications can be carefully considered and responded to.

David Chefneux is a director at Link Group.

Photo: Photo by M. B. M. on Unsplash

—————

FREE monthly newsletters

Subscribe to Room151 Newsletters

Room151 Linkedin Community

Join here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel