You could be forgiven for thinking that CIPFA’s consultation on its prudential and treasury management codes is a done deal.

Closing on November 16th, and with a proposed publication date of, well, sometime in December, a major redraft would be a surprise.

But a fundamental rethink—to some aspects of the proposed wording—is what is required if CIPFA is genuinely interested in listening to its membership.

“The consultation is ill-thought-out and tries to cover everything. That means it is disjointed. There could well be unintended consequences from the new rules if implemented.” – s151 officer

With a relatively small consultation window offered after the September version was published, and with everything else going on, will treasurers have found the time to respond directly and in detail?

Feedback

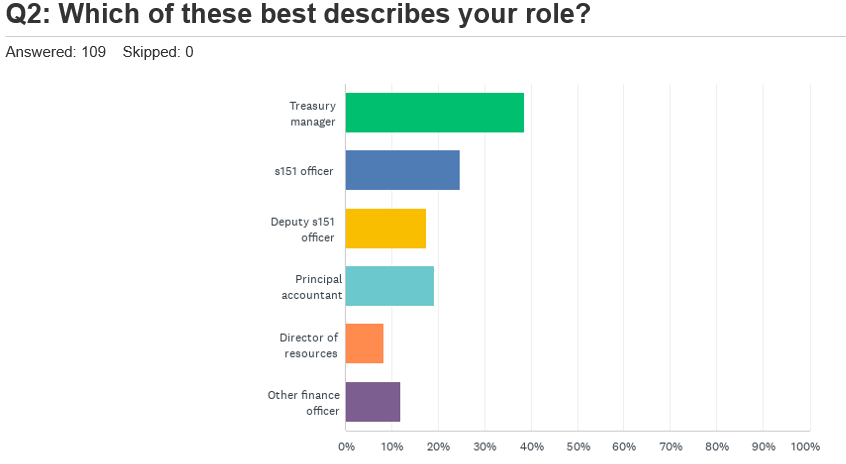

In any event, Room151 felt that a survey of local authority finance officers was needed, asking them for feedback on the contentious aspects of the consultation. More than 100 responded.

Before we get into the results, let’s just consider for a moment the open goal that CIPFA was faced with when it embarked on this process.

There was growing pressure from all quarters about leveraged council investment in retail parks and shopping centres. Particularly those purchased beyond authorities’ immediate borders.

The institutional real estate lobby, the broadsheets, the tabloids, central government, the left wing press, the right wing press and opposition elected members were queuing up to put the boot in on council investments in the retail property sector.

“CIPFA needs to be clear on the distinction between treasury and non-treasury investments. The reasons for investing, risks and associated operational issues involved in these investments are different and need to be managed accordingly.” – deputy s151 officer

They weren’t without reason. The high-street is on its knees, the internet is booming and there were some eye-watering punts going into some risky looking bricks and mortar funded by cheap PWLB borrowing.

Who had the appetite to oppose measures that would prevent direct, eggs-in-one-basket, leveraged investments in real assets on the council balance sheet? Probably no one.

Changes to curb that kind of activity, and the popular introduction of the liability benchmark, would have been waved through with the overwhelming backing of authorities up and down the country.

‘Big stick’

But then, for reasons unclear, measures urging treasury investors to sell down holdings in pooled investments appeared out of the blue.

“There’s a narrative of rogue councils who have to be stopped by CIPFA. We don’t doubt there are concerns about some councils but to be seen to impose a confusing and onerous set of guidance would harm CIPFA’s place as a standard setter.” – treasury manager

It isn’t clear why pooled investments were suddenly lumped into the September revisions, but we’re told there’s a big stick somewhere in central government that will come crashing down if you don’t do as the honest broker says you must.

But that’s not really good enough, is it? Why does HMT or MHCLG not explain themselves if they have a problem with the vast majority of treasury management strategies? Weren’t we told repeatedly that these changes were about addressing the actions of a few bad apples? And why doesn’t CIPFA make the case better on behalf of its members who widely utilise well-diversified, treasury management strategies which include some exposure to pooled funds?

CIPFA’s legitimacy derives from: a) having a paying membership; and b) the code. It is clearly worried that if it loses the latter, then the membership might rightly ask, why this professional body and not a different one? Some are already asking that question.

But the code is there to encourage best practice, and the organisation is there to serve and to represent. CIPFA exists to guide and support public sector finance officers and to give them a collective voice when they individually find it hard to be heard.

As our survey results demonstrate, that is not happening in this instance.

Hundreds of millions of pounds in income has flowed over the last five years from competently-run, well-diversified, pooled investment funds into the treasury coffers of UK local authorities.

Hundreds of millions.

According to treasury adviser, Arlingclose, their clients have received £306m over the past five years on a current balance invested of £2.3bn with an average yield of 4.1%. That money has kept people in work. It has funded frontline services during Covid and provided a bolster against swingeing government cuts.

If CIPFA’s estimate of what is currently invested in pooled funds is accurate (it isn’t by the way, but let’s leave that for now) then that income to councils over the last five years might have been as much as £1bn. A billion quid of funding for services. You can see why both councils and investment managers are scratching their heads.

The changes to the code being proposed impose a one-size fits all judgement on what is acceptable and unacceptable risk. This goes completely against the spirit of an advisory / best practice guidance document.” – director of resources

Investment firms—who have also helped to pay the bills for us at Room151 and at CIPFA, supporting our conferences and our online content—have invested heavily in the sector. They’ve shown a deft hand in managing economic crises and, as mentioned, they have kept sending the cheques back to Local Government Plc ever since treasurers diversified away from high street banks.

Unsurprisingly, their clients aren’t all that keen to see them go.

Of course, this would be a moot point were local government funded well enough. But it isn’t! That is the message s151 officers need driven home at the Treasury. If you underfund a sector where a balanced budget is a statutory requirement then you simply leave authorities with no choice but to sweat their resources as best they can.

“If HM Government funded LAs properly, perhaps the need to seek commercial investment opportunities would not be so crucial.” – deputy s151 officer

Net borrowing

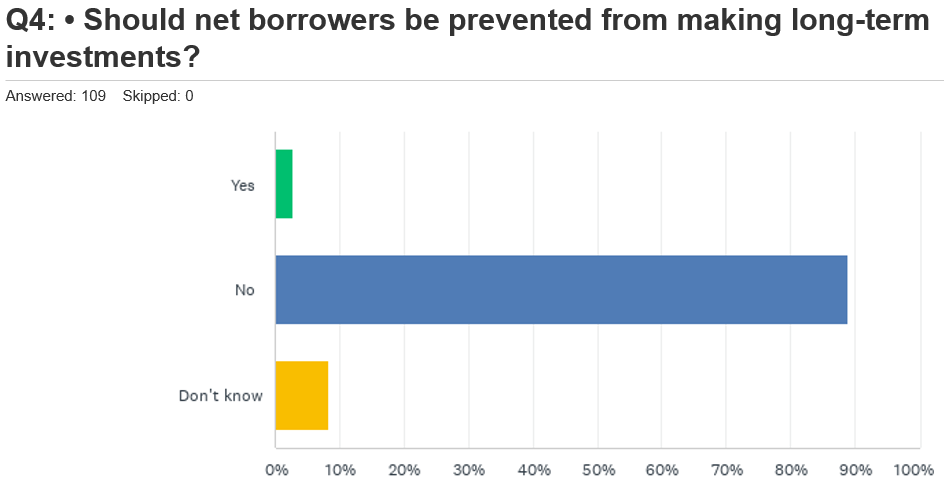

Almost 90% of the 109 senior officers who completed our survey do not believe that “net-borrowers” should be prevented from making long-term investments.

Just three respondents thought they should, and a little more than 8% didn’t know.

When nine out of ten practitioners in any given sector think its professional body is barking up the wrong tree, isn’t it time to take a look at some other trees?

Here are just some of the thoughts articulated by treasurers, s151s, principal accountants and directors of resources:

“Investment portfolios are entered into as long-term, strategic investments. Being forced to exit will be financially detrimental and fly in the face of VFM” – s151 officer

“Being forced to sell ‘pooled’ investments, at a potential huge loss to the ‘public purse’, in order to mobilise borrowing needed to maintain operations just doesn’t make sense and should not feature within the code.” – director of resources

“Many authorities borrowed in the past over long periods and it is ridiculously expensive to repay early. It is daft to then limit investments because of this overhang which can be for 30 years.” – treasury manager

“Pooled fund investments are an option to generate inflation matching returns over the medium term as most borrowing cannot be repaid early without punitive penalties.” – treasury manager

“Investment in pooled funds being treated like commercial investments is a real concern.” s151 officer

“Return on these investments is in excess of PWLB rates so would put pressure on budget if we had to redeem, plus there may be loss of capital if [we] had to sell below initial investment.” – senior finance office

Pooled funds

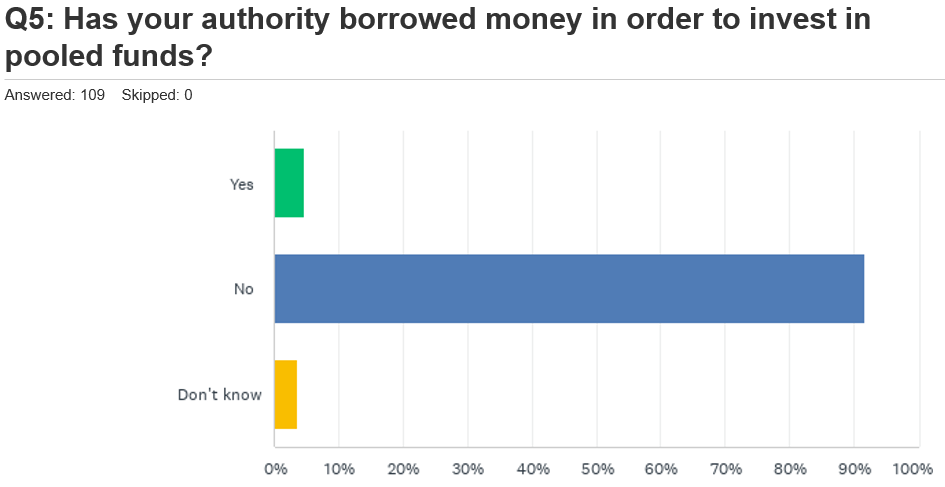

More than 92% of respondents to our survey simply do not accept that they are borrowing money to place in pooled funds. Where is the evidence that this is actually happening?

Is CIPFA genuinely pinning its numbers on the rather vague “other investments” column in the MHCLG live data? If it is, it needs to explain why treasurers wouldn’t have allocated those investments to the data column named “externally managed funds”.

Surely that describes all “pooled fund” investment?

So, not only do 90% of finance officers think that the net-borrowed should not be prevented from making strategic investments, 92% don’t think it’s happening anyway! Confused? You’re not alone.

“Generally speaking, I think CIPFA has got the wrong idea about why authorities are investing in pooled funds … Councils should be able to borrow for any purpose, while maintaining their investment balances, as long as this demonstrates a prudent approach. It is not for CIPFA to decide that this is not appropriate.” – deputy s151 officer

“I think the various codes contradict each other and make it difficult to interpret and make decisions with confidence.” – treasury manager

“Some of the implications (selling assets to redeem borrowing) would appear to overstep the mark into policy-making which should be the purview of local authority governance and financial management.” – treasury manager

Guidance or compliance?

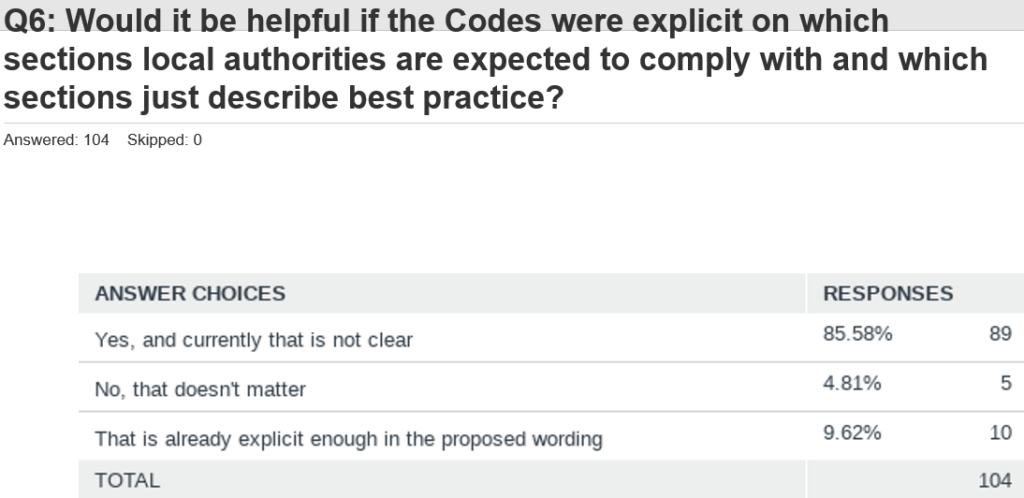

85% of finance officers don’t think the proposed wording makes a clear distinction between what is guidance and what should be complied with.

We know that during our recent webcast, and according to a number of privately held conversations, CIPFA is saying that its guidance is just that … guidance.

However, as one senior officer makes crystal clear in our survey, the current wording is far too prescriptive to be passed off as best-practice guidance:

“The wording of the code is not helpful to councils as it seems, in its current format, to be very prescriptive indeed. If this is not the intention as mentioned in your (Room151’s) webinar then CIPFA needs to change the wording so that it properly reflects [its] intentions. If they do not, then councils will be challenged by external auditors as to why they are not following the requirements of the code. Rest assured, external auditors will read the wording of the code in very prescriptive terms.” – principal accountant

Recent talk of a “soft launch” will do little to abate fears that CIPFA is trying to push these changes through. The soft launch, ostensibly floated to take pressure of the 22-23 TMS workload, looks more like a stay of execution than a meaningful compromise.

CIPFA still has a great opportunity here to listen to its membership and to make some necessary changes. There is strong support for much of the code. The intention to focus on risk management and the introduction of the liability benchmark are all being hailed as sound ideas.

“There is an underlying tone of nanny knows best, which is a weak foundation…” – other senior finance officer

Mystifying

Very few people wanted to see a continuation of big risky bets on out-of-town shopping centres and retail parks, but to muddy the waters with pooled funds, based on tenuous and unpublished data, has been divisive, counter-productive and mystifying.

If there are no further amendments to the September document, CIPFA will be ramming home a hugely unpopular set of instructions not with the blessing of its membership, but in spite of it.

We await the next announcement eagerly and in the meantime, a very big thank you to all those who took the time to take part in our survey.

The full results of the Room151 survey will be submitted to CIPFA’s consultation and are available to all those who took part.

—————

FREE monthly newsletters

Subscribe to Room151 Newsletters

Room151 Linkedin Community

Join here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel