A recent rise in inflation has local government treasury leaders thinking about interest rates, writes Gavin Hinks.

Should local government be worried about rising inflation? The increasingly shrill reports about climbing rates has experts thinking hard about the implications. Some see little to worry about. Others see more uncertainty and say council treasurers appear to be entering a period in which the the usual financial elements behave counter to expectations.

16 September 2021

London Stock Exchange or ONLINE

13th Local Authority Treasurers’ Investment Forum

Room151’s flagship annual conference. Free attendance for local government treasurers and section 151 officers.

Lead sponsor CCLA

Public sector treasurers can register here

According to David Green, startegic director at Arlingclose, the development of inflation is a factor that demands vigilance: “CIPFA added inflation risk back into the treasury management code in 2017 and it is definitely something worth keeping an eye on.”

Inflation is without doubt climbing. The Office for National Statistics revealed earlier this month that consumer price inflation has hit 2.1%, busting through the Bank of England’s target. The ONS says the number was driven higher by rising prices for clothing, fuel, games and media gadgets, and eating out. The biggest upward pressure was transport.

Menawhile in May the UK Puchasing Manager’s Index (PMI) reached, 65.6, it’s highest level ever—and a result of rising costs for raw materials—before falling back to 64.2, lower but still beating all other previous measures.

The implications for local government are much like consumers: goods and services may become more expensive. But treasurers will also be concerned about the implications for interest rates. Unnerving levels of inflation could prompt the Bank of England to take action. This would, of course, affect both savings and investments, on the one hand, and borrowing on the other.

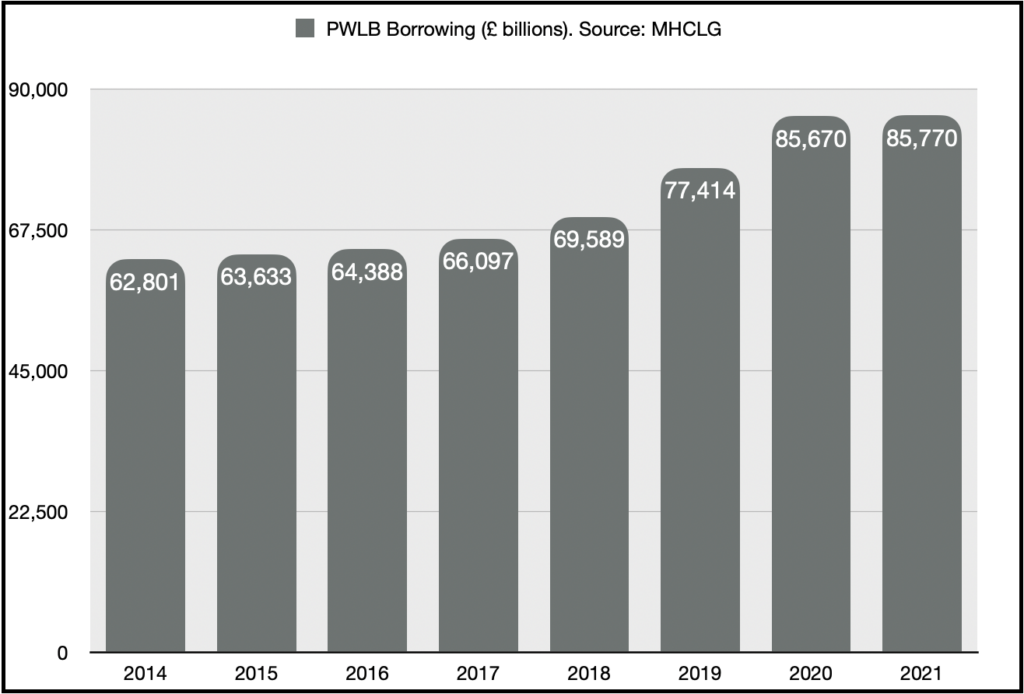

But observers say the inflation and interest rate picture is complicated by other factors. PWLB loans at variable and “new loan” rates currently stand at less than 2%, a level some would consider prime for borrowing. But there appears to be something else going on. PWLB borrowing seems to have tapered off. The rise from 2020 to 2021 is a mere £100m (from £85.6bn to £85.7bn). In contrast, from 2019 to 2020 borrowing rose £8.2bn.

Cash holdings

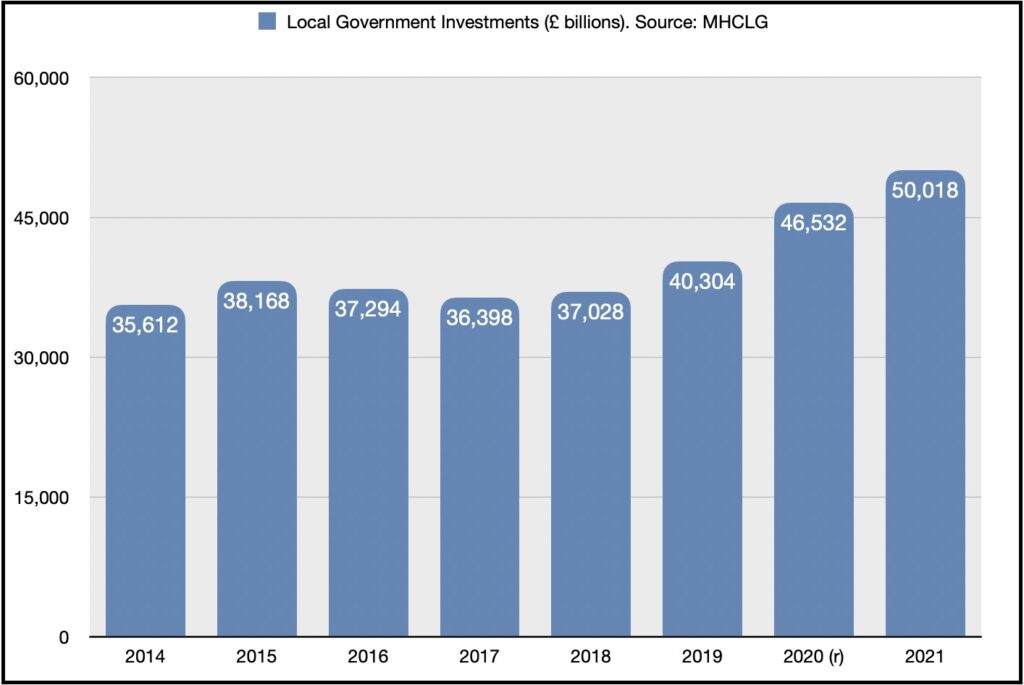

Meanwhile, figures out this week from the Ministry of Housing, Communities and Local Government (MHCLG) show that councils appear to be holding large amounts of cash. Investments, according to MHCLG, stand at £50bn, at March this year, up from £46.5bn last year, and £40.3bn in 2019. During the previous four years total investments hovered around the £37bn mark.

Explanations for this vary. Some of the money could be Covid relief funds still to be distributed. Other observers wonder whether that can be the case at this point in the pandemic: much of the crisis cash shoold have been passed on already. Another explanation is the cash reservoir could be boosted by capital funds unspent during the last year because Covid-19 forced projects to come to a standstill. At this point in time experts say the picture is unclear.

So, funds at PWLB are cheap, but borrowing seems to have dropped off significantly. There’s also evidence that spending on big ticket property deals—a significant driver of council borrowing—has fallen off. Figures show spending on land and property has dropped off 42% from £4.3bn in 2019-20 to a “provisional outturn” of £2.5bn by March this year. This may be largely due to a clampdown by HM Treasury to cut borrowing for yield.

With all these development underways treasury officers may also be concerned to see if the current inflation spike is baked in. In other words, is the current inflation elevation “transitory” or on the way to being embedded in the economy?

“Inflation will be higher currently due to the base effects of commodity and price reductions last year during the pandemic,” one expert tells Room151, “but will these factors fall out of the year-on-year calculation of CPI next year?”

Some see the inflation as less problematic. David Green says: “The MPC (Monetary Policy Committee) is likely to see post-Covid inflation as a one-off that corrects itself naturally without any need for interest rate rises.” The evidence, he says, is that back in 2008, after the financial crisis, inflation was allowed to rise to 5.2% without a compensating rise in rates.

Even so, the treasury runes seem difficult to divine. Treasurers will be concerned about the influence of inflation on gilt yields and what impact they may have on local authority borrowing. David Green adds that PFI contracts and pensions may be linked to inflation while fixed rate loans and minimum revenue position on past capital expenditure is “completly unaffected”. There is still room for caution.

“Councils should assess what their real inflation exposure is and how they can build treasury management portfolios to help manage inflation risk,” Green says.

Photo by Etienne Martin on Unsplash

—————

FREE monthly newsletters

Subscribe to Room151 Newsletters

Room151 Linkedin Community

Join here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel