Partner Content: CCLA Investment Management’s Robert Evans analyses this week’s 0.5 percentage point increase in the Official Bank Rate and discusses how high the rate could reach in 2023.

The Bank of England’s Monetary Policy Committee (MPC) voted in favour of a more moderate 0.5% increase in its Official Bank Rate this week, taking it up to 3.5% – its highest rate in 14 years – while warning that further rate rises were likely. The bank has now increased rates at each of the past nine meetings, representing the biggest year-on-year jump since 1989.

The decision to lift rates to 3.5% was not unanimous and the nature of the vote provided further evidence of an increasing divergence of opinion within the MPC. The vote split was 1-6-0-2. One vote for a 0.75% hike, six members, including governor Andrew Bailey, voted for a 0.5% uplift, no members viewed an increase of 0.25% appropriate, while two favoured no increase at all. The majority of MPC members said further rate rises were likely at future meetings “for a sustainable return of inflation to target”.

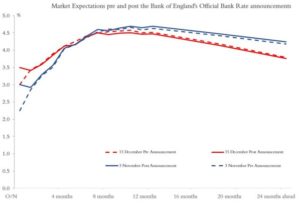

Coming into the latest meeting of the MPC, a 0.5% rate increase was widely expected. The outside chance of a larger 0.75% increase receded after the latest inflation reading undershot expectations. Following the announcement, and in particular the vote split, market expectations for the path of Bank Rate shifted lower as we move into 2023. Investors now see rates peaking at around 4.5% next year, down from around 4.7% in November.

Source: CCLA/Bloomberg, 15 December 2022

Despite the 0.5% increase being in line with recent moves made by other central banks in the Eurozone, the US, Canada and Switzerland, the pound fell by as much as 2% to $1.2157 in the hours after the news, while the yields on UK government debt dropped slightly as markets digested the more dovish voting patten than expected.

In Europe the European Central Bank is taking a different stance and advocating a significantly tighter monetary policy ahead; short-dated European sovereign bond yields were up nearly 30 basis points on the day. (Bloomberg, 15th December 2022)

Rationale behind the increase

Consumer Price Index (CPI) inflation remains about five times higher than the Bank of England’s target of 2%, which means that MPC members remain under considerable pressure to meet their mandate. But, for the first time in a number of months, a few data-points are indicating that we are in peak inflation territory, and it should soon be on a downward trajectory unless there are any additional surprises.

In his letter to the chancellor, Bailey predicted that inflation will fall next year. He wrote:

“The MPC’s latest projections suggest that 12-month CPI inflation has reached its peak.

Household energy prices have been significantly reduced by the government’s Energy Price Guarantee, which has limited the increase in CPI inflation. But inflation is expected to remain very high in the next few months as global and domestic factors continue to push up on consumer price inflation. CPI inflation is then expected to fall gradually into the spring of next year.

A significant part of this expected fall reflects so-called base effects as previous increases in energy prices start to drop out of the calculations of the 12-month rate.”

The most recent CPI release showed that UK inflation dipped to 10.7% in November as an easing in petrol prices helped to lower the rate from a 41-year high of 11.1% the previous month. What was more encouraging was that core inflation, which excludes volatile items like energy, food, alcohol and tobacco, also softened – from 6.5% in October to 6.3% in November – and this was a further positive sign that underlying price pressures were moderating.

Despite the nascent signs that inflation may have peaked, the bank remains very concerned that inflationary pressures are persisting in some areas, especially in the services sector which is crucial for the performance of the UK economy, and this is becoming increasingly embedded in the wage demands that staff are able to command.

In their statement on 15 December, the MPC commented:

“The labour market remained tight and there had been evidence of inflationary pressures in domestic prices and wages that could indicate greater persistence and thus justified a further forceful monetary policy response.”

This week’s unemployment report showed that regular pay rose by a stronger-than-expected 6.1% in the August-to-October period, the biggest gain since records began in 2001. This is a level that is simply incompatible with the bank’s 2% inflation target.

Adding fuel to this already tight labour market was the continued growth in the number of those employed, and suggests that the headwinds facing the economy haven’t started to feed through into hiring. However, in an early sign that this market too is cooling, vacancies fell materially in November, continuing their recent downward trend.

Growing divergence of MPC opinion

The majority of MPC members believe further Official Bank Rate rises may be needed at future meetings, to bring inflation down towards its 2% target. The minutes of the MPC meeting stated:

“The majority of the committee judges that, should the economy evolve broadly in line with the November Monetary Policy Report projections, further increases in Bank Rate may be required for a sustainable return of inflation to target.”

But they did not say whether rates would have to rise as high as financial markets expect, which were forecast to peak at just above 4.5% by the middle of 2023. In contrast, at their November meeting, the MPC pushed back on those market expectations, which were at that point closer to 5%.

Catherine Mann, the external MPC member who voted for an even larger rate rise, said the bank needed to combat “an inflation psychology that was embedding in wage settlements and inflation expectations, and was pushing up core services and other underlying inflation measures”.

Silvana Tenreyro and Swati Dhingra voted to keep interest rates on hold at 3%, warning that the effect of the rate moves to date had not yet been fully transferred through the financial system. Consequently, they said, a 3% interest rate was “more than sufficient to bring inflation back to target, before falling below target in the medium term”.

How high will UK interest rates go?

In line with their November projections, the bank expects the UK to fall into recession this quarter, although they now expect a smaller contraction. They also highlighted concerns about the housing market and the health of corporate borrowers. The MPC minutes state:

“Bank staff now expect UK GDP to decline by 0.1% in 2022 Q4, 0.2 percentage points stronger than expected in the November Report. Household consumption remains weak and most housing market indicators have continued to soften. Surveys of investment intentions have also weakened further.”

In light of a rapidly slowing economy, inflation peaking and early indicators that the jobs market is starting to cool, the bank should no longer need to act to the same magnitude as it has over the last few months. That said, it is highly likely that rates will need to rise further, albeit in smaller increments, over the first half of next year, until the heat comes out of the labour market and clear progress is being demonstrated in reducing core services inflation.

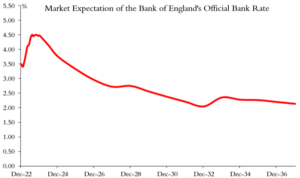

We expect the MPC will continue with its rate-hiking cycle, but the pace of tightening will likely drop back. We see a 0.25% increase as most likely at the next meeting in February (with a significant risk of a 0.50% increase), followed by a further tail of 0.25% increases in March and May, considering the continued decline in economic indicators.

We expect Bank Rate to peak during the second quarter of 2023 at either 4.25% or 4.50%, although there are considerable uncertainties around this outlook. Even with the economy struggling, we do not expect the bank to look to cut rates until inflation is under their 2% target, which doesn’t look likely next year. As set out in the chart below, our view is broadly in line with the markets:

Source: CCLA/Bloomberg as at 15 December 2022

Impact on deposit funds

Throughout the year, we have been positioning the investments within our three cash funds to allow for their net yields to quickly react to this new rate environment. Using CCLA’s Public Sector Deposit Fund (PSDF) as an example, within the next seven days, 53% of the holdings will have been rolled over at the new higher rates, 63% within a month and 89% in less than three months. Therefore, we should see a relatively quick readjustment in their net yields.

Given the volatility we have witnessed over recent months at the longer end of the curve, we have been reluctant to overextend the funds into these periods, thereby protecting mark to market values in the process. However, this approach has excluded us from some of the attractive yields in these periods.

As of Friday 16 December, the PSDF net yield is 3.3%. We expect to see a continued upward trend in these yields over the coming weeks and months.

Robert Evans is senior portfolio manager at CCLA Investment Management.

Disclaimer

This document is a financial promotion and is issued for information purposes only. It does not constitute the provision of financial, investment or other professional advice.

To ensure you understand whether a CCLA product is suitable, please read the key investor information document and the prospectus. CCLA strongly recommends you seek independent professional advice prior to investing.

The Public Sector Deposit Fund (PSDF) is a UK short-term LVNAV Qualifying Money Market Fund.

In addition to the general risk factors outlined in the prospectus, investors should also note that purchase of PSDF shares is not the same as making a deposit with a bank or other deposit taking body and is not a guaranteed investment.

Although it is intended to maintain a stable net asset value per share, there can be no assurance that it will be maintained. Notwithstanding the policy of investing in short-term instruments, the value of the PSDF may also be affected by fluctuations in interest rates. The PSDF does not rely on external support for guaranteeing the liquidity of the fund or stabilising the net asset value per share. The risk of loss of principal is borne by the shareholder.

Past performance is not a reliable indicator of future results. The value of investments and the income derived from them may fall as well as rise. Investors may not get back the amount originally invested and may lose money.

Any forward-looking statements are based upon CCLA’s current opinions, expectations and projections. CCLA undertakes no obligations to update or revise these. Actual results could differ materially from those anticipated.

The PSDF is authorised in the United Kingdom and regulated by the Financial Conduct Authority as a UCITS Scheme and is a Qualifying Money Market Fund.

CCLA Investment Management Limited (registered in England & Wales, No. 2183088, at One Angel Lane, London, EC4R 3AB) is authorised and regulated by the Financial Conduct Authority.

—————

FREE weekly newsletters

Subscribe to Room151 Newsletters

Room151 LinkedIn Community

Join here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel