Local authorities are being pushed into a deepening “debt crisis” with data suggesting the “worrying trend of insolvency” will continue.

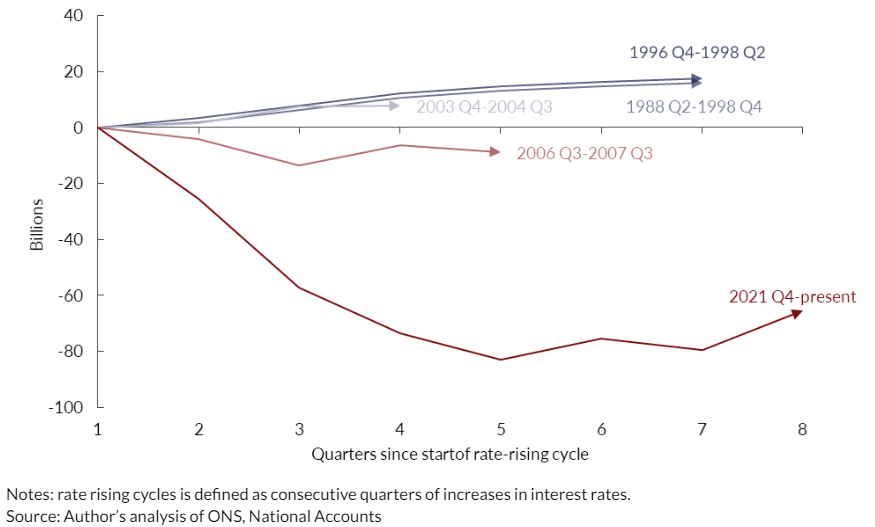

Research conducted by the National Institute of Economic and Social Research (NIESR) shows that local authorities have seen an £80bn fall in net worth since interest rates started to rise in late 2021, with net worth defined as the value of all non-financial and financial assets owned minus the value of all outstanding liabilities.

This represents the largest fall in net worth since records began, economic think tank NIESR said, and is being driven by a growing cost of debt.

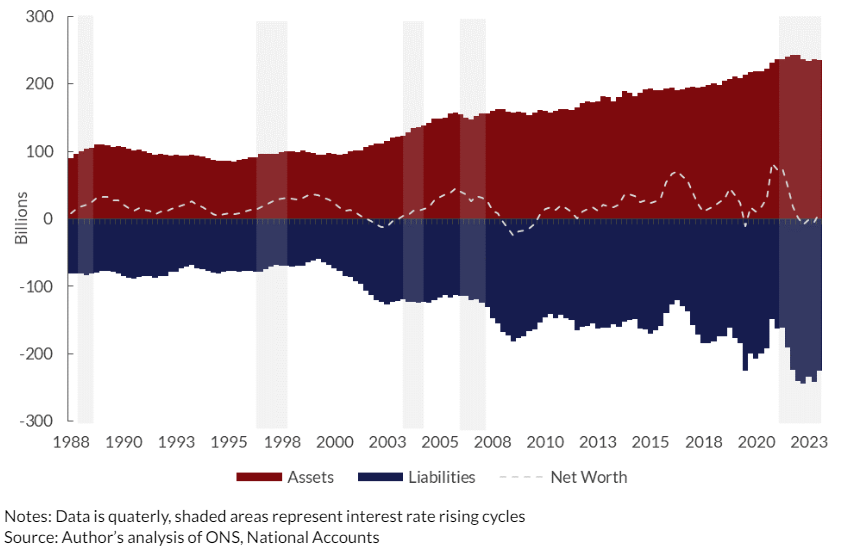

The use of loans at local authorities has been “building substantially since 2010”, with the overall level of debt in the sector nearly doubling in that time as “many invested in capital to meet future financial shortfalls by taking out loans with comparatively low rates”, NIESR stated in the research briefing.

Rising interest rates will be pushing many local authorities into a “debt crisis”, with the average interest on this debt having broadly doubled since the Bank of England started raising interest rates.

“Debt as a tool to combat the funding pressures of the 2010s may now be the very source of funding pressures for the 2020s,” wrote Max Mosley, senior economist at NIESR, in the briefing.

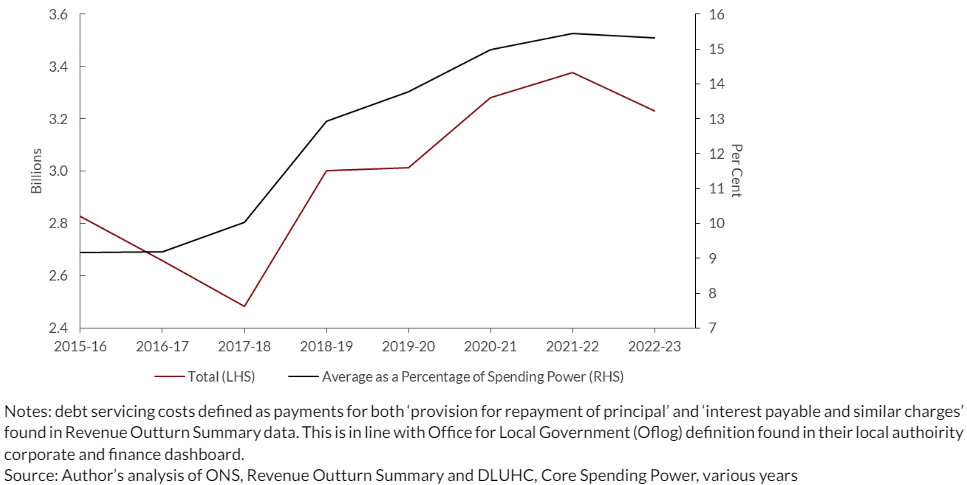

On average 15% of all local authority budgets is being spent on debt interest payments – worth £3.2bn a year, the research found.

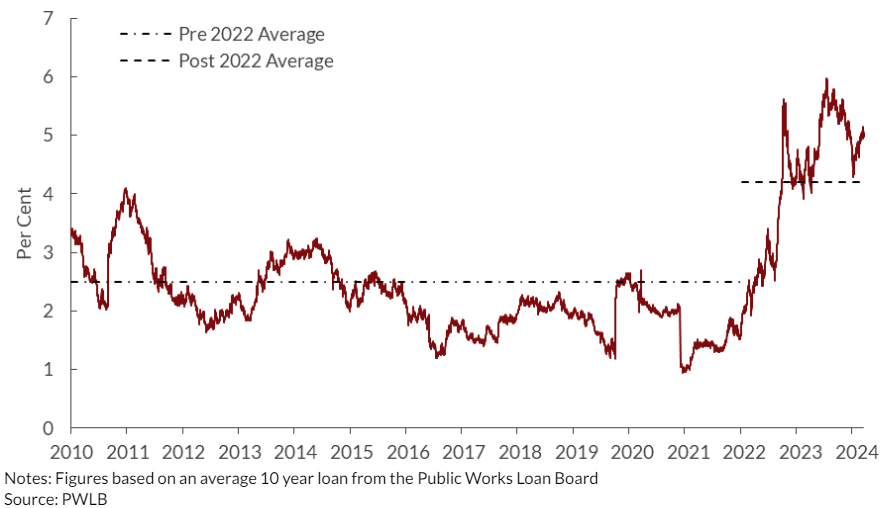

Describing the impact of rising interest rates, Mosley wrote: “The overall cost of debt through the 2010 period was historically low, as interest rates remained constrained at the zero-lower bound. Naturally, the interest charged by the Public Works Loan Board (PWLB) to local authorities was similarly low. The average interest charged for a 10-year loan was around 2.5% between 2010 and 2022. From 2022 onwards, this rose to an average of just over 4% as a result of rising interest rates.

“The latest data takes this level to over 5%, which is double what local authorities were spending just a few years ago.”

According to Mosley, the consequences of rising interest charged on loans are that future projects become more expensive and local authorities have to pay more for their existing debt.

“We can see by comparing reported debt servicing costs in revenue outturn data and estimates of Core Spending Power that local authorities are spending more of their budgets on debt interest costs, which stand at around 15% of their budget on average,” he added.

“It is important to note though that this has been rising for some time and is not exclusively driven by the rising cost of debt. However, this trend will continue to worsen as debt becomes more expensive.”

The NIESR research briefing concludes that “the debt crisis developing in local government will be slowly pushing many local authorities to the brink of bankruptcy, and that the few who have already done so are not exceptions to the rule that local authorities always find a way to survive difficult financial periods, but proof that this rule may not survive into the 2020s.

“A trend of local authorities declaring bankruptcy just as a new government is sworn in will be an unenvious image for any government in any country. A considerable amount of reform and money will be needed to make sure that it is not this one.”

—————

FREE bi-weekly newsletters

Subscribe to Room151 Newsletters

Follow us on LinkedIn

Follow us here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel