The government has released the final wording of its revised investment code, including a softening of draft proposals on transparency requirements relating to property investment.

The government has released the final wording of its revised investment code, including a softening of draft proposals on transparency requirements relating to property investment.

The Ministry for Housing, Communities and Local Government (MHCLG) last week published its response to a consultation on its draft proposals, which were released in November.

The rules outline government’s desire to see councils provide more information on such investments, but the final wording has dropped a requirement for the information to be produced in a separate investment strategy.

A government statement on the new guidance said: “The government believes that it is important that local authorities take decisions in an open and transparent manner.

“However, the government does not want to increase the reporting burden on local authorities.

“For this reason the government has revised the guidance to make it clear that providing all the required disclosures are made and are publicly available, local authorities should have the flexibility to decide how to structure that information.”

In addition, the government said that local authorities should have the discretion to set appropriate indicators which allow councillors to assess total exposure from borrowing and investment decisions.

It said: “The final code recognises that if this is the most important principle, then it may not be possible to select indicators that allow comparability between authorities, and therefore this requirement has been removed.”

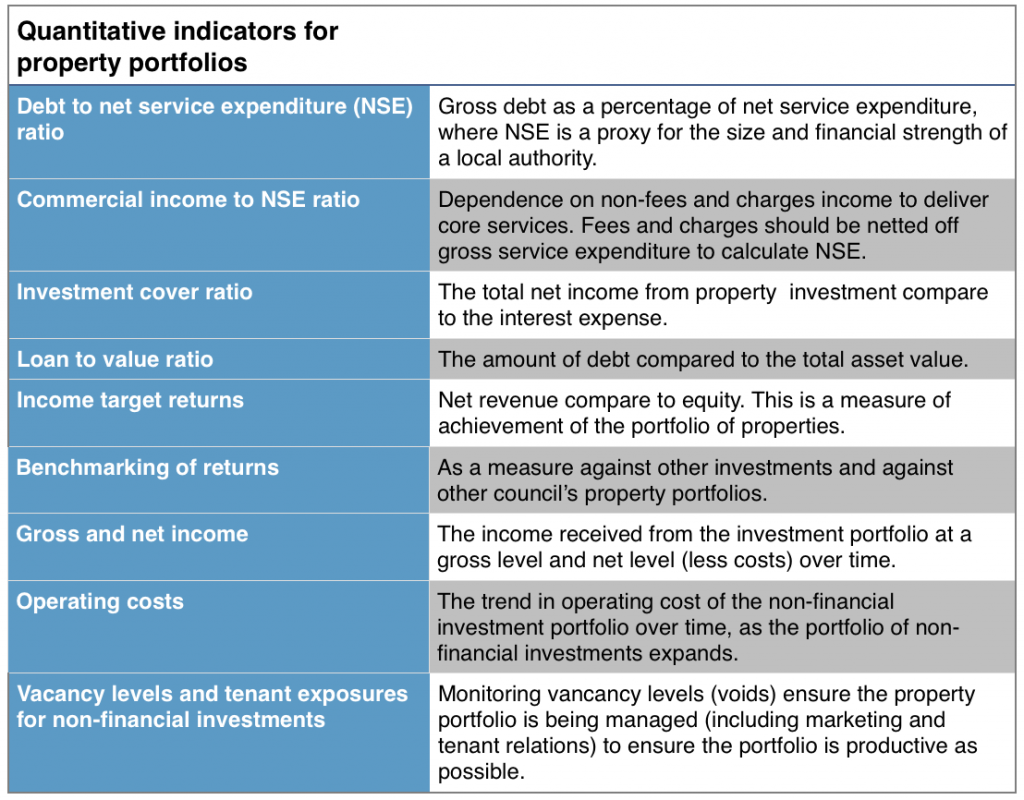

The government has published non-statutory guidance notes, which outline nine quantitative indicators which it says “allow councillors and the public to assess a local authority’s total risk exposure as a result of its investment decisions”. (see below)

These include the debt to net service expenditure (NSE) ratio, commercial income to NSE ratio, gross and net income and operating costs.

But David Green, strategic director at Arlingclose, said the wording of the guidance and accompanying notes made it unclear how much force the guidance would have.

He said: “I would summarise it as confusion. It is not clear whether the bulk of the guidance applies to treasury investments, or not; whether you can borrow for investment property or not; nor whether the nine new indicators are mandatory or not.

“I believe that a number of local authorities are now checking the legal status of the guidance and what happens if they disregard parts of it, especially where one part contradicts another.”

Despite the changes in the final wording to ease transparency burdens, Jo Pitt, local government policy manager at the Chartered Institute of Finance and Accountancy (CIPFA), said: “There is an increase in reporting and any increase in transparency translates into practical challenges when already pressurised staff are asked to deliver more.

“There is some flexibility around the strategies and the timings, which is helpful, but the additional compliance requirements have been noted by CIPFA and we are already looking at ways to support finance professionals.”

Elsewhere in the final code, the government has dropped a proposal to extend the principle of security, liquidity and yield to non-financial investments such as property.

It said: “In recognition that non-financial investments are, by their nature illiquid, and that local authorities may choose to hold onto investments for a number of years, particularly where they are held to contribute to local regeneration objectives, the investment guidance is now explicit that local authorities can determine the relative importance of security, liquidity and yield for different types of investment and can assess liquidity of non-financial assets on a portfolio basis.”

The new code also sees the government sticking with its original proposal to restrict the maximum use life for assets to a maximum of 50 years for the purposes of minimum revenue provision.

However, in response to concerns raised during the consultation, the government will allow councils to select a maximum use life for assets of more than 50 years for PFI debt, and for other investments “where a local authority has an opinion from an appropriately qualified person that an operational asset will deliver benefits for more than 50 years”.

Stephen Sheen, managing director at local government accountancy consultancy Ichabod Industries, said: “The paradox of the MRP statutory guidance is that the more restrictive it gets the more scope authorities have to depart from it in meeting their underlying statutory duty to determine a prudent MRP.

“However, the further authorities move from it, the greater the risk that MHCLG will give up trying to persuade authorities to be reasonable and enforce its own ideas of prudence through legislation.”