Sponsored article: Gavin Haywood of Federated Hermes looks at the integration of ESG in Federated Hermes’ money market funds.

Federated Hermes has over 300 public sector clients invested in our AAA rated money market funds but managing these and other liquidity portfolios has never been routine for us.

Our funds avoided certain commercial paper before the collapse because our liquidity team has always looked beyond traditional credit ratings and included in our proprietary analysis, financial and other additional material insights that could question the quality of an issuer.

Today, more than ever and with the clarity of hindsight, money market funds must utilise an enhanced investment process. This, in addition to credit fundamentals, focuses on the long-term strategic direction of its issuers in order to identify hidden risks that could result in a surprise downgrade.

The integration of ESG and stewardship information into an already robust investment framework acknowledges this evolution and is a key priority for Federated Hermes.

ESG: Early adoption

In 2004 Federated Hermes EOS team was founded with the adoption of the UN Principles of Responsible Investment following in 2006. In 2017 we joined the UN Global Construct—the World’s largest corporate sustainability initiative.

Integrating ESG factors into money market and liquidity portfolios helps maintain utmost confidence in the high quality and minimal credit risk requirements needed to achieve the objectives of principal stability and liquidity while maximising return.

QESG Model

Federated Hermes’ liquidity team uses information from 18 third-party vendors as well as proprietary in-house data and research in order to facilitate the integration of ESG factors into the credit review process. This is our own Quantitative ESG Model. We believe that this is the best way to fully integrate the differing views and positions of a large number of monitoring organisations that are needed to provide a full picture.

These key metrics are synthesised into our ESG Dashboard, which gives our team a concise assessment of a company’s exposure to material ESG risks.

Significantly, this Dashboard also highlights individual engagement activity that is carried out by our stewardship arm, EOS. These personal interactions provide important context to existing data and enhance our team’s ability to appropriately integrate those ESG factors. These qualitative ESG insights are among the many inputs used by our skilled and long-tenured liquidity team to build portfolios designed to meet the investment needs of our clients.

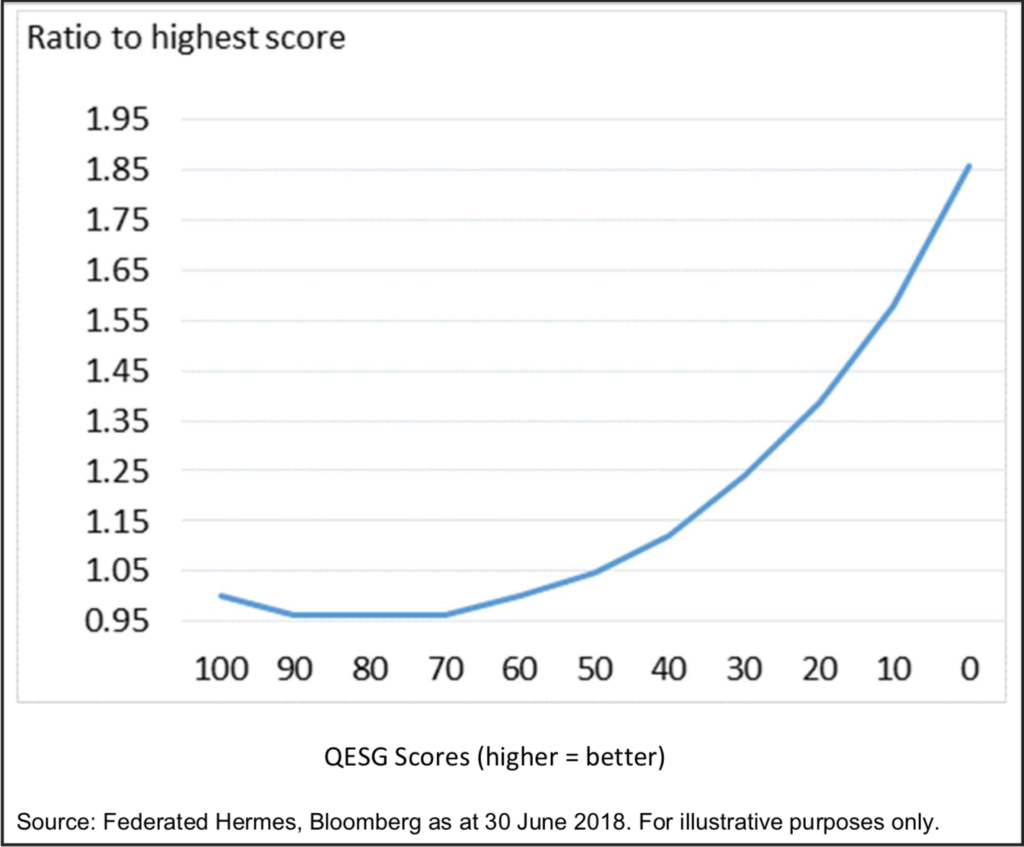

Implied CDS spreads vs QESG Scores

Engagement

The reason we use engagement rather than divestment is simply that by divesting of certain strategies or credits we can have no influence on the issuer. With engagement, the ability to influence has positive outcomes for all despite the time, patience and resources needed to employ an engagement agenda.

Federated Hermes has the largest engagement and stewardship team in any Asset Manager we are aware of.

What sets us apart?

- Methodically determining how ESG factors may be applied to our liquidity management franchise to improve risk adjusted returns.

- One of the largest institutional money market fund managers*;

- Offer a diverse array of liquidity products with varying strategies and legal structures to meet all types of client’s needs;

- 40-year history of demonstrated credit analysis;

- Helped to pioneer amortised cost method for valuing shares of money funds;

- Never had to infuse capital to protect NAV**.

Gavin Haywood is a director at Federated Hermes.

*iMoneyNet, Inc. 9/30/20. For more information on credit ratings, visit standardandpoors.com;

**Although Federated Hermes stable NAV money market portfolios have never broken the $1.00 stated price, there is no guarantee that such price stability will be achieved in the future.

FREE monthly newsletters

Subscribe to Room151 Newsletters

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel