David Chefneux looks at the impact of the pandemic on the cash and liquidity position of councils.

Data released by MHCLG recently, provides another useful insight on borrowing and lending trends within the local authority treasury management arena. The quarterly borrowing and investment tables released by central government provides individual data for all English, Scottish and Welsh authorities, but also provides useful summary tables and trends.

The latest data on borrowing shows a fairly steady position compared with recent quarters, with an increase in net borrowing from the PWLB of just £82m in the quarter to the end of June 2020. Total borrowing from the PWLB stood at £85.752bn. Total borrowing from all sources by authorities fell £363m to £126.495bn, driven by a reduction of £725m in short-term borrowing from local government, which is not unusual for the first quarter of a new financial year.

In terms of the quarter between April and June 2020, the more interesting data was always likely to come on the investments side, with the coronavirus pandemic and financial market volatility in late-March likely to have a significant impact on authority balances, cashflows and investment decisions.

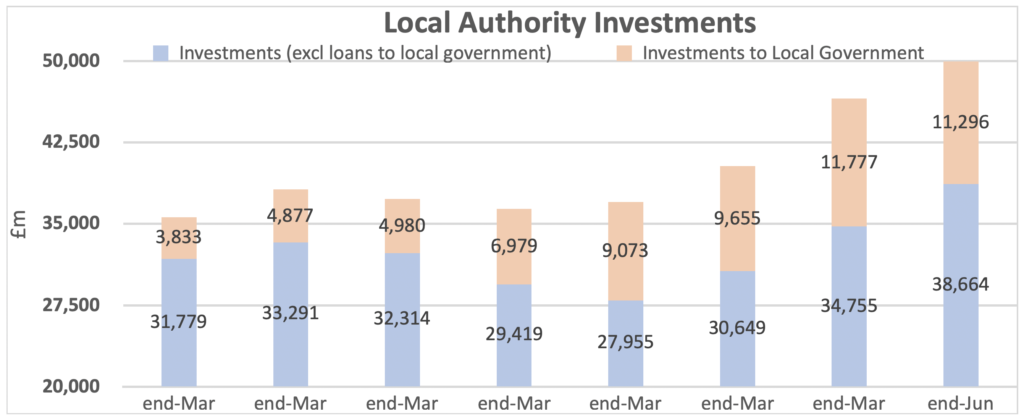

Perhaps what is most telling from the quarterly data is the continued increase in the underlying level of balances invested (now just shy of £50bn) and also the allocation of investment balances across the financial markets.

Pandemic impact

Local government practitioners will be well aware that traditionally cash/investment balances do tend to tick up during the first quarter of the financial year, but how much of an impact has the pandemic had on demands for cash and investment/liquidity decisions?

When analysing such a significant market, it’s always difficult to provide specific commentary, as individual positions will vary, but the impact of financial support provided from central government grants has no doubt been a key driver in the increase in overall balances invested referred to above.

Indeed, further data released by central government shows that a total of over £12bn in grant payments have been made to local authorities for passporting through to local businesses as part of the retail, hospitality and leisure grant support scheme. Of that total, around £10.5bn had been paid out by early August, leaving £1.5bn still to be paid across at that time. This may therefore explain some of the increased balances temporarily invested in the last quarter, ahead of payments being made to local businesses.

Further evidence is also highlighted in the allocation of investments at the end of June. A total of £15.4bn was invested at quarter end in the debt management account deposit facility (£2.3bn) and money market funds (£13.1bn). This represented over 31% of the total invested, compared to average historical levels of £9.5bn, or 20% of total investments, and was above comparative levels for this time of year in previous years.

Events of the last quarter have certainly been unique and time will tell in the coming months which direction borrowing and investment balances will take. One to watch when the next set of figures is released in a few months’ time.

David Chefneux is director of Link Market Services at Link Asset Services.

FREE monthly and weekly newsletters

Subscribe to Room151 Newsletters

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel