Sponsored article: Peter Hunt and George Carne from Fidelity International ask how treasury departments can balance the need for yield and liquidity.

The massive stimulus and waves of liquidity provided by central banks in response to the COVID pandemic have suppressed borrowing rates, making it increasingly difficult for investors to generate yield. Given huge debt burdens around the world and policymakers’ desire to maintain financial stability, monetary policy is expected to remain highly accommodative and the problem of income generation is unlikely to disappear any time soon.

Treasury departments could once rely on money market instruments to generate reasonable returns safely. That changed when the global financial crisis ushered in an era of low yields, an environment that has been entrenched further by the COVID pandemic.

As a result, the challenge of earning yield on their capital while maintaining adequate liquidity for corporate operations has come sharply into focus once again. The choice appears to be to either stay in cash and earn returns that are likely to be negative after inflation, or embrace more risk in exchange for higher yields.

It is clear that the job of balancing yield and liquidity has become much harder, but there are investment opportunities beyond cash that can deliver income while providing decent levels of liquidity. These provide opportunities for treasurers to create balanced portfolios generating attractive, diversified and liquid returns.

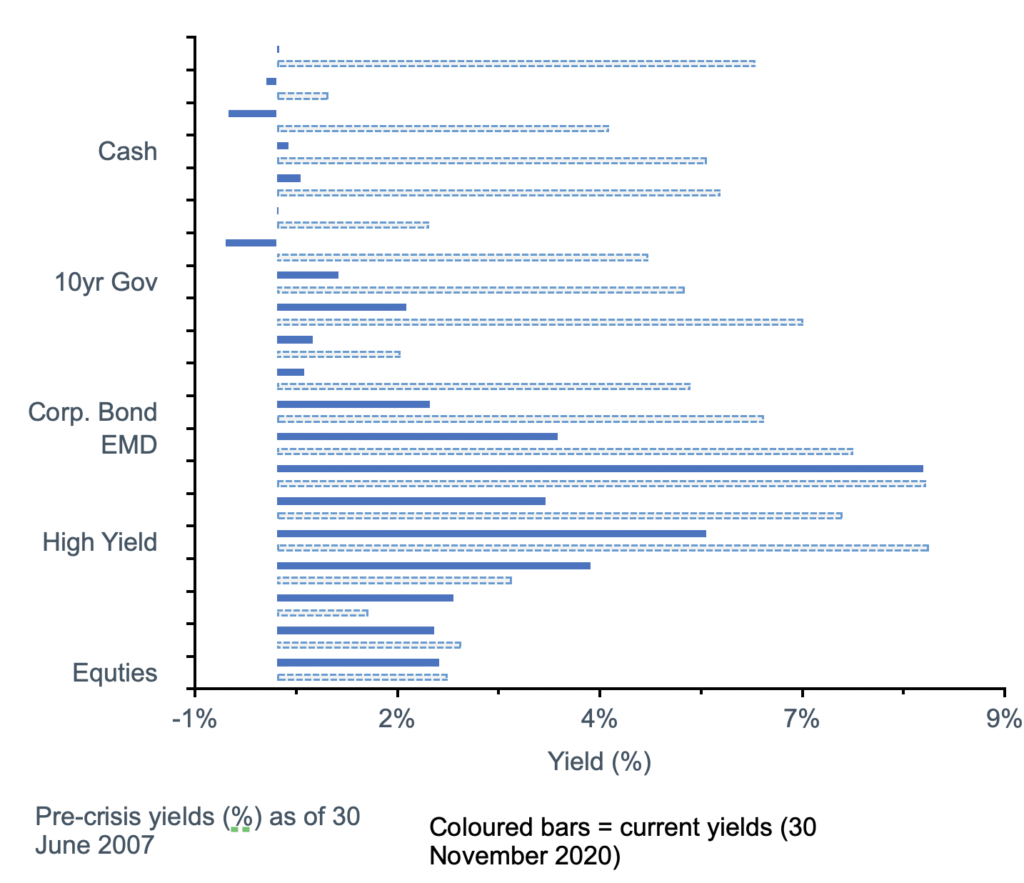

Investors are being pushed up the risk spectrum in search of yield

Source: Refinitiv Datastream, 20 November 2020.

Source: Refinitiv Datastream, 20 November 2020.

Fixed Income: The yield machine

Fixed income sits at the conservative end of the risk profile, offering more stable returns with lower capital risk. The safest parts of the fixed income world have seen significant yield compression, particularly among government bonds, many of which now offer only negative yields.

Investment grade corporate bonds are also offering lower yields than they once did but can still provide reasonable levels of income while maintaining high credit ratings. Emerging market debt and high yield are the riskier asset groups within fixed income but can generate attractive risk-adjusted returns when combined with safer types of bonds.

Bond portfolios can comprise a mix of sub-set assets depending on the required yield

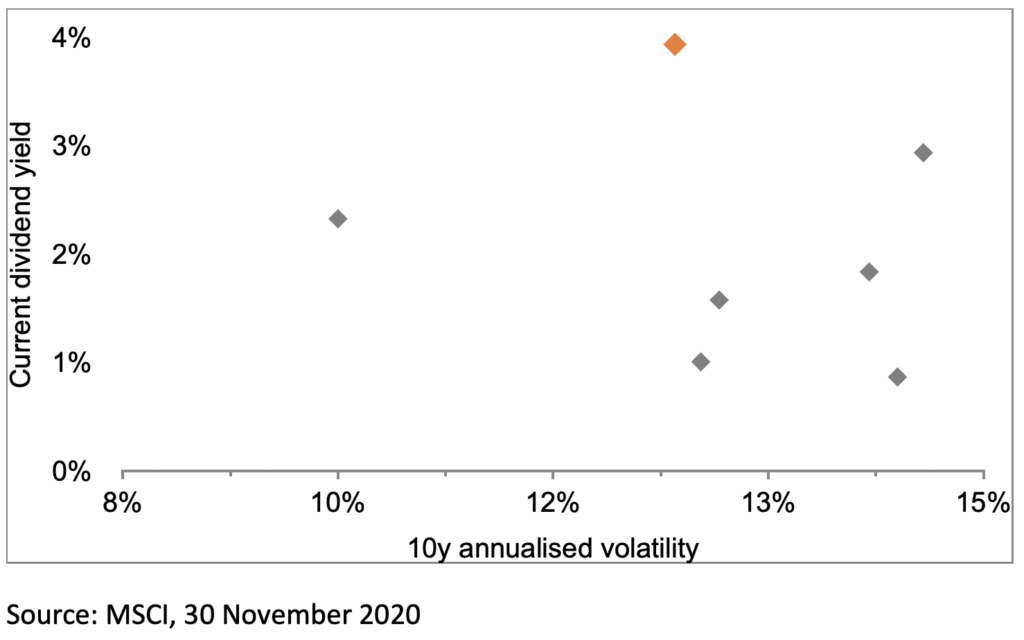

Equities: Higher yields than a decade ago

Equities are generally more risky than fixed income, but they tend to provide more capital growth than other asset classes and can provide inflation protection.

There are low volatility approaches available within this asset class; stable businesses that produce reliable earnings and pay attractive dividends over extended timeframes can present low volatility investments, but at the sacrifice some yield.

However, even high dividend yield stocks currently represent lower volatility than most other equity approaches.

A combination of high dividend-paying and minimum volatility stocks can be attractive for treasurers

Real estate: An effective diversifier

Real estate: An effective diversifier

Diversified real estate exposure (including residential, industrial, office, retail and other groups) can produce inflation-resistant income, while remaining liquid during times of distress.

However, the key attraction of real estate as part of an income portfolio is its limited correlation with other asset classes.

Risk management is of utmost importance, with exposure diversified regionally, by sector and at the individual investment level.

Conclusion: Combinations are key

The job of treasurers has become much harder since the global financial crisis and COVID has only exacerbated the issue of generating income while maintaining liquidity.

Treasurers are no longer able to maintain the liquidity and generate the income they require through cash. However, they are still able to earn decent yields while ensuring adequate levels of liquidity via other asset classes, including fixed income, equities and real estate.

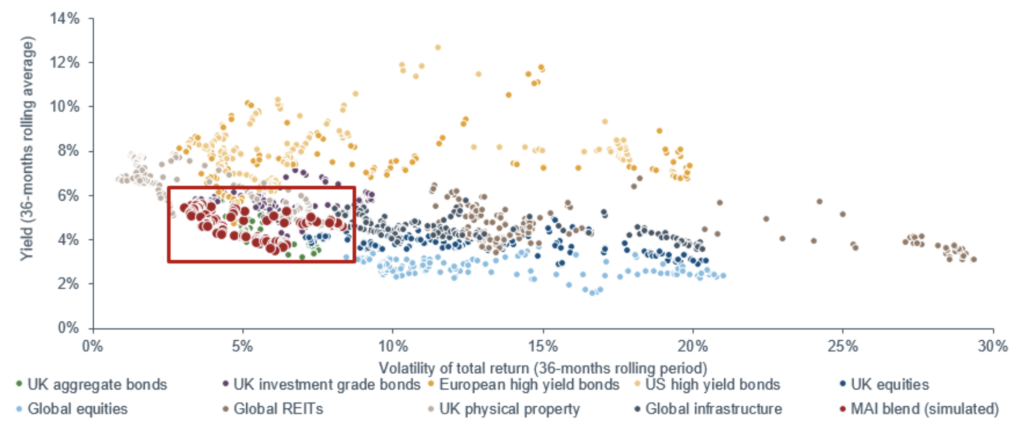

A flexible multi asset approach can open up an array of different performance profiles for investors.

By allocating to both fixed income and equities, multi asset portfolios can provide higher yields than the former, alongside lower volatility than the latter. Adding allocations to alternative asset classes such as real estate can further improve diversification and therefore risk-adjusted returns.

Multi asset blends can provide tailored investment outcomes

Simulated exercise based on our proprietary modelling, for illustrative purposes only – not based on an actual portfolio performance. Impact of fees will change these figures. Past performance is not a reliable indicator of future results.

Simulated exercise based on our proprietary modelling, for illustrative purposes only – not based on an actual portfolio performance. Impact of fees will change these figures. Past performance is not a reliable indicator of future results.

Peter Hunt & George Carne, UK & Ireland Institutional Business Development, Fidelity International.

FREE monthly and weekly newsletters

Subscribe to Room151 Newsletters

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel