Barnsley Metropolitan Borough Council’s external debt hit £836.631m at the end of the 2022/23 financial year.

This – along with the council’s calculated maximum level of external borrowing on a gross basis of £870.398m – is close to, but compliant with, the statutory authorised limit of just over £1.1bn set under the Local Government Act 2003.

The council noted that, against the CIPFA Financial Resilience Index, it had some indices related to borrowing levels and reserves currently indicating ‘high risk’.

And in comparison to other metropolitan authorities, the council has the highest ratio of interest costs to net revenue expenditure. This is largely attributed to a combination of additional capital expenditure on town centre redevelopment and interest payable on PFI schemes.

However, in an annual report on treasury management activities, director of finance and section 151 officer Neil Copley said he was “confident” that the risks associated with the high level of external debt are “manageable via the council’s ongoing reserves, capital investment and treasury management strategies”.

He added: “The council continues to demonstrate a strong financial grip, holding a robust and stable reserves position with a sound strategy in place to meet the immediate challenges faced by the council.”

In a draft statement of accounts for 2022/23, Copley reported an overspend against resources of £10.5m. However, Barnsley’s general fund reserves increased by £2.6m to reach £219.7m at the end of the financial year.

The council gained financial support from the Department for Education as part of the Safety Valve Programme, resulting in an additional payment of £9.160m.

Borrowing strategy

Barnsley Council’s stated borrowing strategy is to actively reduce its exposure to interest rate risk, while maintaining an under-borrowed position. There was no new long-term borrowing undertaken during 2022/23, resulting in a net decrease of £32.7m on the council’s borrowing portfolio during the financial year.

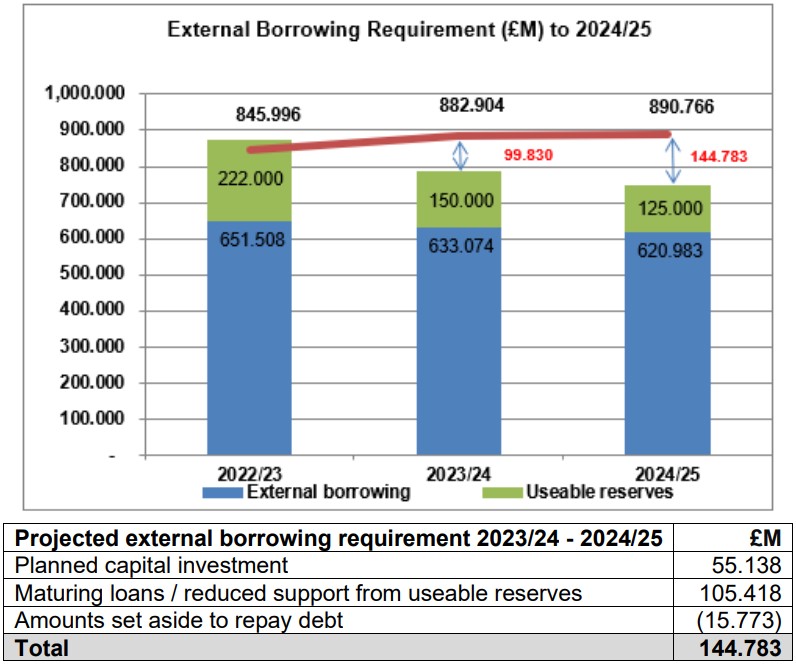

However, there will be a borrowing requirement of £144.8m by the end of 2024/25, including planned capital investments of £55.1m and maturing loans of £105.4m.

Some 70% of the council’s overall borrowing requirement is being financed by long term, fixed rate borrowing, Copley’s report noted. The decision to undertake any further borrowing has been delayed while interest rates remain at elevated levels and the council has the option to utilise cash balances and reserves in lieu of long-term external borrowing, he said.

“The exposure targets are kept under review and reflect the medium-term forecasts for interest rates and the current uncertainties within the economy. Fixing out 70% of the council’s capital financing requirement is considered prudent and affordable whilst leaving sufficient flexibility to maximise the use of internal balances and less expensive short-term/temporary borrowing,” Copley added.

15th Annual LATIF & FDs’ Summit – 19 September 2023

250+ Delegates from Local Government & Investment

Copley also noted that Barnsley’s treasury position stated in the report does not currently account for the proposed South Yorkshire Mayoral Combined Authority Gainshare policy, which he said was “expected to add significantly to the council’s overall level of borrowing in future, increasing all aspects of our treasury management risk”.

He stated: “In view of this and the council’s existing debt levels, the advice of the director of finance is to undertake prudent and modest additional borrowing to effectively manage the council’s risk exposure, which is essential in the current economic climate of rising interest rates”.

Copley also advised keeping the council’s position in terms of its financial resilience and ability to continue to meet future financial challenges under “close scrutiny” so that its “future policy choices are not overly constrained and to ensure that its long-term financial sustainability is maintained”.

—————

FREE weekly newsletters

Subscribe to Room151 Newsletters

Follow us on LinkedIn

Follow us here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel