Regulators acted “too late, too weakly and did not enforce the rules enough” in failing to prevent a rise in local authorities being issued with section 114 notices, according to treasury advisor Arlingclose.

With Woking, Thurrock, Slough and Croydon all issuing s114 notices within the last two years and more likely to come, these councils “represent a failure of regulatory bodies” such as the Chartered Institute of Public Finance and Accountancy (CIPFA) and the Department for Levelling Up Housing and Communities (DLUHC) “to stop [financial] problems occurring in the first place, or at least stop them getting as bad as they did”, Arlingclose said.

Giving some context, the treasury advisor noted that many councils adopted income generating schemes, with or without local benefit, in response to austerity measures and funding cuts. But a lack of clarity and enforcement by regulators over what investment was allowed, and what investment would ensure security was always emphasised – a central tenet of local authority codes of practice – created issues over the course of many years.

Assessing regulator intervention at councils and regulators’ ability to see the wider financial picture, Laura Fallon, assistant client director at Arlingclose, gave her view in an ‘Insights’ article for the company’s website, published today (24 July).

“I believe regulators understood what was happening, but often struggled to word regulation in an effective and clear manner. Regulatory bodies did not always consult each other effectively, leading to confusing and sometimes contradictory rules from different bodies,” she wrote. “As anyone will tell you, whilst most people will stick to a rule because they feel they ought to some people will not unless there is enforcement. Enforcement of the regulations was lacking. There was a trust that authorities would follow the spirit as well as the letter of guidance, which again may have been the case for most authorities but clearly not all of them.”

Fallon said it was “a predictable consequence that trying to save money by having less regulatory bodies like the Audit Commission [whose abolition was announced in 2010] leads to a much higher risk of something untoward happening”. Although “not making a political statement” on the rights and wrongs of the Audit Commission, Fallon said “the savings made by its abolition will have to be seen against the costs of the recent failures”.

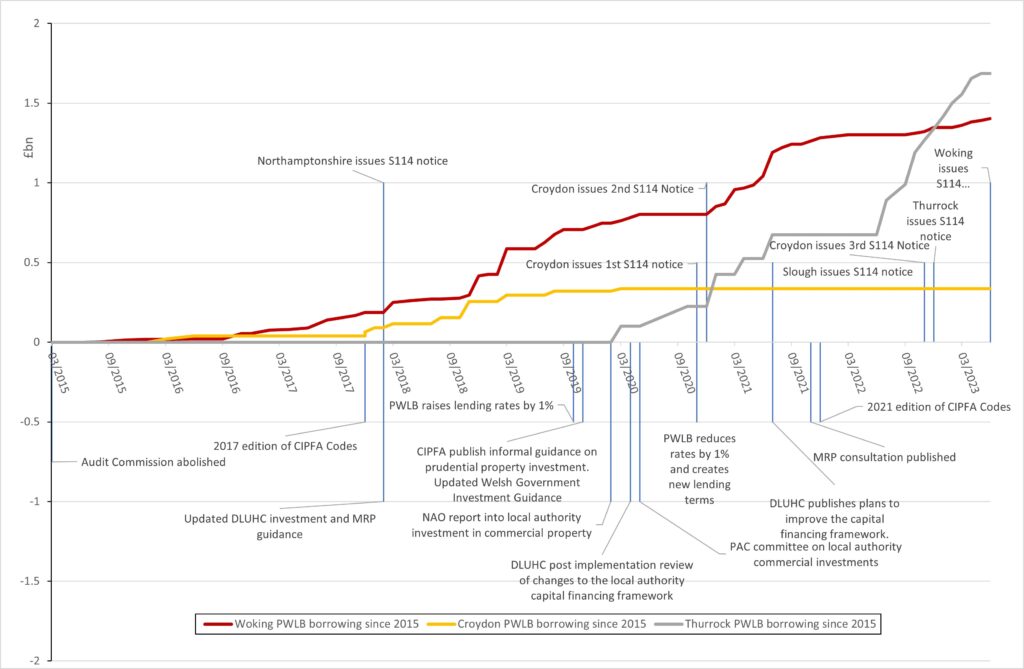

From March 2015 to June 2023, Arlingclose noted that there were 11 interventions by CIPFA, DLUHC, the Welsh government, the Public Works Loan Board (PWLB), the National Audit and the Public Accounts Committee. These interventions included two new versions of CIPFA codes, new minimum revenue provision (MRP) guidance, a consultation on further new MRP guidance, and four other reports.

In her article, Fallon said that the definition of ‘borrowing to invest’ was not made clear in regulatory documents and was regarded as a grey area by many practitioners. This meant some councils were able to make large debt funded investments in commercial property that might previously have been considered unsafe. Revisions made by CIPFA to its prudential and treasury management codes, and by other regulators such as DLUHC, failed to clarify the grey areas, she added.

“The CIPFA treasury management codes frequently referred to authorities not ‘borrowing in advance of need’ which rather missed the point as to what some local authorities were doing,” Fallon wrote. “Whilst ‘borrowing to invest is illegal’ was a refrain heard quite frequently, the law only stated that local authorities must ‘have regard’ to the codes of practice on this and other subjects. Some local authorities argued that it was essential to their function to generate additional income to fund public services in the wake of central government cuts.”

MRP guidance similarly failed to eliminate grey areas, with local authorities “being allowed to choose their own policy on MRP – including not making any on certain assets – provided it was regarded as ‘prudent’”.

This situation was compounded by a lack of enforcement, Fallon believes. “CIPFA and DLUHC may have been busy publishing guidance but there was no real enforcement of them. Whilst many authorities may have looked at the new guidance and decided to change their plans, a small number clearly didn’t and nothing was practically done about this,” she wrote.

15th Annual LATIF & FDs’ Summit – 19 September 2023

250+ Delegates from Local Government & Investment

“In the past the Audit Commission would have been much more likely to check adherence to codes of practice – by for example looking at if borrowing really was affordable and that MRP was actually being calculated in a prudent manner. The private sector firms auditing local authority accounts in England didn’t have the resources or expertise to understand these highly specialised areas of local government finance. Lack of finance capacity within councils and external audit resources also led to many accounts being published late and audited late.

“Whilst regulatory bodies should still have been aware of the high debt levels and large investment portfolios of some councils (this was widely known about by those working in the sector and PWLB lending is published monthly on their website), the lack of published financial statements for these authorities clearly didn’t help the situation.”

Although the PWLB eventually took some steps “to practically curbing the high levels of borrowing by some local authorities” in October 2019, it was not until December 2021 that CIPFA “finally put the nail in the coffin by stating that local authorities must not borrow to invest primarily for financial return. It also stated that any investment decision that raised the CFR and was for purposes not primarily related to the functions of the authority was not prudent.”

By this point though, Fallon noted, “Slough had issued a section 114 notice and Croydon had issued two, Thurrock and Woking would follow and the wider fallout from the situation continues”.

In her article, Fallon wrote that some positives look set to come out of the situation, with “regulators now looking at ways to prevent these problems in the future”. She also noted the establishment of the Office for Local Government, an “ongoing project” to improve the auditing of local authorities, and the fact that DLUHC and the PWLB “have and are considering how to regulate local authorities better, including more of an emphasis on sanctions for any who break guidelines”.

She concluded: “Whilst the trade-off between more regulation and less autonomy by local authorities will need to be considered carefully, I believe we can look towards a brighter future on this front.”

The full article, titled ‘How Regulators Failed to Stop Local Government Failures’, can be read here.

—————

FREE weekly newsletters

Subscribe to Room151 Newsletters

Follow us on LinkedIn

Follow us here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel