Sponsored article: Pre-pandemic fiscal performance will shape local government’s capacity to address the long-term impacts of the coronavirus, writes Zoe Jankel.

The coronavirus pandemic has had material effects on the fiscal performance of regional and local governments (RLGs) across Europe.

In Moody’s view, however, the impact of the pandemic varies significantly both between and within countries, and depends on two main variables—the respective fiscal responsibilities of RLGs and how these responsibilities are funded.

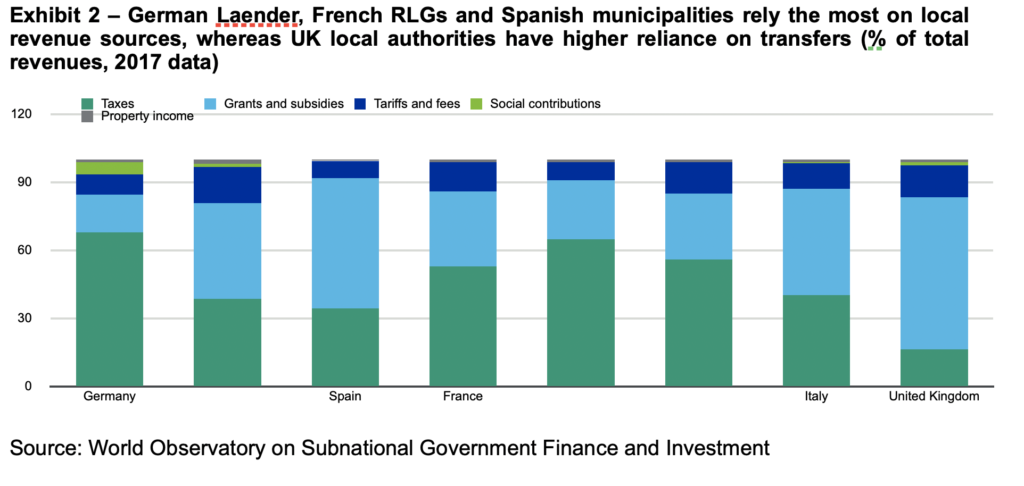

RLGs which are responsible for funding key pandemic-related services such as health care, social care, housing and economic development are most exposed to expenditure pressures—this includes RLGs in the UK, Germany and Spain. RLGs which are more reliant on locally-generated revenues, which tend to fluctuate with the economic cycle, are more exposed to losses of revenues.

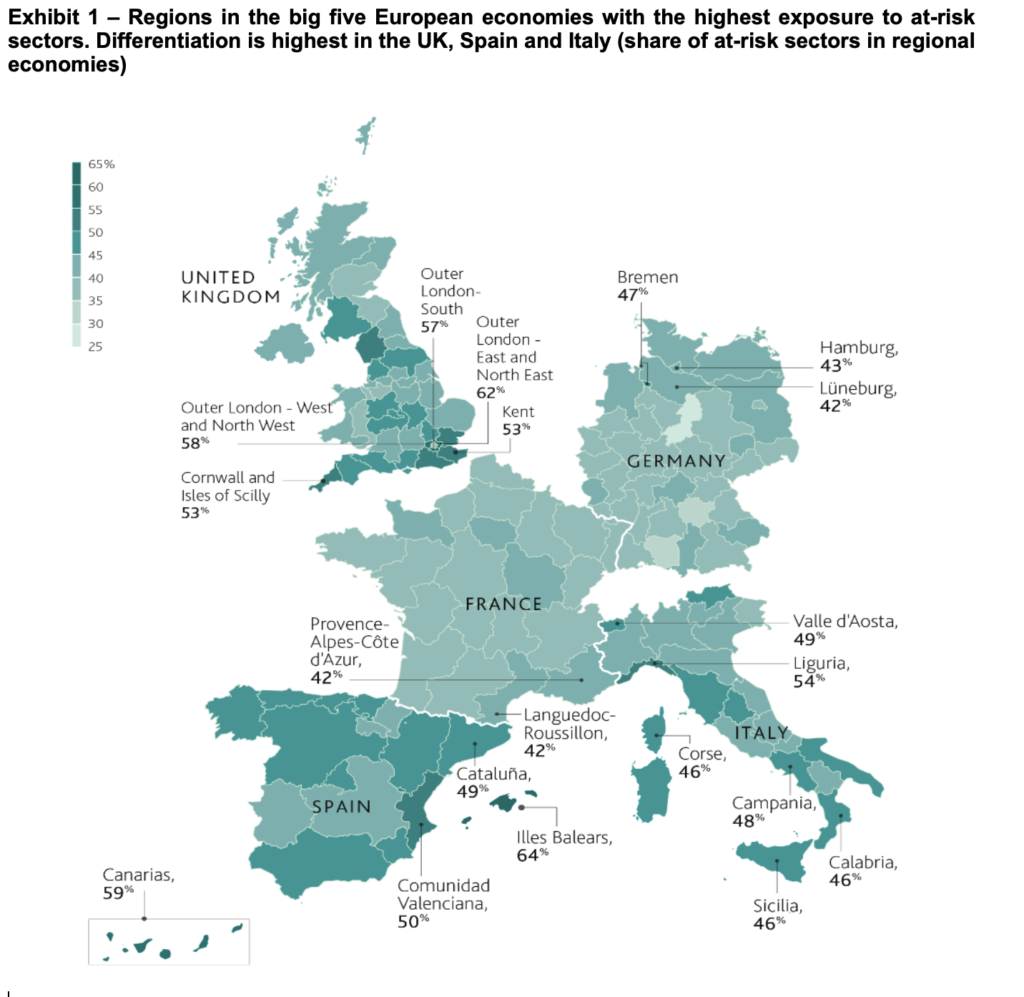

In addition to these two variables there is a third dimension which relates to differences between RLGs but within countries. On the revenue side, local economies which have a high concentration of the sectors most vulnerable to the economic contraction will face more pressures, and on the expenditure side poorer areas – which typically have also featured higher coronavirus mortality rates in many countries – will face higher spending pressures.

12th Local Authority Treasurers Investment Forum & FDs’ Summit

NOW A VIRTUAL EVENT + ZOOM151 Networking

Jan 21, 22 & 23, 2021

Drivers

The key drivers for spending pressures are the responsibilities of RLGs and the intersection of these responsibilities with the increased needs created by the pandemic. Clearly the first order impacts are on health care and social protection, where RLGs in Spain, Italy and the UK have high fiscal responsibilities.

Economic affairs are also important as some RLGs, particularly the Laender in Germany, are responsible for supporting local businesses and have paid around €65bn in grants and reliefs to small and medium sized enterprises within their regions. In Spain, around 92% of public sector healthcare expenditure is borne by and funded by regions. For Italian regions this figure is 47%, however this spending is funded by the national government through pass-through grants and consequently does not exert direct pressure on regional budgets.

For UK local authorities, social protection expenditure is more material. Just over 20% of this expenditure is funded at the local authority level and social care, in particular, is one of the key statutory responsibilities of local authorities.

Income

On the income side, Moody’s believes that the economic impacts of the pandemic will be most severe in areas with high concentration in high-contact sectors such as transportation, hospitality, cultural and leisure services.

Here we find that areas of the UK, Spain and Italy have the highest concentration in these sectors (see Exhibit 1).

(Source: Calculations based on % of NUTS2 GVA in at-risk sectors including construction, wholesale and retail trade, transport, accommodation and food service activities, real estate activities, arts, entertainment, recreation and other services and % of NUTS2 employment in the manufacture of transport equipment due to unavailability of GVA data for this economic sector. GVA and employment data from Eurostat – 2017 data).

This exposure is particularly material for RLGs which are more reliant on locally-generated revenues which fluctuate with the economic cycle, as opposed to government transfers. When we look at this factor we find that the German Laender are most exposed, but also French regions and departments are typically more reliant on taxes than RLGs in other countries (see Exhibit 2).

Strength & performance

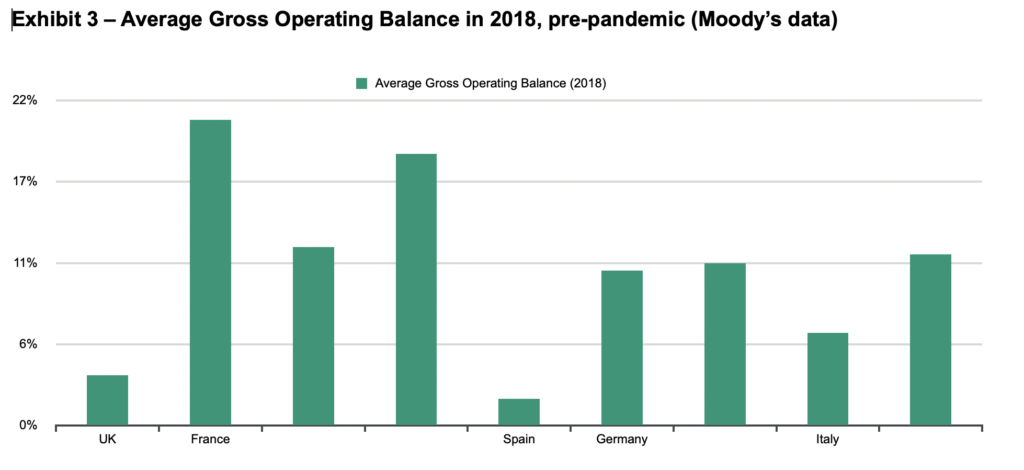

The materiality of the impact of these fiscal pressures will ultimately rely on the fiscal strength and performance of regional and local authorities before the pandemic, in addition to the level of flexibility they have in determining their revenue base and expenditure levels.

Moody’s-rated UK local authorities and Spanish regions went into the pandemic in a relatively weak position compared to those in the other large European economies, with very slim operating surpluses, making them less resilient to the pandemic’s fiscal impacts (see Exhibit 3).

Although national governments are providing high amounts of compensation for fiscal losses, we expect that in the majority of countries this level of support will mainly be concentrated in this fiscal year, whereas some of the impacts—particularly on the revenue side—are likely to be long-lasting due to a permanent loss of business and employment in close-contact service sectors.

Adapting to lower own-source revenues and higher spending pressures over the next few years will be challenging in the context of current fiscal frameworks. Most RLGs only have moderate levels of fiscal flexibility, particularly with regard to own-source tax revenues. Flexibility on expenditure is more prevalent, however RLGs will find it challenging to implement large cuts in a period of high reliance on public services.

Room151’s Monthly Online Treasury Briefing

November 27th, 2020

Money market funds and deposit accounts

Register here with a .gov.uk email address

Overall, Moody’s expects UK local authorities and Spanish regions to experience the highest fiscal pressures out of the five countries. These RLGs face relatively high spending pressures, moderate expected lost revenues and weak pre-pandemic fiscal performance. Whilst German Laender face the highest pandemic-related spending pressures, their very strong pre-pandemic fiscal performance provides a buffer amid continued pressures.

Zoe Jankel is a senior analyst at Moody’s Public Sector Europe.

Photo by Adam Nieścioruk on Unsplash

FREE monthly newsletters

Subscribe to Room151 Newsletters

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel

*Photo by NICHOLAS CAPPELLO on Unsplash.