Aberdeen City Council made the headlines in October by becoming the first Scottish Local Authority to achieve a public credit rating and in November raised £370m via a bond that was oversubscribed. Treasury officer Neil Stewart reveals the work and detail behind the project.

Our council has an ambitious capital programme of c£850m over the next five years. A key component of this programme, and also our city centre masterplan, is the need for economic diversification, away from our traditional base of oil and gas.

At the heart of this strategy will be the new Aberdeen Exhibition and Conference Centre (AECC). This project, and the income stream it will bring the council once it is fully operational, changed the way we have traditionally approached long-term financing.

The council has a statutory duty to secure best value and ensure the long term affordability of its capital investment programme. To achieve this, three products were identified which were independently assessed by advisers to determine their suitability. The recommended financing solution was an index linked public bond.

Bond rationale

The bond option provided the optimal solution as:

- Cost — it delivered the lowest net present cost of debt service over the 35 year term.

- Flexibility — a three-year “repayment holiday” could be built in, matching the construction period of the AECC, after which an income stream will be available to the council to meet the repayments.

- Future flexibility — a public bond can be traded in the secondary market thereby potentially offering the council the opportunity to “buy back” its own debt at a point in the future.

- Affordability — the net present value of the cash flows associated with the bond offered a potential saving to the council of up to £99.8m over the lifespan of the instrument compared to a traditional strip lease.

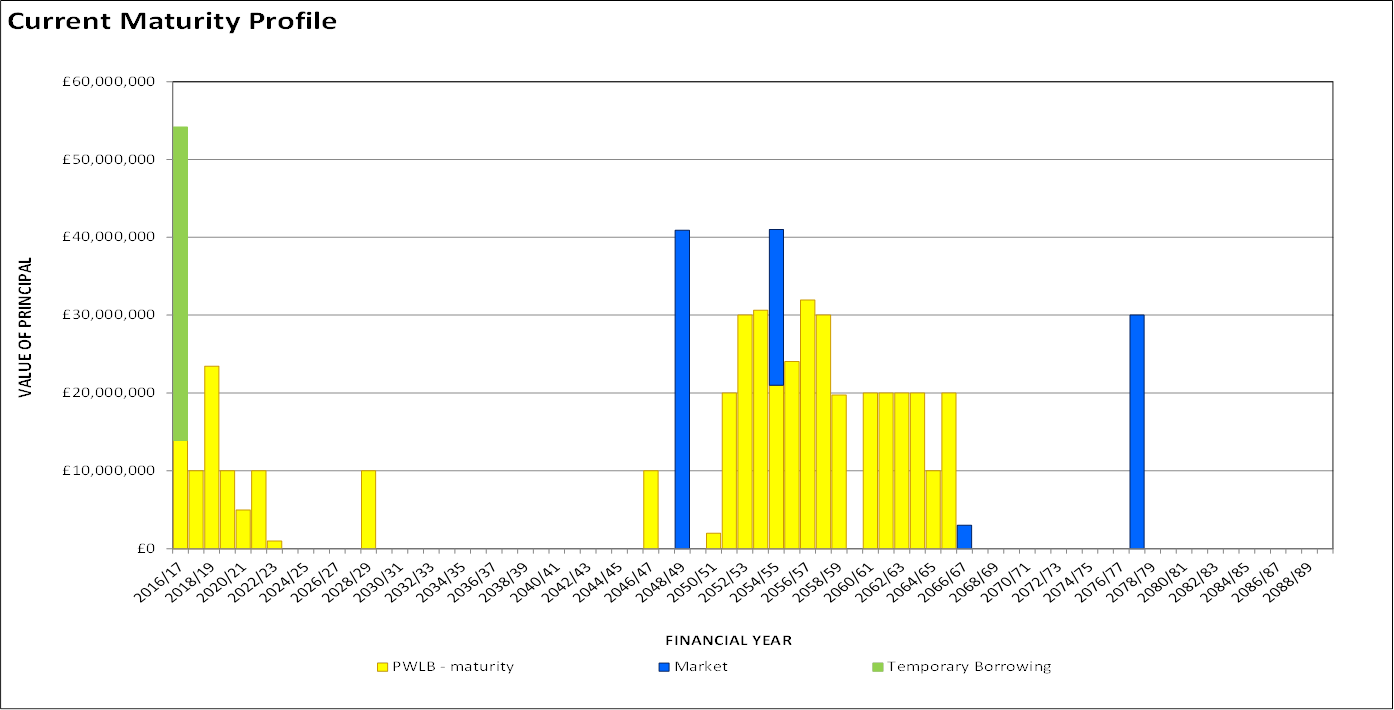

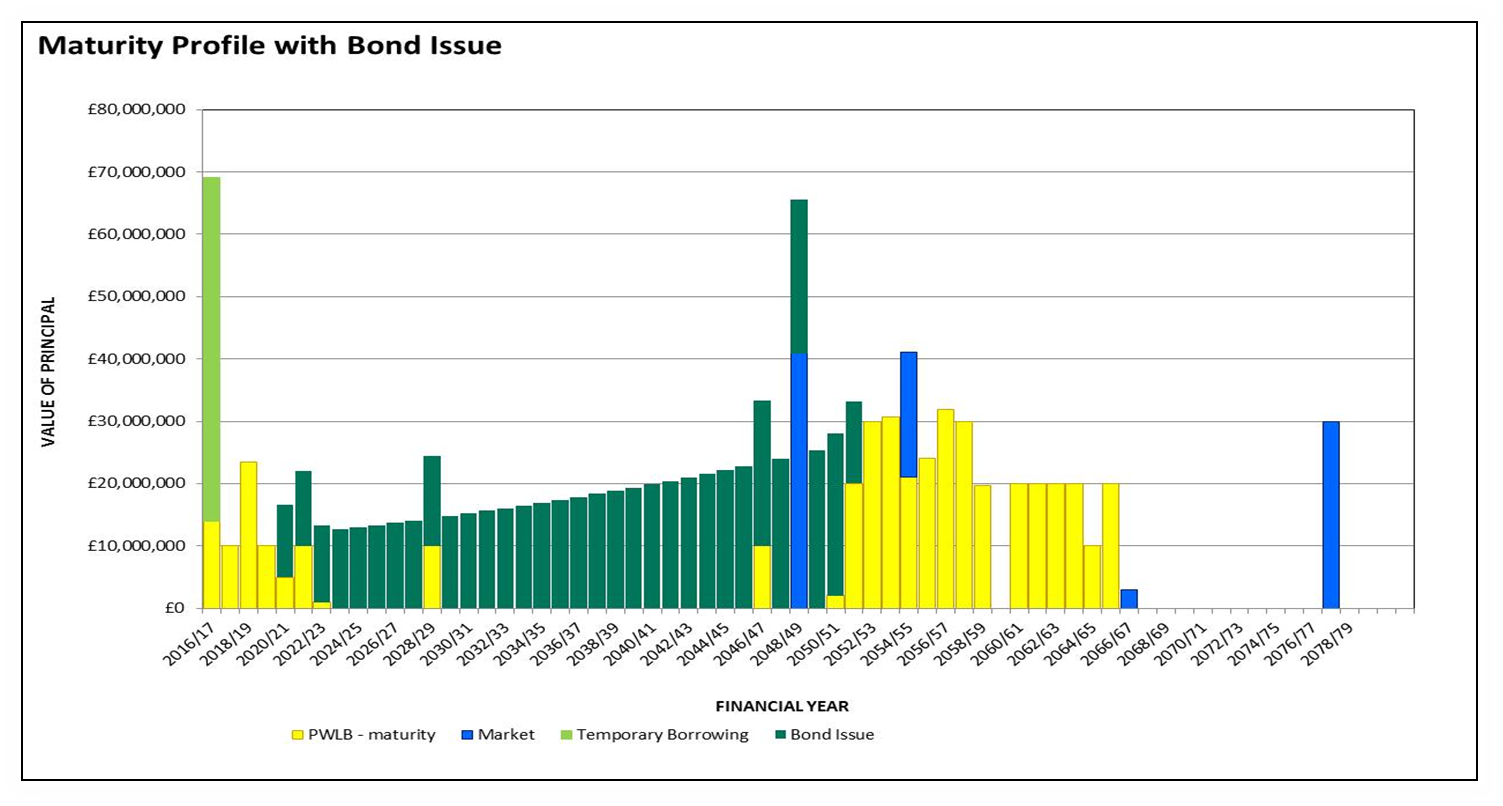

- Debt profile — the repayment profile of the bond complimented the council’s existing debt maturity profile, smoothing out its future debt repayments.

- Income match — the bond provides a better inflation hedge with project income than the next best option (PWLB), given project income is generally expected to rise with inflation over time.

The council’s head of finance, Steven Whyte, referred to the above as a “perfect storm of conditions” which led us to go down the Bond route.

These debt maturity profiles (below) show how the repayment profile of the bond complimented the council’s existing debt maturity profile, as previously mentioned.

Credit Rating

Before the Council was able to issue its bond, it had to secure a credit rating from a recognised credit rating agency. Any council considering a bond option should not underestimate how much work is involved in getting this stage over the line.

The council was required to submit detailed financial information to the ratings agency in order to demonstrate its governance and financial stewardship. This information was studied by the agency in great detail, and was followed up by many questions and queries on particular aspects.

The council was also required to submit detailed information outlining the institutional framework in which Scottish local authorities operate. This was particularly important, with this being the first time a Scottish council had been publically rated.

Information was also provided to the agency describing the council’s local governance framework, the political make-up, the committee structure, the executive structure, the decision making process and its key functions and responsibilities. The council was also required to submit a wealth of economic information about the city and the wider city region, outlining both its economic performance and potential.

The final step was for key council officials to make a management presentation to Moody’s at their London offices in late July.

In late August, the council received an indicative credit rating score from Moody’s of Aa2, with a negative outlook. The “negative outlook” mirrors the negative outlook on the UK sovereign rating, following the vote to leave the European Union. This rating is the third highest rating out of the 21 that Moody’s award.

After further due diligence by Moody’s, in early October the council was publically awarded the credit rating of Aa2, with a negative outlook. Having secured the rating, we were then in a position to issue the bond. In early November, based on the final Offering Circular, Moody’s also assigned the rating of Aa2 to the £370m bond.

Affordability

In working towards obtaining a credit rating a long term financial model was developed based on a range of assumptions and modelled accordingly. The agency focussed on the access to liquidity, level of working capital and financial performance. These are three of the most critical elements in examining long-term affordability and we demonstrated this through a 35-year projected cash flow position.

The Prudential Code also requires the council to demonstrate affordability in making investment decisions and the use of a 35-year financial forecast on an “all things being equal” basis validated this assessment.

Treasury Management Issues

The council’s investment strategy required to be updated with a revised counterparty list taking account of the additional capacity to invest the funds resulting from the bond issuance. This was approved by the council’s elected members in August. It is worth noting that the ratings agency was particularly keen to see a liquidity policy written into our investment strategy.

Bond Issuance

With a suitable level of credit rating achieved, the council was in a position to proceed towards issuing its bond. HSBC, the council’s appointed book runner, had already been “soft-sounding” potential investors about the issuance and initial feedback had been encouraging.

A suite of necessary bond documents had been prepared in draft form early on in the process and these were worked on by officers, our legal representatives and the legal representatives which had been appointed on behalf of the investors. Challenges and suggested amendments to clauses in these documents were made on a daily basis, right up until launch day.

An investor presentation was produced which was an extension of the management presentation which had been produced for the ratings agency, with additional slides to answer investor’s questions. This was sent to potential investors to complete the soft-sounding process. Investor feedback was still encouraging, however caution was urged by the book-runner, and it had been suggested that despite strong interest in the issuance, due to uncertain market conditions, we should not expect to be oversubscribed.

In late October an announcement was made to the markets via Bloomberg of a potential bond issuance by Aberdeen City Council. This was followed up by a series of roadshow meetings to investors. These were presented over three days at the end of October by the council’s chief executive, Angela Scott, along with the head of finance and the head of economic development in both Edinburgh and London.

After some follow up calls to investors to gauge both appetite and pricing indications, it was agreed that the bond would be launched on 1st November. The bond documentation was then finalised and executed as required. The bonds were being issued “above-par”, meaning the council would receive a premium of around 12% on the bonds, on the understanding that the council would pay interest of 0.1% on the outstanding sum.

On the bond launch day, investors placed bids steadily throughout the morning. By late morning it became clear that the bond issuance had been oversubscribed — although the council had sought up to £350m of bonds, it had received offers for £373m. A council urgent business committee meeting was quickly convened, and this approved that the head of finance could now accept up to £400m of bonds. The book was closed at £370m and the bonds were allocated to investors.

As the bond issue was priced “above-par”, the council received c£415m on settlement day. The council has invested the bond proceeds across a range of fixed term deposits, call deposits and notice deposits, in line with the revised counterparty list. This mix of investments will provide the council with the necessary liquidity to meet its anticipated cash flow requirements over the coming years.

Rewards

The bond issuance was both an exciting and challenging project, both in terms of workload and the way we have traditionally looked at borrowing and the associated risks. End to end, even with a dedicated team of three, and help from a wide range of people, the project took us six months to complete. With lessons learned, perhaps this could be shortened by a month.

The level of risk and intensive workload mean the bond solution wouldn’t suit everyone, but given the potential rewards, it will suit others, we are sure of it. The council is now working through all the regulatory requirements of being listed and a “post bond” project team has been established to implement the changes to reporting and governance following a stock exchange listing.

Neil Stewart is treasury officer at Aberdeen City Council.