District councils are paying nearly twice the scale fee originally agreed with audit firms for their most recent audited accounts, a survey has found.

Most local authorities opted to pay a scale fee to cover the cost of audit for the period 2018/19 to 2022/23, set by the Public Sector Audit Appointments (PSAA) for each individual authority.

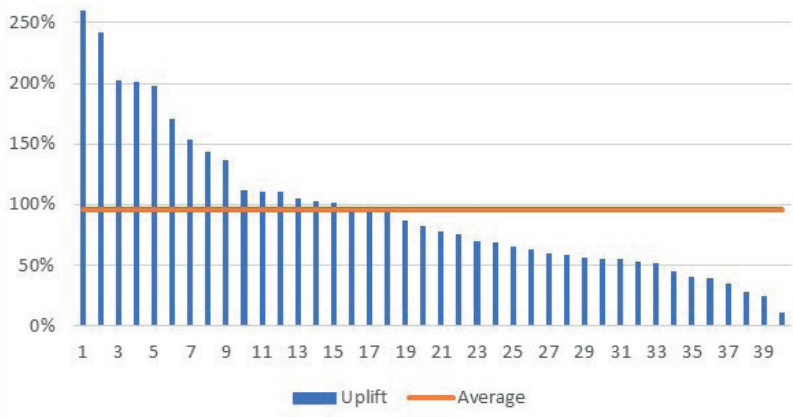

However, the scale fee is subject to variations if auditors carry out more work than expected, and the average uplift on the original PSAA scale fee was 96%, or £41,448 in cash terms, according to the survey conducted by the Society of District Council Treasurers (SDCT) of its members, of which 44 responses were received.

The uplift is equivalent to around 1% of these authorities’ net revenue expenditure, the society said, with district councils facing bigger fee uplifts than local authorities generally.

The SDCT noted other external costs, such as for property and actuarial valuations, as well as in-house costs, stating that a new PSAA contract is set to lead to much higher audit fees with effect from 2023/24.

With district councils facing “exactly the same accounting requirements as much larger unitary and upper tier authorities”, the society questioned whether “it would be worth exploring whether reporting requirements could be differentiated” given “the variation in the size and resources available to different tiers of local government”.

Audit delays and focus

Addressing now “notorious” audit delays, the SDCT pointed out that only five authorities out of 467 had provided an audit opinion for 2022/23 by the official publication date of 30 September 2023.

Its survey respondents were, however, “slightly quicker” at completing 21/22 and 22/23 audits than local authorities in general.

Nearly 90% of respondents blamed a lack of capacity at external audit firms for the delay, with over 40% citing a delay in finalising the previous year’s accounts.

Other factors given by between 20 and 40% of respondents as a cause for the delays (see table) were: increased level of audit scrutiny generally; additional audit challenge around property valuations; lack of capacity in the internal accounts team; and increasing complexity of accounting requirements.

The SDCT said its survey results also highlighted a “questionable” emphasis on asset valuations. Comparing materiality levels as a percentage of the authority’s reported net revenue expenditure and as a percentage of total assets, the median materiality level for revenue purposes was 3.2%. However, it was only 0.7% for total assets.

“Because the same materiality figure in cash terms applies to both revenue account items and to assets, potential misstatements relating to assets are likely to receive much more focus than those for revenue,” the SDCT said. “Given that assets are often held for the long term, whereas balancing the revenue budget on a day-to-day basis is often the greater challenge for local authorities, this emphasis is questionable.”

On pensions accounting, cited as one reason for audit delay, some 41% of respondents incurred additional costs as a result of the McCloud judgement. The average additional cost for those authorities was £3,7151.

Other pensions accounting rules were adding to the creation of “additional complexity for local authority accounts”, the SDCT said, with the dependence on separate pension fund audits cited. And where audits have been delayed, additional work has often been required to reflect pension valuations carried out subsequent to the planned original audit dates.

“All of this complexity could be avoided if local authorities were allowed to account for pensions on the basis of actual contributions made to their pension schemes, as opposed to basing pensions costs on a notional pension fund valuation,” the SDCT commented.

—————

FREE bi-weekly newsletters

Subscribe to Room151 Newsletters

Follow us on LinkedIn

Follow us here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel