Cabinet members at Norfolk County Council have approved the creation of an investment fund in a move timed to allow access to European Union money before the UK completes Brexit.

Councillors this week approved plans for a low carbon innovation fund, dependent on investment of £10.9m from the European Regional Development Fund (ERDF).

The general funding agreement, between the council and the Ministry of Housing, Communities and Local Government needed to be signed before the UK’s exit from the EU in order to “guarantee the funding”.

The council had a deadline of 5 July to complete its due diligence on the arrangements.

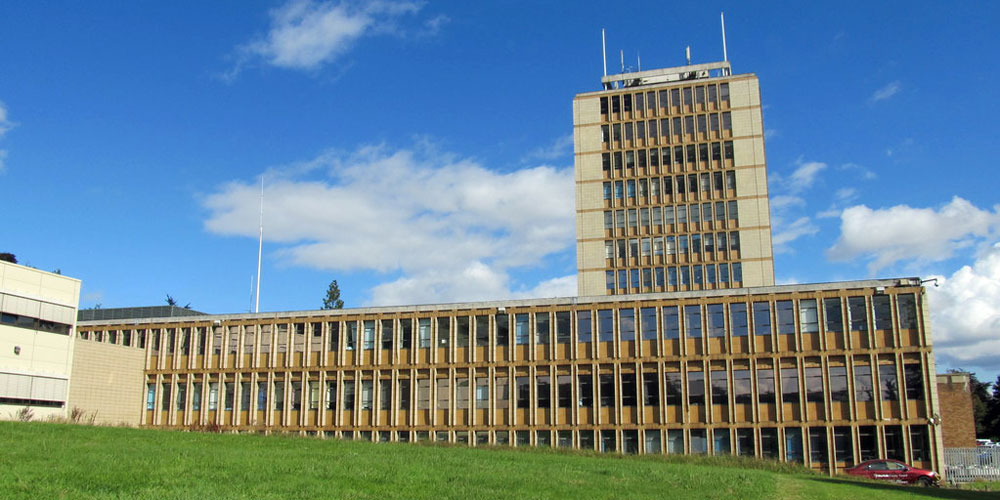

The innovation fund—a partnership with the University of East Anglia (UEA) benefiting businesses across three local enterprise partnership areas in the east of England — aims to invest in up to 48 growing technology companies.

The council says the initial £10.9m would enable the leveraging of a further £22m because fund investment will take place alongside private sector cash.

A report to cabinet members said the innovation fund, known as LCIF2, “unlocks over £30m of innovation funding for early stage businesses operating in the field of low carbon development…”

Businesses in the New Anglia, Hertfordshire and Cambridgeshire and Peterborough LEPs will be eligible for investment.

Benefits for Norfolk include businesses in the county receiving cash injections from the fund and the opportunity to influence the fight against climate change.

Perhaps more importantly, the county council will also have the opportunity to influence investment in economic development as returns are reinvested.

Norfolk will jointly set up a management company with the UEA, each providing two directors.

They will be responsible for management of the fund and its governance.

The management company will be set up as a partner in a separate limited partnership that will procure and appoint a fund manager.

The fund manager will then establish a subsidiary to act as a “general partner” in the limited partnership.

This will undertake investment decisions and accept liability for investment activity. The limited partnership’s liability is then restricted to the value of the investment it makes.

The limited partnership cannot make investment decisions, though it can participate in the creation of investment guidelines.

Risk in the innovation fund is mitigated in a number of ways: drawdown of funds will take place over time and comes in two tranches, the second only available following an audit. UAE and the three LEPs have agreed to underwrite first-year operational costs of £61,000.

Norfolk has experience in managing European funds for investment projects.

The county collaborates with Suffolk County Council on the Invest East programme, backed with £1.8m of ERDF money to help prepare SMEs for seeking investment.The programme helps mentor entrepreneurs at early stage businesses.

Elsewhere, Norfolk has worked on the LEADER Programme, backed by the European Agricultural Fund for Rural Development (EAFRD) which supports local action groups that in turn backs rural businesses.