The government has injected new life into plans to allow councils to retain 100% of business rates, launching a new round of pilots and resurrecting the steering group overseeing the process.

Following the loss of prime minister Theresa May’s majority in June, the government dropped its Local Government Finance Bill and asked members of the steering group to step down.

But last week, the Department for Communities and Local Government asked councils to bid for places in a second round of pilots for rates retention beginning in April next year.

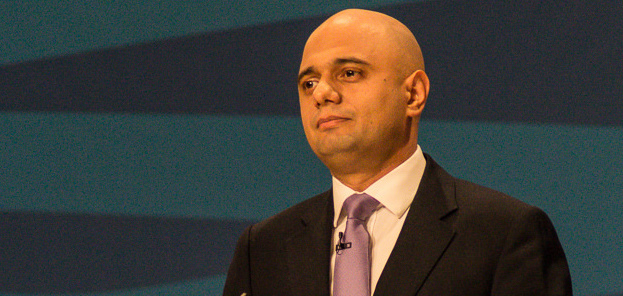

Communities secretary Sajid Javid said: “I am committed to helping local authorities control more of the money they raise locally.

“Expanding the pilot programme is an opportunity to consider how rates retention could operate across the country and we will continue to work closely with local government to agree the best way forward.”

Andrew Burns, CIPFA president and director of finance and resources at Staffordshire County Council, told Room151: “This is a pleasant surprise.

“I broadly welcome this as a sign that business rates retention is not dead, but has maybe been asleep post-election and pre-Brexit.

“The positive indications from the prospectus are that the government wants two-tier areas to apply and wants a focus on rural areas which is encouraging.

“In addition, there is no mention of additional responsibilities being passed to the authorities in the pilot and the only grants that will be foregone are Revenue Support Grant and the Rural Services Grant.”

However, he said that the “devil in the detail” provided some challenges to the process including a response deadline of 27 October, “which does not leave much time for authorities to agree on a proposal and to obtain political buy-in”.

He also said that a requirement that all authorities must be in the same business rates pool could cause issues where districts and county pools are not aligned with Local Enterprise Partnership areas.

He added: “There is also no guarantee that the new pilots will include a ‘no detriment’ clause.

“The prospectus does not make a decision either way but says that authorities must state in their bid if they are prepared to accept the lack of a ‘no detriment’ clause.”

One source close to the process told Room151 that the government is considering dropping proposals for a new accounting framework to account for safety net payments that would have required primary legislation.

Steering group

Room151 has also learnt that a meeting of the business rates steering group, which had been working on details of the proposals prior to the election, has been called for early October.

Shortly after the general election, Anne Stuart, the newly-installed senior civil servant leading the business rates retention process, wrote to steering group members, saying: “I’m sorry this should be my first communication, but I am emailing because as you will have no doubt seen, the Queen’s Speech did not include a new Local Government Finance Bill and so it will not form part of the Parliamentary timetable for this session.”

In her letter, she thanked members of the steering group but said she would only be in touch “once we are in a position to resume working with you on the future of local government finance reform.”

Successful pilots for 2018/19 will be announced in December and the department will support authorities in preparing for implementation in April 2018.

In June, the Local Government Association said that local authorities must be granted 100% business rate retention—without taking on new responsibilities.

The position is a shift from the LGA’s previous line, which agreed with the government’s stance that the extra money retained must be accompanied by new service responsibilities.

Meanwhile, preparations by the first round of rate retention pilots, due to begin from April next year, continue.

Javid confirmed that these pilots – in Liverpool, Greater Manchester, West Midlands, West of England, Cornwall and Greater London – will also continue into next year.

James Duncan, executive director of resources at Knowsley Council – part of the Merseyside pilot – said: “There was a very short wobble after the dropping of the Bill but civil servants communicated very quickly that their expectation was that 100% business rates retention would continue. Our planning has not really been affected.”