There are many interesting opportunities in the trade finance asset class, as David Newman, CIO Global High Yield, Head of Public & Private Solutions at Allianz Global Investors, explains in this partner content analysis.

Trade finance funds much of the commerce economies are built on – and it is also becoming an increasingly crucial part of many investors’ portfolios. In the shorter-term, it can help investors plot a path through a shifting landscape of higher interest rates and slowing growth. And longer-term, the asset class can provide a compelling proposition for several reasons, ranging from its lack of correlation to other asset classes to its low volatility.

Key takeaways

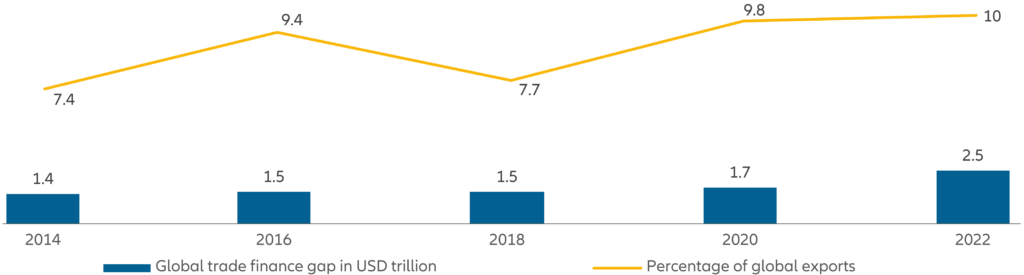

- Providing a bridge between the delivery of products and payment, trade finance helps keep commerce moving – and global demand for the funding is huge, estimated at USD2.5tn.1

- For investors, trade finance can serve a variety of roles – from an alternative to traditional credit assets to a strategic cash position, offering favourable returns compared to money market funds.

- Higher interest rates mean investors can expect a higher yield than in years when rates were near historic lows, while the asset class is also benefiting from inverted yield curves.

- In a fluid economic environment, trade finance’s typically short-term horizon allows flexibility as conditions change, while in the longer run the asset class’s potential for stable returns and low volatility make it an attractive option.

How to negotiate a changing economic landscape while meeting long-term goals: that’s the challenge facing many investors. So, where to turn? Trade finance, a USD4tn asset class2 funding a broad array of commerce, may help a range of investors meet their objectives.

In a shifting economy, trade finance stands out as a resilient option. It provides stability and a low correlation to traditional asset classes – vital during swings in public markets. The higher yield it offers may help boost portfolio performance in the long term. Finally, the asset class’s versatility is also a boon, serving as an alternative to short-dated fixed income, private debt or as a strategic cash position.

1 Source: Global Trade Finance Gap Expands to $2.5 Trillion in 2022, Asian Development Bank

2 Source: Global Trade Finance Market Size, 2023, Mordor Intelligence

Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors might not get back the full amount invested. Investing in fixed income instruments may expose investors to various risks, including but not limited to creditworthiness, interest rate, liquidity and restricted flexibility risks. Changes to the economic environment and market conditions may affect these risks, resulting in an adverse effect to the value of the investment. During periods of rising nominal interest rates, the values of fixed income instruments (including positions with respect to short-term fixed income instruments) are generally expected to decline. Conversely, during periods of declining interest rates, the values of these instruments are generally expected to rise. Liquidity risk may possibly delay or prevent account withdrawals or redemptions. Past performance does not predict future returns. If the currency in which the past performance is displayed differs from the currency of the country in which the investor resides, then the investor should be aware that due to the exchange rate fluctuations the performance shown may be higher or lower if converted into the investor’s local currency. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer companies at the time of publication. The data used is derived from various sources, and assumed to be correct and reliable at the time of publication. The conditions of any underlying offer or contract that may have been, or will be, made or concluded, shall prevail. This is a marketing communication issued by Allianz Global Investors UK Limited, 199 Bishopsgate, London, EC2M 3TY, www.allianzglobalinvestors.co.uk. Allianz Global Investors UK Limited, company number 11516839, is authorised and regulated by the Financial Conduct Authority. Details about the extent of our regulation are available from us on request and on the Financial Conduct Authority’s website (www.fca.org.uk). For a free copy of the sales prospectus, incorporation documents, daily fund prices, Key Investor Information Document, latest annual and semi-annual financial reports, contact the issuer at the address indicated below or regulatory.allianzgi.com. Please read these documents, which are solely binding, carefully before investing. The duplication, publication, or transmission of the contents, irrespective of the form, is not permitted; except for the case of explicit permission by Allianz Global Investors GmbH.

—————

FREE weekly newsletters

Subscribe to Room151 Newsletters

Follow us on LinkedIn

Follow us here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel