Jason Wood, head of client solutions, at Novum analyses how LGPS investors can enhance returns in equity portfolios through equity protection

Can equity protection enhance equity returns? To answer this question lets think about brakes on a car…bear with me.

How fast would you drive on a motorway if you didn’t have any brakes in your car? Most readers would drive a lot slower than the speed limit.

Some readers may have been guinea pigs for an experiment we used to run: We got LGPS officers and members to drive around Silverstone (on a driving simulator) with and without brakes. Sure enough, when people had brakes, reckless drivers paid less of a price for their recklessness and tentative drivers were more confident.

Equity investors face the same dilemma.

On one hand, LGPS are long term investors and want to deliver performance. On the other hand, there is a fear of how painful it could be if there is a market fall.

A common response to this dilemma is to invest less in equities (whether directly or through diversification) and therefore have less performance.

Equity Protection can be thought of as brakes on a car. It is a set of contracts that protect investors from losses if the market falls. The contractual nature is important – the protection is not reliant on managers stock picking or asset allocation or diversification. Like brakes on a car this reliability provides confidence.

Surely there is a cost I hear you asking? Yes – there is no free lunch (with anything in investing). Protection is paid for by sacrificing returns, as outlined below. Importantly though, the level of protection and the sacrifice can be tailored to suit the LGPS. In addition, the current cost of that protection is relatively low – even more so when compared to returns that have been earned in US equities over the last few years.

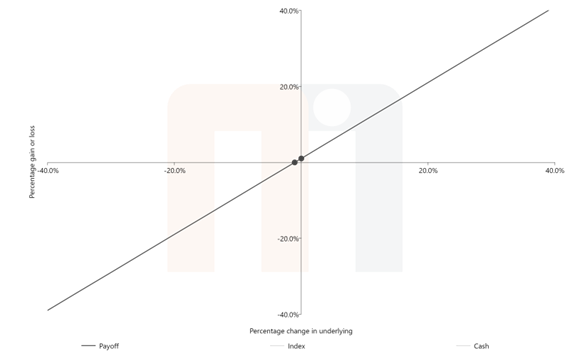

The best way to explain this is with pictures. Firstly figure 1 below illustrates what you get from Equity over 1 year (horizontal axis is market change over 1 year and vertical axis is the return on the investment).

Figure 1 – Equity

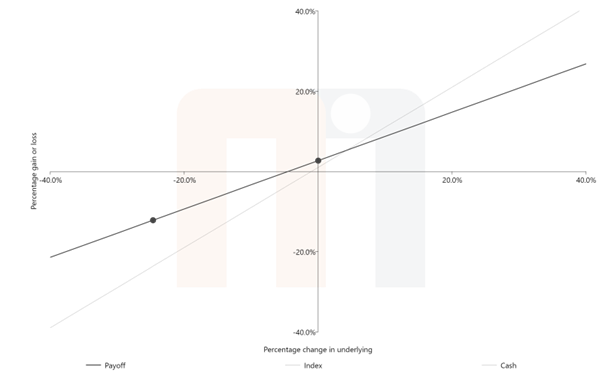

Now let’s look at how this changes if you decide to sell some equity in order to manage risk. Consider selling 40% of equity, Figure 2 shows what 60% equity looks like – essentially a lower sloped line meaning more protection on the downside but less upside:

Figure 2 – 60% in Equity

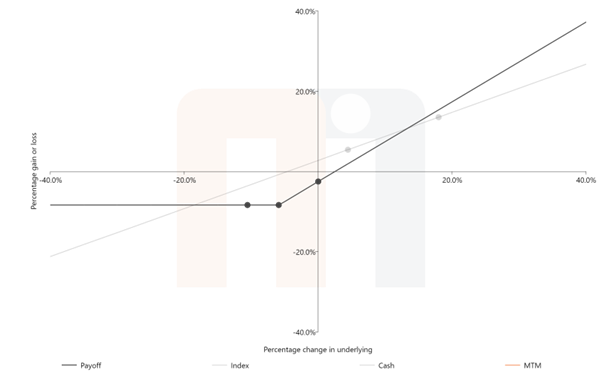

Equity Protection is actually just a kinked line. Looking at at a basic kinked line where 95% the value of the equity is protected, the light grey line shows the 60% equity line:

Figure 3 Protection kinked line

Figure 3 also shows the 60% equity in the background. The chart shows how for market movements of more than c10% in either direction the Equity Protection line have better protection and return characteristics. The trade-off for this is the small underperformance of equity for smaller moves.

Importantly, this kinked line is flexible – LGPS investors can have more or less protection and decide what return they want and where – i.e. it is about shaping exposure to equity. This is why we prefer to call it Shaped Equity.

So how can protection help earn returns? In short, as with brakes on a car, the protection from market falls might provide the confidence to stay invested.

Therefore, even though the protection may sacrifice return, compared to selling equity, that sacrifice may not be great as that given up by driving slower to stick with the metaphor, or disinvesting.