Sherilee Mace, Executive Director at Pemberton examines the role of senior secured private lending for the Local Government Pension Scheme (LGPS) Funds.

Private debt has emerged as an asset class that can provide resilient, high-yielding income, which is a diversifier from equity dividends and fixed income coupons. This is particularly attractive when higher-than-expected inflation figures have fed through to LGPS pensions over the last few years. This inflation is now baked into future pensions and for some LGPS funds, results in a greater need for income generating assets, especially as funds mature.

Private debt has emerged as an asset class that can provide resilient, high-yielding income, which is a diversifier from equity dividends and fixed income coupons. This is particularly attractive when higher-than-expected inflation figures have fed through to LGPS pensions over the last few years. This inflation is now baked into future pensions and for some LGPS funds, results in a greater need for income generating assets, especially as funds mature.

As LGPS funds become better funded and more mature, some are revisiting asset allocations to ensure that the objectives and outcomes that were set after the 2022 valuation remain valid.

In 2022, the LGPS were deemed to be on average over 100% funded. However, since then inflation has continued to be a challenge, with the Consumer Price Index (CPI) rising to 10.1% in September 2022 and 6.7% in September 2023 (ONS). This has led to a significant shift in cash flow positions for a number of LGPS funds, as they deal with inflation linked pensions. Although contributions remain the main source of funding to support pension outflows, there is also the need for predictable investment income as funds start to mature.

As an open defined benefit pension scheme, with a long investment horizon, the LGPS continues to hold a high weighting to equities; they account for approximately 67%1 of the average portfolio. Over the long term, this has provided an implicit inflation hedge and a steady stream of dividend income.

However, as LGPS funds become better funded, this has allowed them to broaden their investment universe and allocate towards assets which can provide resilient income with attractive yields.

Private debt has emerged as an asset class that can provide resilient, high-yielding income, which is a diversifier from equity dividends and fixed income coupons. This is particularly attractive when higher-than-expected inflation figures have fed through to LGPS pensions over the last few years. This inflation is now baked into future pensions and for some LGPS funds, results in a greater need for income generating assets, especially as funds mature.

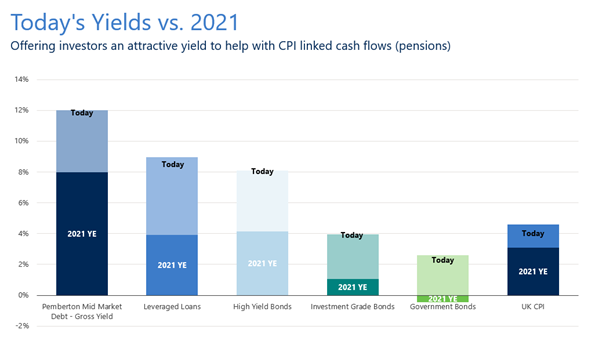

Asset classes that can deliver a yield above inflation but with strong risk adjusted returns are becoming attractive. Yields on private debt have risen considerably over the last year or so, making them an attractive asset class to support CPI Linked Pensions. The increase in yields from private debt comes from the floating rate nature of the loan, so as interest rates rise the interest rate on the loans goes up accordingly. The current yield for senior secured mid-market loans is c.10-12%.

The floating rate also means it has no duration3 risk, which is generally a feature of more traditional fixed income assets. This can provide LGPS funds with a higher yielding income stream, which is both predictable, yet diversified from traditional equity dividends and fixed income coupons.

Put simply: each private debt fund, in the mid-market space at Pemberton consists of a portfolio of loans, which have all undergone intense credit underwriting and been made to performing sub-IG companies in Europe, with an enterprise value of between £150-£500m. Not only do these private debt portfolios provide a diversified source of income away from other asset classes but also has diversification benefits within the portfolio of loans, with exposure to approximately 30-40 underlying investments. The yields from loans within private debt portfolios are a strong contributor towards addressing the challenge of CPI-linked pension increases that have been seen over the last two years.

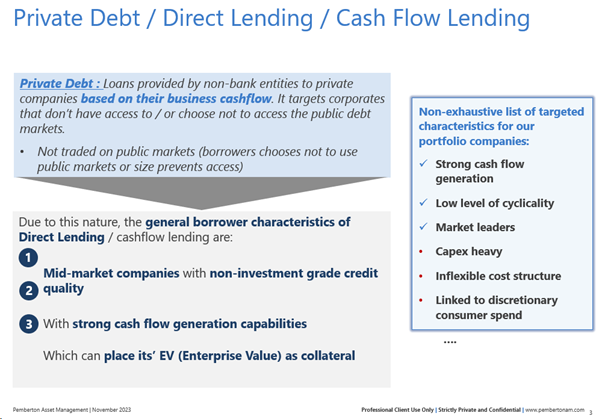

The general borrowing characteristics of direct lending

Downside protection

Private debt (also known as direct lending or cash flow lending) is providing loans to private companies, which are usually owned by private equity sponsors and in return receive an attractive income stream from the interest payments of the loan. Getting your money back is paramount: there is no growth potential in private debt. Therefore, the key consideration for LGPS funds is understanding the guardrails that are in place to protect investors downside risks.

Senior secured lending provides a number of protections to an investor, which might not be available within other forms of fixed income investment.

Protection comes from understanding the businesses we are lending to and ensuring appropriate controls and tools are in place to monitor and manage the risks. This means an ability to:

- Assess and select robust credits

- Structure the financial covenants correctly at the inception of making the loan, knowing why they are important and what breaches tell us

- Manage warning signals of deterioration in credit

- Intervene early and engage with the private equity sponsor and management teams of those companies, which is only possible if the asset manager is lead lender in the transaction4

- Assess what action should be taken if a company defaults on its obligations.

Furthermore, lenders are structurally senior to the private equity sponsor of the business and if things go wrong, the lender may take control of the business via the shares that have been pledged as security for the loan. This would generally be after all other avenues have been exhausted.

Because private debt lending is focused on the cash flows of the borrowers, lending is primarily targeted at companies that are leaders in their markets, which have strong free cash flow generation, with low levels of cyclicality and that operate in defensive sectors.

Being the sole lender or lead underwriter gives us direct access to senior management and private equity sponsors and much greater visibility on the performance of the business. It also provides more control over decision-making during the life of the loan and in particular where a loan needs to be restructured, which can have a material effect on whether lenders recover all of their principle or not. This all results in a more robust portfolio of loans.

Pemberton’s private debt portfolios are highly diversified. Typically, one vintage will lend to between 30 and 405 companies over its lifetime. This means the asset class itself provides diversification of income streams as well as being diversified from traditional asset classes.

While the downside protections give comfort to investors, it is also important not to lose sight of the extra income that private debt can generate. LGPS funds have a range of levers they can pull to assist with income, including dividend income. However, when the dividend yield on an equity portfolio is c. 2%, the additional income of c. 8% from a private debt portfolio can have a meaningful positive impact on the cashflow needs of pension funds. This is an extra £8m of income per £100m of investment.

In summary, a thoughtful reallocation of assets away from equities or traditional fixed income, into a private debt portfolio can generate a diversified income stream that can provide a yield above inflation to help LGPS funds meet their increasing payout obligations.

—————

For more information or if you wish to discuss any aspects please contact:

Sherilee Mace, Executive Director

sherilee.mace@pembertonam.com

2 Data as of 31st December 2023. Pemberton Mid-Market Debt – Gross Yield (2021) Source: MDF III Target Gross Return (8.0% – 9.0%) – there is no guarantee that target returns will be achieved. Such forecasts are not a reliable indicator of future performance. Target returns are presented as a guideline for investors only. The target returns have been based on a variety of factors and assumptions, including, among others, investment strategy, volatility measures, risk tolerance and market conditions, and such assumptions are subject to various risks. Target returns are not intended to be, and are not, a prediction, projection or guarantee of future performance and should not be relied upon as an indication of future performance. Pemberton Mid-Market Debt – Gross Yield (Today) Source: Current expected Gross Yield on the strategy assets as of 31st December 2023, excluding add-on investments. Leveraged loans are represented by LCD / European Leveraged Loan Index EUR YTM. High Yield Bonds represented by the Bloomberg Pan-European HY B rating Only Total Return Index Unhedged Yield to Worst. Investment Grade Bonds (IG Bonds) are represented by the Bloomberg Pan-European Aggregate: Baa Total Return Index Unhedged EUR. Government Bonds are represented by the five year Bunds from Bloomberg. Past performance is not indicative of future results.

3 duration refers to a bonds sensitivity to interest rate changes e.g. most often when interest rates rise. The longer the bond’s duration, the most its price will fall e.g. if rates were to rise by 1% a bond with a five year duration will lose c. 5%.

4 Pemberton has been sole lender or lead underwriter on 94% of loans since 2017

5 Based on average numbers across Pemberton’s direct lending funds