Partner Content: Emma Gullifer from Columbia Threadneedle Investments discusses the key occupancy trends that investors need to know in the Build-to-Rent market.

Rental housing is becoming a sector of choice for UK investors seeking sustainable income growth and positive ESG impact. Strength of occupational demand is key to delivering performance, so what are the key occupancy trends investors need to know?

Build-to-Rent housing – purpose-built, professionally managed accommodation – is increasingly prevalent as investors recognise the sector’s attractive supply/demand fundamentals. It demonstrates a professionalisation of the rental market, with better management standards and increased security of tenure, and fills a gap left by traditional buy-to-let landlords exiting the sector (Figure 1). Investment in Build-to-Rent is targeting an increased supply, delivering new-build accommodation for long-term living. The sector’s share of permanent dwelling starts is up from 4.4% in 2015 to 11.2% in 2022.

Single-family housing and changing demographics

The over-35s are the fastest growing group of private renters, and the number of families renting looks set to increase as higher mortgage costs price more households out of ownership. This supports a growing interest from investors in single-family housing assets rather than apartment blocks. A professionally managed, new-build rental home can provide the quality and security of tenure families seek given their ties to local schools, employment and support networks.

Concurrently, the longevity of tenure offered by occupiers of single-family housing – 62% of private renters over 35 have lived in their property for three years or more – means single-family housing is an attractive sub-sector of the residential market for investors seeking a sustainable, long-term income stream.

Rental affordability

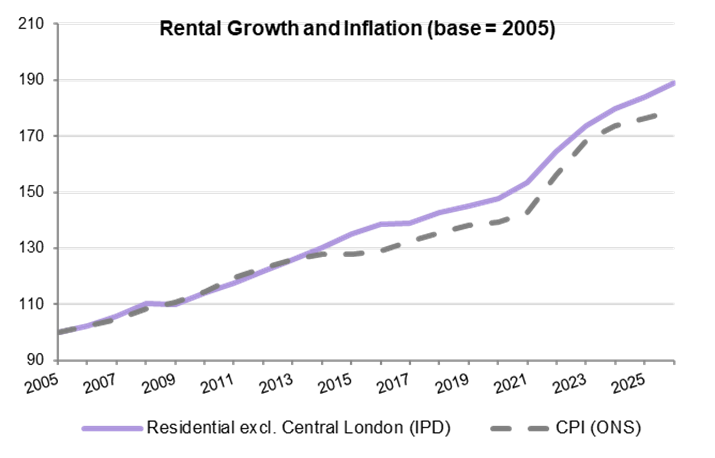

While record levels of growth make the rental sector compelling, its sustainability has been questioned in terms of affordability. There are two aspects to examine: the long-term trend of rental growth, its sustainability and drivers; and which areas will demonstrate resilient demand. The alignment between rental growth and inflation is one of the reasons the sector is attractive to institutional investors. The primary driver of this relationship is wage growth: as wages increase, occupiers have a proportional increase in their capacity to pay rent. The consensus forecast is for a sustainable level of 4-5% growth per annum, which is supported by the corresponding outlook for wage growth (Figure 2).

In seeking resilience of demand, investor focus is moving from premium options and high rents to delivering solutions for the deepest occupier segment. Rents affordable to local incomes help provide housing that can be accretive to the community, and that also delivers a more resilient investment proposition. For example, Columbia Threadneedle has a development in Harrogate that are the first professionally managed, purpose-built single-family dwellings in the city. Mass-market rental options also enable investors to participate in wider regeneration schemes, contributing to and benefiting from master-planning and public investment into creating new communities that can drive occupational growth.

Energy efficiency – new build cost savings

Energy efficiency is a rental market priority. Energy performance is no longer just looked at by investors, but also occupiers. New-build houses can offer savings of around £2,600 a year on household bills compared to older housing stock. Long-term institutional funders of Build-to-Rent stock, such as Columbia Threadneedle, are motivated to ensure assets are future-proofed from an energy standards perspective, which further enhances new-build over older housing stock. In Liverpool, where we are building a block of 260 units, design interventions ensured all units achieved the highest EPC rating possible, maximising energy efficiency and optimising future energy cost savings.

Investors and occupiers are now more aligned in the provision of future-proofed, cost-effective, high quality energy-efficient housing, which also improves the impact housing stock has on the environment.