Kathleen Hunter, investment specialist director at Baillie Gifford argues that when it comes to UK equities, LGPS investors can benefit from looking beyond the negative headlines.

It’s fair to say that the UK market is no stranger to negative headlines but are investors perhaps missing a trick? A closer look at the figures reveals that UK-listed companies are trading at a notable discount to global peers, creating an attractive hunting ground for active stock pickers. However, stock selection is still key because there is a wide dispersion in the growth outlook for British businesses.

An attractive hunting ground

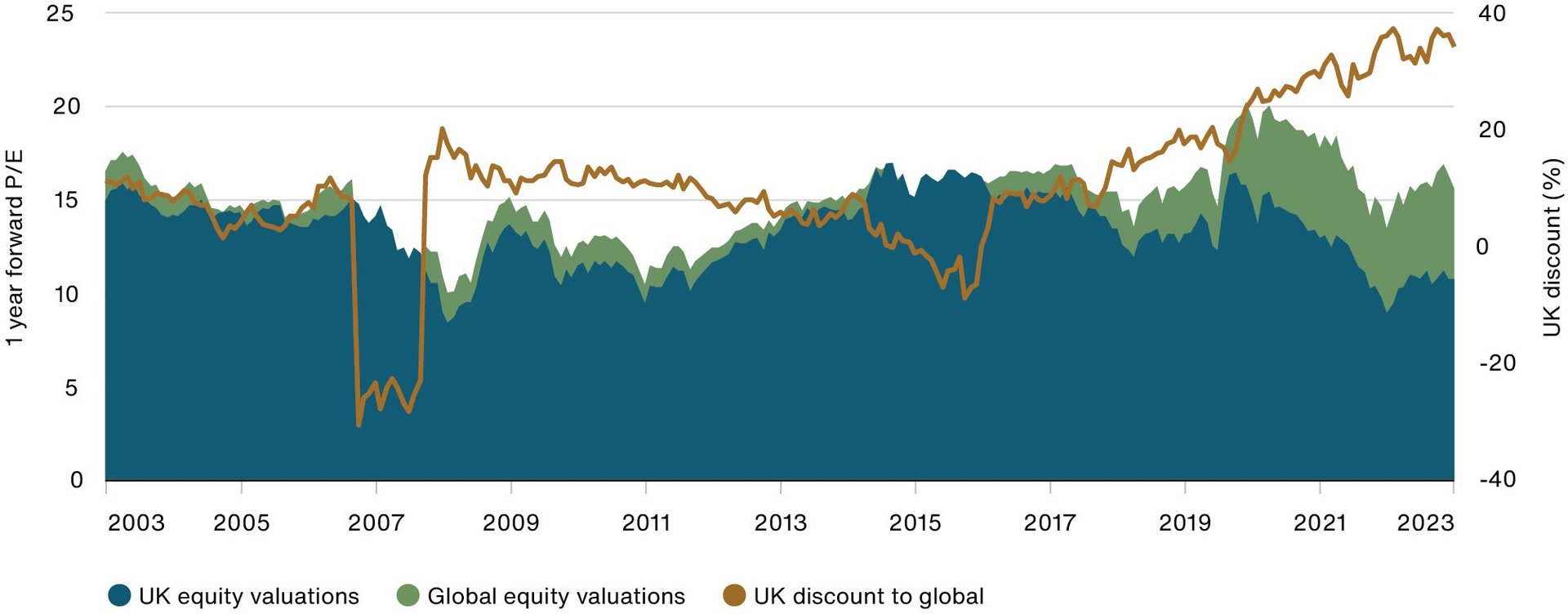

UK equities are trading at a notable discount to global peers, the biggest mark-down we have seen in our working lives. This has created a very attractive hunting ground for active stock pickers. For example, when we look at UK-listed companies, their valuations are now trading at around a 35 per cent discount to global peers.

Valuations

Source: Baillie Gifford & Co, Factset and underlying index providers, 30 September 2003 to 30 September 2023.

This is not to say that cheaper is necessarily better. In some cases, there are good reasons for UK businesses to be trading at lower valuations. But this market backdrop does create an interesting opportunity for active investors who are aiming to carefully select mispriced growth companies.

Stock selection is still key

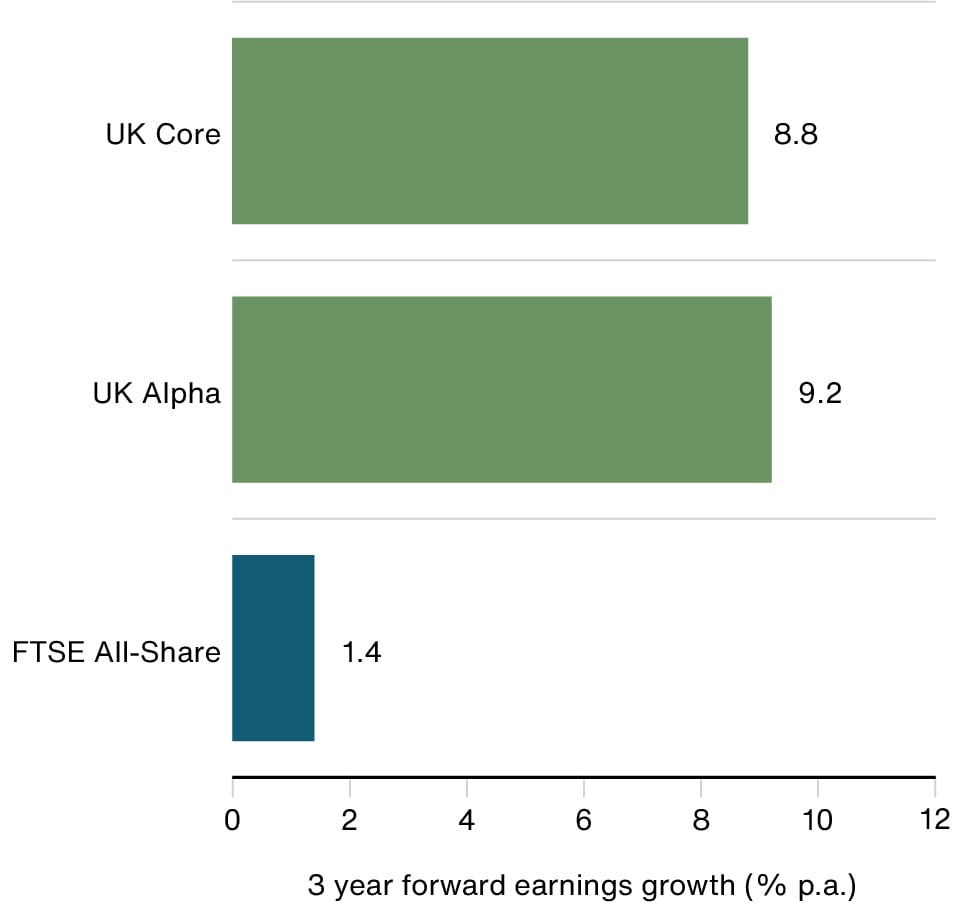

The graph below highlights the wide dispersion between the growth outlook for the broad UK equity market compared to our two UK Equity strategies. While we would avoid relying too heavily on spuriously precise earnings forecasts, it is encouraging to note that our funds are invested in companies with significantly higher growth expectations than the broader market.

Why does this matter? Our investment philosophy is anchored around a core belief that share prices will follow fundamentals over the long term. Therefore, enduring growth should act as a catalyst for long-term share price appreciation. This is why we try to identify companies with superior growth characteristics and hold on to them long enough for their unique strengths to emerge as the dominant influence on share prices.

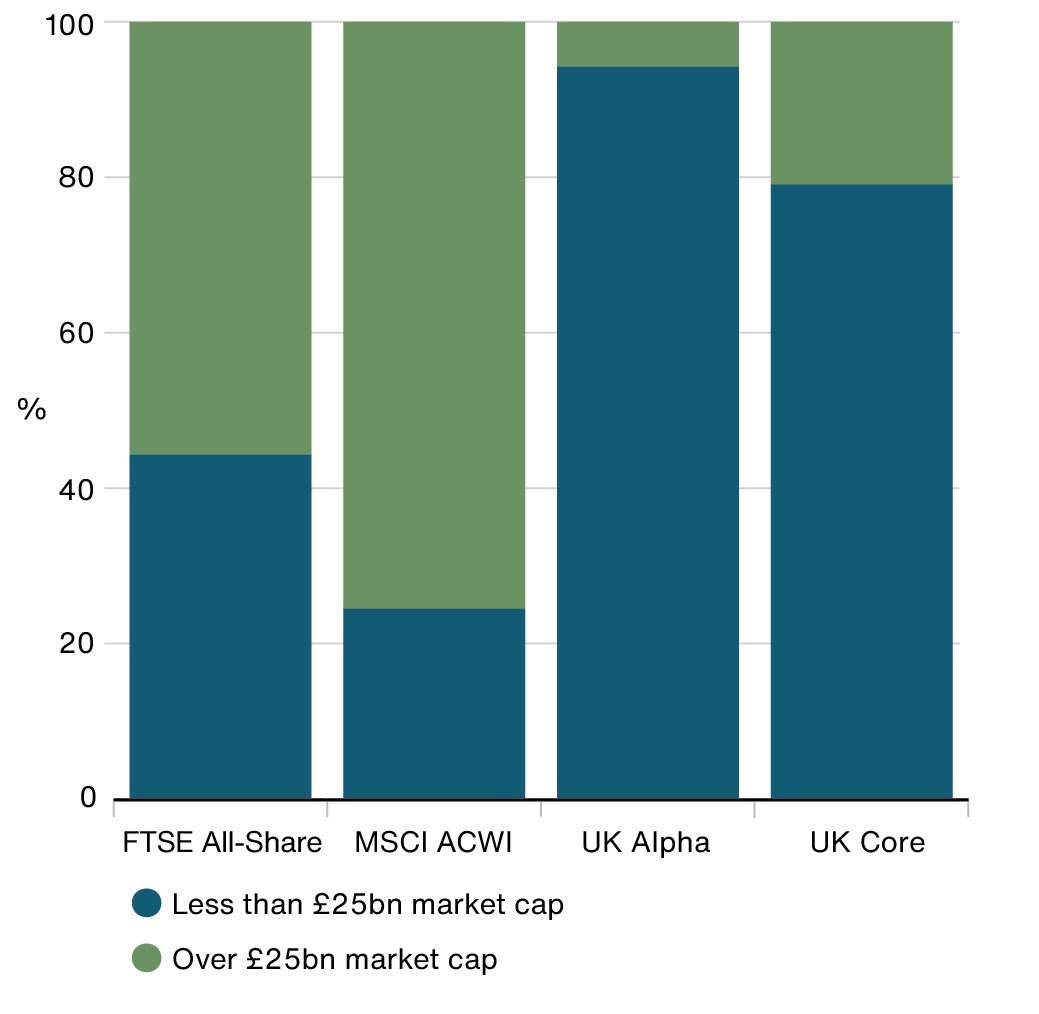

We can invest in regional champions at an earlier stage

Having a team of investors focused solely on the UK market gives us the best opportunity to uncover the hidden gems and back our regional champions. It allows you to access companies at an earlier stage of their growth. For example, over 75 per cent of companies in the broad global equity index have a market cap of over £25bn. The inverse is true for our UK equity portfolios.

The companies we invest in are not always household names, but in many cases, they are true world leaders in their fields with enviable competitive positions that rivals find hard to match. And they are operating right across the country.

Access to earlier opportunities

Source: Baillie Gifford & Co, Factset and underlying index providers, 30 September 2023.

Our local heroes operate on a global stage

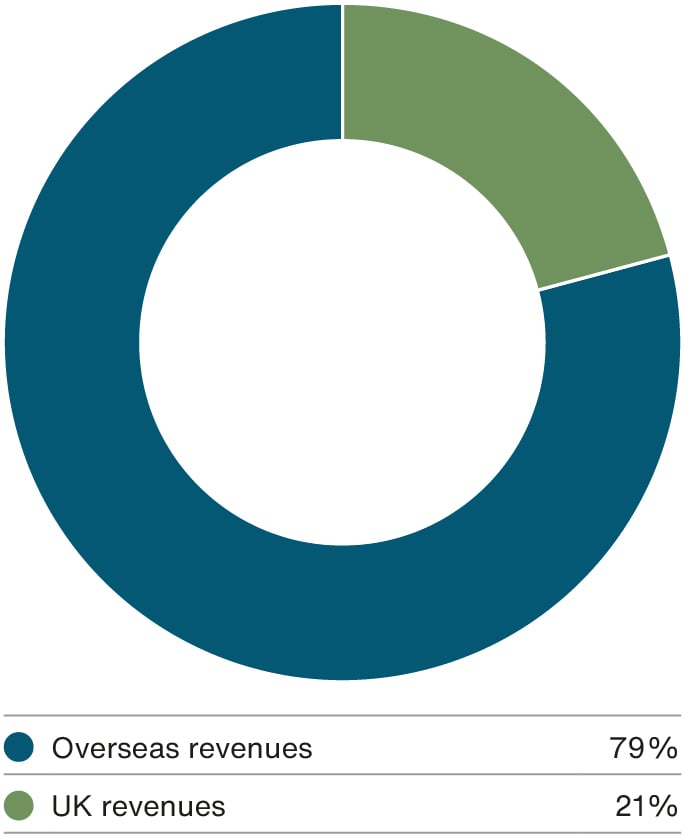

Investing in the UK equity market is not the same as investing in the UK economy. Almost 80 per cent of the revenues generated by UK-listed companies come from overseas, so these businesses are exposed to a range of global themes and international demand for their products.

FTSE All-share revenue exposure

Source: Baillie Gifford & Co and FTSE, 30 September 2023.

Access to international demand

- Renishaw

94% revenues from overseas

This is a world-class engineering company that has developed unparalleled measurement technology. Its high-precision tools are now being applied across a wide range of industries, from aerospace to neurosurgery. Despite residing in a picturesque market town in Gloucestershire, Renishaw generates only 6 per cent of its revenues in the UK. A far greater influence on its sales comes from customers in China, Japan and the US which account for over half of its revenues.

- Games Workshop

78% revenues from overseas

A manufacturer and retailer of fantasy tabletop games and miniature figurines. It has developed a leading fantasy/sci-fi franchise nurtured over decades, with a core base of passionately devoted customers. Its addressable market is expanding as the hobby continues to gain in popularity in the large US market and is beginning to develop in the Far East. The business is now more focused on monetising its deep pool of intellectual property across the broader media space.

- Ashtead

92% revenues from overseas

Founded in the village of Ashtead, Surrey, in 1947, Ashtead is now the largest equipment rental company in the UK and second largest in the US, with stores across 49 states. With a leading market position, we believe the business is well placed to benefit from a structural shift from buying to renting large expensive equipment, which provides it with a long runway for future growth. You can read more analysis on Ashtead’s growth story here.

Games Workshop, manufacturer and retailer. © ton koene/Alamy Stock Photo

The UK has a supportive ecosystem for growing businesses

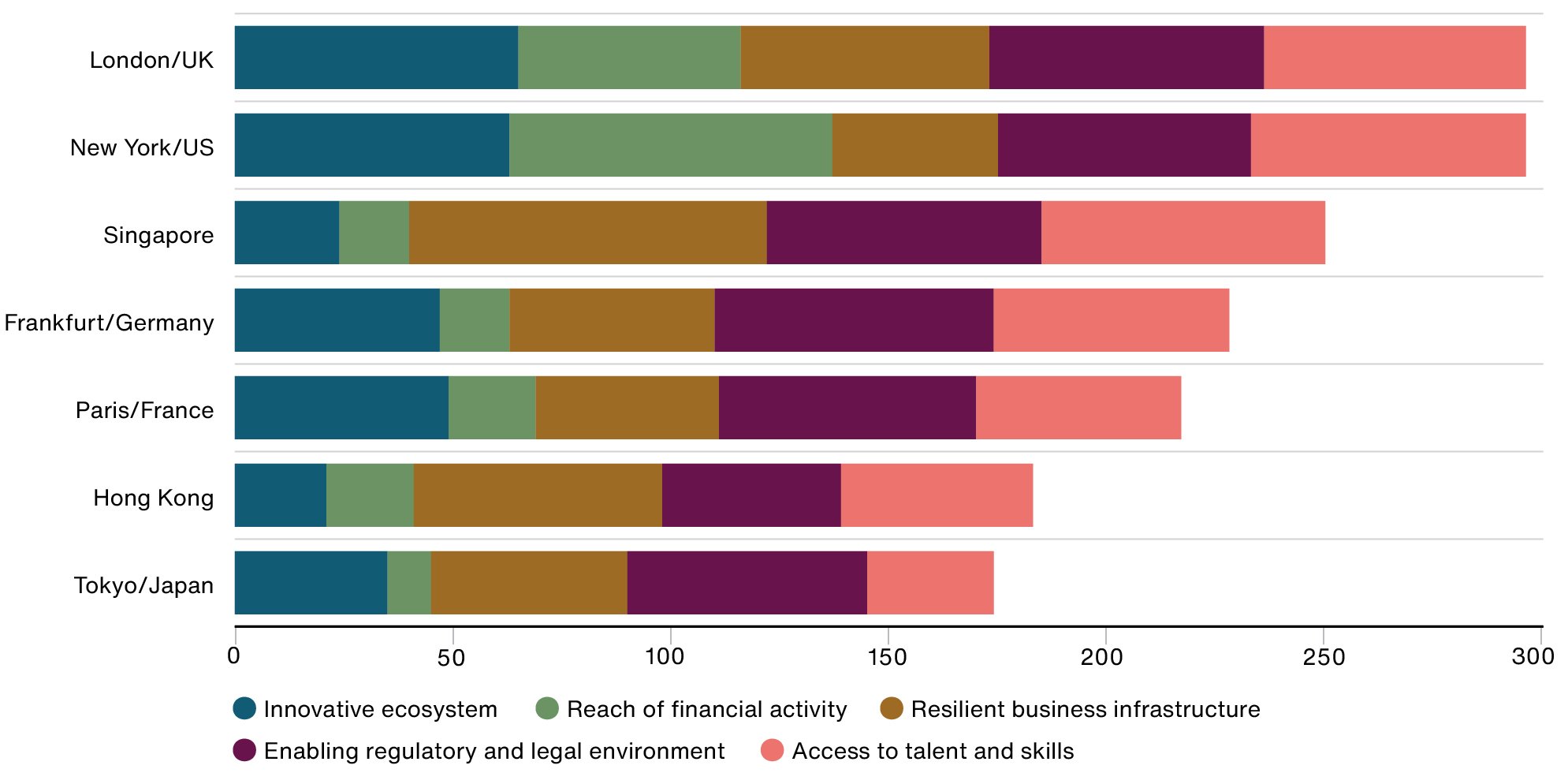

The UK is Europe’s top financial centre for fast-growing tech companies and consistently outperforms in the creation of so-called ‘unicorn’ start-ups . A recent study by the City of London Corporation highlighted several structural factors that make the region an attractive place to start and scale a company. They include innovation, financial reach, legal environment, business infrastructure and talent.

With four of the top 10 universities in the world, British businesses have access to a world-leading pool of highly qualified talent. This gives both incumbent businesses and startups access to cutting-edge research and to the talent they need for their firms to succeed.

London and the UK perform consistently well across all competitive measures

Source: City of London Corporation 2023, Our Global Offer to Business: London and the UK’s competitive strengths in support of growth.

Conclusion

The current market backdrop has created an attractive opportunity for stock pickers to invest in UK companies at relatively cheap valuations. Taking an active approach to investing in the UK equity market enables us to seek out exciting growth opportunities, invest in them at an early stage and gain exposure to a range of global themes – all within a robust regulatory framework. And we are finding these opportunities right on our doorstep.

If you would like to hear more about Baillie Gifford’s UK Equity strategies, please contact Kathleen Hunter, investment specialist director at UKEquityClientGroup@bailliegifford.com, or visit bailliegifford.com for details of the funds available to UK individual investors.

Risk factors

The views expressed should not be considered as advice or a recommendation to buy, sell or hold a particular investment. They reflect opinion and should not be taken as statements of fact nor should any reliance be placed on them when making investment decisions.

This communication was produced and approved in November 2023 and has not been updated subsequently. It represents views held at the time and may not reflect current thinking.

All investment strategies have the potential for profit and loss, your or your clients’ capital may be at risk. Past performance is not a guide to future returns.

This communication contains information on investments which does not constitute independent research. Accordingly, it is not subject to the protections afforded to independent research, but is classified as advertising under Art 68 of the Financial Services Act (‘FinSA’) and Baillie Gifford and its staff may have dealt in the investments concerned.

All information is sourced from Baillie Gifford & Co and is current unless otherwise stated.

The images used in this communication are for illustrative purposes only.

Important information

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). Baillie Gifford & Co Limited is an Authorised Corporate Director of OEICs.

Baillie Gifford Overseas Limited provides investment management and advisory services to non-UK Professional/Institutional clients only. Baillie Gifford Overseas Limited is wholly owned by Baillie Gifford & Co. Baillie Gifford & Co and Baillie Gifford Overseas Limited are authorised and regulated by the FCA in the UK.

Persons resident or domiciled outside the UK should consult with their professional advisers as to whether they require any governmental or other consents in order to enable them to invest, and with their tax advisers for advice relevant to their own particular circumstances.

Financial intermediaries

This communication is suitable for use of financial intermediaries. Financial intermediaries are solely responsible for any further distribution and Baillie Gifford takes no responsibility for the reliance on this document by any other person who did not receive this document directly from Baillie Gifford

Europe

Baillie Gifford Investment Management (Europe) Limited provides investment management and advisory services to European (excluding UK) clients. It was incorporated in Ireland in May 2018. Baillie Gifford Investment Management (Europe) Limited is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. Baillie Gifford Investment Management (Europe) Limited is also authorised in accordance with Regulation 7 of the AIFM Regulations, to provide management of portfolios of investments, including Individual Portfolio Management (‘IPM’) and Non-Core Services. Baillie Gifford Investment Management (Europe) Limited has been appointed as UCITS management company to the following UCITS umbrella company; Baillie Gifford Worldwide Funds plc. Through passporting it has established Baillie Gifford Investment Management (Europe) Limited (Frankfurt Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in Germany. Similarly, it has established Baillie Gifford Investment Management (Europe) Limited (Amsterdam Branch) to market its investment management and advisory services and distribute Baillie Gifford Worldwide Funds plc in The Netherlands. Baillie Gifford Investment Management (Europe) Limited also has a representative office in Zurich, Switzerland pursuant to Art. 58 of the Federal Act on Financial Institutions (“FinIA”). The representative office is authorised by the Swiss Financial Market Supervisory Authority (FINMA). The representative office does not constitute a branch and therefore does not have authority to commit Baillie Gifford Investment Management (Europe) Limited. Baillie Gifford Investment Management (Europe) Limited is a wholly owned subsidiary of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co. Baillie Gifford Overseas Limited and Baillie Gifford & Co are authorised and regulated in the UK by the Financial Conduct Authority.

Hong Kong

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 is wholly owned by Baillie Gifford Overseas Limited and holds a Type 1 and a Type 2 license from the Securities & Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes to professional investors in Hong Kong. Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 can be contacted at Suites 2713-2715, Two International Finance Centre, 8 Finance Street, Central, Hong Kong. Telephone +852 3756 5700.

South Korea

Baillie Gifford Overseas Limited is licensed with the Financial Services Commission in South Korea as a cross border Discretionary Investment Manager and Non-discretionary Investment Adviser.

Japan

Mitsubishi UFJ Baillie Gifford Asset Management Limited (‘MUBGAM’) is a joint venture company between Mitsubishi UFJ Trust & Banking Corporation and Baillie Gifford Overseas Limited. MUBGAM is authorised and regulated by the Financial Conduct Authority.

Australia

Baillie Gifford Overseas Limited (ARBN 118 567 178) is registered as a foreign company under the Corporations Act 2001 (Cth) and holds Foreign Australian Financial Services Licence No 528911. This material is provided to you on the basis that you are a “wholesale client” within the meaning of section 761G of the Corporations Act 2001 (Cth) (“Corporations Act”). Please advise Baillie Gifford Overseas Limited immediately if you are not a wholesale client. In no circumstances may this material be made available to a “retail client” within the meaning of section 761G of the Corporations Act.

This material contains general information only. It does not take into account any person’s objectives, financial situation or needs.

South Africa

Baillie Gifford Overseas Limited is registered as a Foreign Financial Services Provider with the Financial Sector Conduct Authority in South Africa.

North America

Baillie Gifford International LLC is wholly owned by Baillie Gifford Overseas Limited; it was formed in Delaware in 2005 and is registered with the SEC. It is the legal entity through which Baillie Gifford Overseas Limited provides client service and marketing functions in North America. Baillie Gifford Overseas Limited is registered with the SEC in the United States of America.

The Manager is not resident in Canada, its head office and principal place of business is in Edinburgh, Scotland. Baillie Gifford Overseas Limited is regulated in Canada as a portfolio manager and exempt market dealer with the Ontario Securities Commission (‘OSC’). Its portfolio manager licence is currently passported into Alberta, Quebec, Saskatchewan, Manitoba and Newfoundland & Labrador whereas the exempt market dealer licence is passported across all Canadian provinces and territories. Baillie Gifford International LLC is regulated by the OSC as an exempt market and its licence is passported across all Canadian provinces and territories. Baillie Gifford Investment Management (Europe) Limited (‘BGE’) relies on the International Investment Fund Manager Exemption in the provinces of Ontario and Quebec.

Israel

Baillie Gifford Overseas Limited is not licensed under Israel’s Regulation of Investment Advising, Investment Marketing and Portfolio Management Law, 5755-1995 (the Advice Law) and does not carry insurance pursuant to the Advice Law. This material is only intended for those categories of Israeli residents who are qualified clients listed on the First Addendum to the Advice Law.