Partner Content: Paul Sprenger from WTax talks to Room151 about how Local Government Pension Scheme funds could be missing out on millions of pounds of withholding tax recovery opportunities.

Withholding tax is a term that is often assumed to solely impact individuals – where an overseas government levies a tax on dividends or income received by non-residents. But withholding tax also applies to various legal structures, including investments and pension funds.

The Local Government Pension Scheme (LGPS) – comprising 88 funds consolidated into eight pools – is a case in point. Paul Sprenger, head of strategy and sales for Europe at WTax, believes that, with the right advice, LGPS funds could recover substantial sums and, in doing so, make considerable improvements to fund performance.

He told Room151 about the best approach for funds to take, the potential sums involved and the impact of the LGPS pools.

Room151: What is foreign withholding tax and how is it relevant to LGPS funds?

PS: Foreign withholding tax is levied on non-domestic dividend and interest income. When an LGPS fund invests in a direct foreign equity or fixed-income instrument, the tax authority of the foreign investment jurisdiction will withhold up to 35% of the investment income.

Repeatedly, we see that pension funds are not receiving the tax relief they are entitled to, negatively impacting their dividend income and fund performance. It is therefore crucial that any LGPS fund seeking to maximise the return on investment for investors and fulfil their fiduciary duty is aware of their withholding tax leakage and making every effort to minimise its impact.

R151: Why are pension funds not receiving the tax relief to which they are entitled?

PS: There are several reasons why an LGPS fund may not be fully utilising all available methods of tax relief.

Where relief at source is concerned (the mechanism by which an LGPS fund can prevent the tax being suffered from the outset), pension funds typically struggle with the quantity and complexity of documentation required. This is exacerbated by the small window of time available to file for relief at source after the dividend is declared.

Foreign tax authorities meticulously scrutinise the submitted documents, and relief at source applications are frequently rejected. It is also worth noting that there are a number of foreign investment jurisdictions in which relief at source is typically not available.

Therefore, whether due to a rejected relief at source claim or due to it not being available in the first place, pension funds are repeatedly relying on withholding tax reclaims to repatriate their foregone investment yield.

Unfortunately, the operational difficulties are not unique to the relief at source process. The reclaim process also has its fair share of administrative and technical hurdles, and investors either struggle to submit reclaims in the first place or see them clogged up at the tax office via queries and rejections.

Additionally, for an LGPS fund to fully reduce any withholding tax leakage, it will often have to pursue additional legal tax reclaims through the European Court of Justice (ECJ). These claims are based upon the principle of the free flow of capital within the European Union and aim to prevent discrimination between foreign and local investors. A UK LGPS fund can utilise this reclaim methodology, as well as exemption claims, to fully reduce the withholding tax rate down to 0% in certain developed European markets.

Due to the way ECJ claims are filed, they are considered a form of tax advice and generally fall outside of the scope of the custodian and are not included in their suite of reclaim services. Therefore, when an LGPS fund assumes all bases are being covered by their custodian we typically see they are missing out on fully reducing their withholding tax leakage via ECJ or exemption claims.

Gaps in withholding tax recovery infrastructure could be resulting in pension funds missing out on multi-million-pound recovery opportunities and considerable improvements to fund performance.

R151: In your experience, how significant is the amount of value that is being left unclaimed in the UK LGPS space?

PS: WTax’s work within the UK LGPS space has cast light upon the material value that can be unlocked through minimising withholding tax leakage. Using custodian data, we can examine the withholding tax position of a UK LGPS fund, the reclaim amounts that were being covered by their existing recovery agent, and the additional value uncovered by WTax.

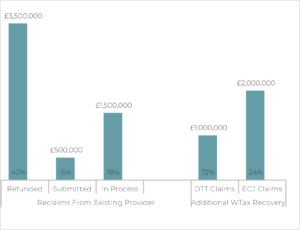

When analysing the withholding tax suffered by the LGPS fund over a three-year period, WTax identified a total of £8.5m of recoverable value. Of this value, £5m was being actively pursued by the existing provider or had already been successfully refunded.

This left an additional £3m of reclaims for WTax to pursue on the client’s behalf. These reclaims were made up of £1m in Double Tax Treatment (DTT) claims in administratively complex jurisdictions such as Taiwan and South Korea, and £2m in claims made via the ECJ reclaim methodology.

As WTax’s data shows, gaps in withholding tax recovery infrastructure could be resulting in pension funds missing out on multi-million-pound recovery opportunities and considerable improvements to fund performance.

R151: What steps can an LGPS fund take to fill in the gaps and ensure withholding tax leakage is kept to a minimum?

PS: Principally, it is important to develop awareness of one’s own withholding tax position. This can be hindered by a general lack of transparency throughout the recovery chain, and an absence of sophisticated withholding tax reporting. Therefore, it can be necessary to utilise the services of a withholding tax specialist to interpret the dividend income and withholding tax reclaim reports, ensuring a comprehensive analysis is performed to understand fully the extent of the withholding tax leakage.

This is beneficial in gaining insight into existing reclaim opportunities and, most importantly, identifying any reclaims that may be expiring as per the statute of limitations that need to be prioritised in terms of claim preparation.

Once you have assessed the available reclaim opportunities, it is important to apply the optimum mix of reclaim methodologies. This will ensure that the success rate of claims and recovery yields is maximised, and the time to receive refunds is minimised. This will likely require knowledge of the necessary reclaim methodologies and jurisdiction-specific tax legislation and, where fiscal representation is necessary, tax agents on the ground in the relevant investment jurisdiction. As these requirements often fall out of the core competencies of an LGPS fund, utilising an external tax specialist is recommended.

We also regularly see that pension fund teams can be overwhelmed by the administration and back-and-forth dealings with foreign tax authorities and the requirement to fill out forms in multiple languages, which can negatively impact operational efficiencies in other areas. The best solution to avoid this is to consolidate the entire reclaim function into one dedicated recovery agent that offers a fully outsourced solution with minimal administration on the LGPS end.

All these steps can help to ensure that tax leakage is minimised, operational efficiency optimised and investment performance maximised.

Pension fund teams can be overwhelmed by the administration and back-and-forth dealings with foreign tax authorities and the requirement to fill out forms in multiple languages, which can negatively impact operational efficiencies in other areas.

R151: What are the future considerations for LGPS funds?

PS: One trend is that LGPS funds are consolidating their assets into investment pools. From a withholding tax perspective, this has significant implications. As withholding taxes are recovered on a beneficial owner level, reclaims are made on behalf of the fund, and, therefore, when working with an investment pool we would recover for the entirety of the consolidated assets with the agreement of the underlying participants due to the transparent nature of the pooled funds.

However, as withholding taxes can be recovered retrospectively up to the full statute of limitations (typically between two to five years depending on the investment jurisdiction) there still may be an opportunity to perform a “clean-up” of any outstanding withholding tax reclaims from the past, prior to an LGPS fund transferring assets into an investment pool.

While there is increased awareness of the importance of withholding tax recovery in the LGPS space, there is still material value being left on the table across the board. We therefore recommend that any party seeking to improve investment performance and the fulfilment of fiduciary duties should consider the services of a withholding tax specialist to ensure an optimised recovery process.

—————

FREE weekly newsletters

Subscribe to Room151 Newsletters

Room151 LinkedIn Community

Join here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel