Most local government pension funds provide good value for money, but need to demonstrate this to members and stakeholders writes Peter Worth.

Most local government pension funds provide good value for money, but need to demonstrate this to members and stakeholders writes Peter Worth.

Local government pension schemes (LGPS) have been coming in for a rough ride recently with headlines like: “UK pension schemes waste millions of pounds on high fees,” and “staggering inefficiencies in local government pension schemes” appearing in the national press and reports of think tanks.

The government’s response has been to establish the LGPS Advisory Board, focussing initially on investment management costs; and eight new pooled investment “mega-funds” aimed at reducing costs through economies of scale.

To form my own view about local authority pension fund costs and performance I have analysed every set of audited accounts for 2015/16 – and on average reported investment costs represented just 0.42% of year-end fund values.

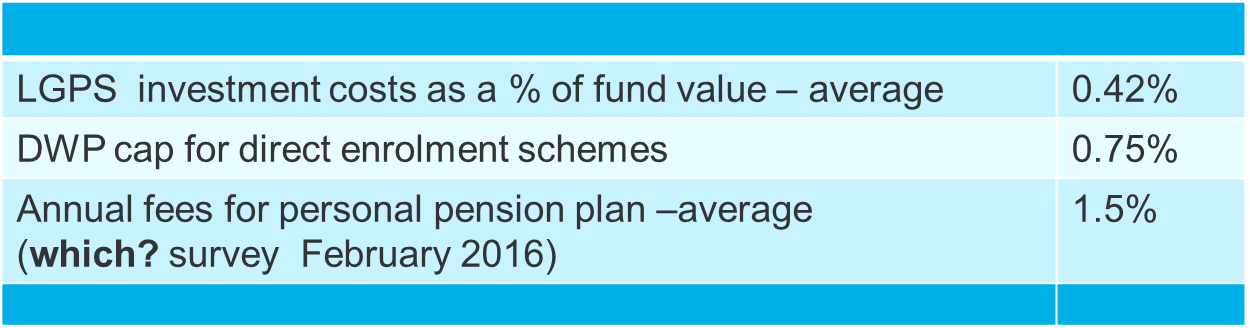

This was less than the 0.45% average for 2014/15, and considerably less than equivalent fees for other types of pension (see Table 1).

Table 1. Pension fund average investment management costs

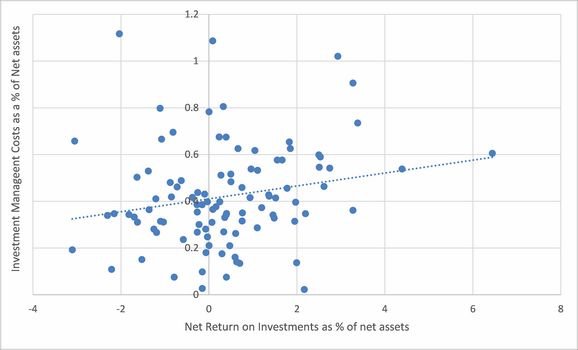

When local authority pension funds reported higher costs this was generally, although not always, justified by improved returns. The 1st quarter of 2016 was a difficult year for investments, taking local authority pension fund average returns down to just 0.7%, compared to 12% the previous year, but still well above the 0.1% reported in the press for pension funds as a whole. Seventeen of the “top 20” LGPS, reporting returns over 2.5% also reported above average investment costs.

However, the balance between cost and return is not a straightforward relationship, as shown below:

Graph 1. LGPS investment costs and returns as a % of net assets. (dotted line represents the expected relationship between investment costs and returns)

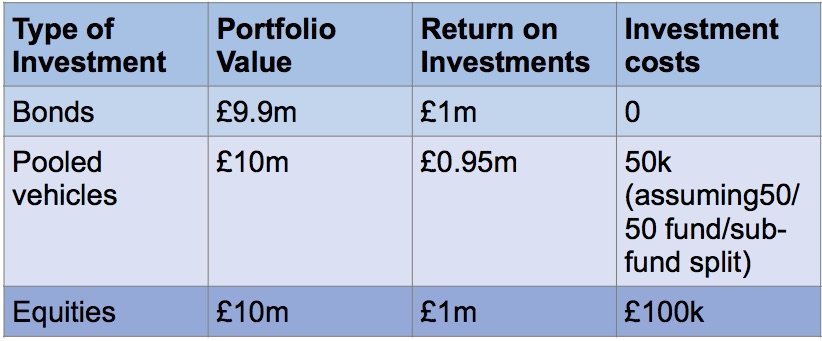

It can be difficult to compare performance across different investment portfolios given that most bond transactions reflect fees in the sale or purchase price, whereas equity fund managers tend to invoice fees separately and remit returns gross.

Pooled vehicles deduct sub-fund costs (which are not a liability of the investor) from the return on investments, a feature of investment management which will become increasingly apparent as the eight asset pools get under way.

For example, three different types of £10m investment portfolio all yielding a 10% gross return with 1% fees would be reported differently as follows, but each is yielding the same return for the same fee.

Table 2. Financial reporting for different investment types

To promote transparency and consistency in this contentious area, CIPFA has published guidance for practitioners. Although voluntary, this has been widely adopted and recommends that:

- Netted off costs are grossed up

- “Indirect” costs which affect returns but are not the legal responsibility of the LGPS to pay are set out in the annual report alongside an explanation of fee structures, benchmarks and returns achieved.

The Scheme Advisory Board has endorsed and developed this approach through a Transparency Code and annual data collection arrangements. The aim of the Code is to ensure all local authority pension fund investment costs are consistently identified, checked and published.

Similar initiatives in the Netherlands have led to more confidence in published information, less criticism of pension providers, and more joint working to reduce fees. The Scheme Advisory Board’s work should be able to promote more reliable data which can be used to benchmark investment costs and performance, and provide more meaningful information to members and stakeholders.

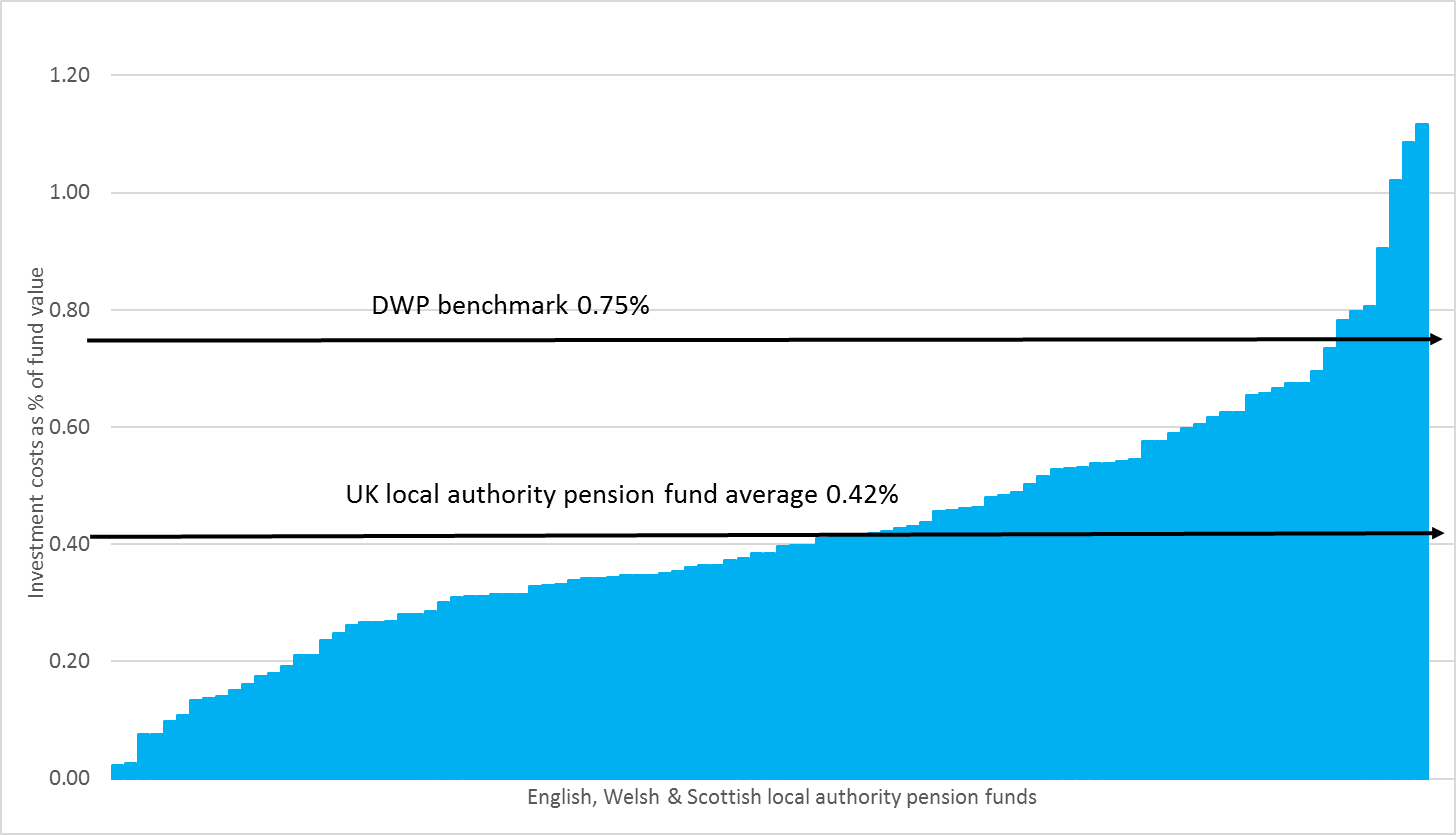

Most funds can rightly be proud of their achievements, but some individual schemes are reporting costs well above DWP benchmarks not matched to investment returns.

Graph 2. LGPS investment management costs 2015/16

Any local authority pension fund committee or local pension board wishing to review performance can start by asking 10 simple questions:

- Have we adopted CIPFA’s 2016 guidance on management costs?

- Are investment costs above the LGPS average?

- Are costs above the DWP benchmark for workplace pensions?

- Are investment returns achieving Fund benchmarks overall?

- Are benchmarks set for individual managers also being achieved?

- Are returns achieving LGPS averages?*

- Are we confident that above average costs are yielding better than average returns?

- Is our Investment Strategy and allocations policy up to date?

- Are we using independent investment advisors to best effect?

- Are fund mandates kept under regular review?

*0.38% of net assets in 2015/16 and 11.9% in 2015/16 when combining income and capital growth

The better local authority pension funds are already highly focussed on achieving or bettering industry benchmarks. They track the market, use fund mandates and pooled vehicles effectively and keep investment strategies under regular review.

Adopting these good practices universally, combined with the reporting improvements described above, should go a long way towards restoring confidence in the LGPS and dispelling the largely inaccurate allegations made in the press.

Peter Worth is a director at Worth Technical Accounting Solutions.