Partner content: AlphaReal’s Shajahan Alam explores highlights from the keynote speech at the recent Room151 Private Markets Forum. In it, Ed Palmer, AlphaReal’s CIO, explained why it is the right time for LGPS investors to consider shifting their focus towards secure income markets.

The backdrop

Following completion of their March 2022 valuations, most LGPS funds have:

- Higher funding levels – most funds are at above 100% funded as at March 2022, and that position will have improved (due to higher gilt yields) at the time of writing. Coming from being underfunded just a few years ago, there is naturally a shift in strategic priorities towards preserving funding levels. While returns are still a priority, building resilience into portfolios is at least equally important.

- Higher cashflow requirements – higher inflation, maturing liability profiles and potentially lower employer contributions going forward means more reliance on the asset portfolio to deliver inflation-linked cashflows. Many schemes are reviewing cashflow waterfalls to ensure the asset portfolio can efficiently deliver pension payments as they fall due.

- The S in ESG as a focus – many funds have dedicated resources and time to invest for social impact, both local to the LGPS and nationally. The UK government is also encouraging such activity through its levelling up agenda, the Productive Finance Initiative and more recently the Mansion House reforms.

With high inflation, economic uncertainty and volatile markets persisting, we believe that now is the right time for LGPS investors to shift their focus towards secure income assets.

What do we mean by secure income and how can these assets benefit LGPS investors?

We define secure income as: private assets that generate predictable cashflows secured against real assets or other forms of collateral.

These assets can benefit LGPS funds through providing:

- Portfolio diversification benefits – bringing resilience into portfolios. Secure income assets can be natural portfolio diversifiers. They typically give investors exposure to underlying sectors, names and investment formats that are not available via public markets. For example, providers of essential services that are resilient to economic downturns means more stable, capital and income returns.

- Secure cashflows – they provide reliable income streams to feed into cashflow waterfalls. The assets are typically investment grade, with high income cover and are highly collateralised. For example, commercial ground rents (CGR) are typically structured to provide 8x income cover and the CGR value is typically 2.5x covered by the underlying property asset value. They are also super-senior in the capital structure of investee companies.

- Contractual inflation-linkage – there are very few asset classes with this inflation-protection feature, which provides more certainty for meeting inflation-linked pension payments.

- Tangible, measurable social and environmental benefits (see below).

What are some example secure income assets?

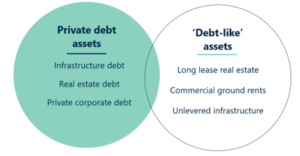

We split the secure income universe into private debt and debt-like assets. Debt-like assets involve creating a debt-like income stream secured by equity ownership of a real asset.

What are the ESG benefits?

Secure income assets can provide real-world ESG benefits. For example, an allocation to social infrastructure can support:

- E – through improving EPCs in buildings.

- S – through supporting levelling-up ambitions and contributing towards UN SDGs.

- G – these are highly regulated sectors.

What are the risks with secure income?

Each individual secure income asset class has nuanced risk/return profiles. Some generic risks associated with these assets include:

- Origination – these are simple assets, but not simple to source.

- Credit – default risk could impact returns.

- Illiquidity – these are private assets.

The above risks can all be mitigated through using experienced managers.

Conclusion

Better funding positions and a greater focus on cashflows means that now is the time for LGPS funds to focus on secure income.