There have been a number of objections to government plans for LGPS funds to invest 5% of their assets in local projects. But George Graham says these objections can be overcome and council pension funds should embrace the levelling up agenda.

On a university visit a few years ago, I took my daughter into the middle of Manchester hoping to recreate one of my student experiences with a trip to the Dutch Pancake House, only to find that Greater Manchester Pension Fund had financed the site’s redevelopment and plonked a large office in its place. While the loss of such an iconic, low-cost and carb-filled student experience is to be regretted, that project points to what an LGPS fund can do to support local development when it puts its mind to it.

On a university visit a few years ago, I took my daughter into the middle of Manchester hoping to recreate one of my student experiences with a trip to the Dutch Pancake House, only to find that Greater Manchester Pension Fund had financed the site’s redevelopment and plonked a large office in its place. While the loss of such an iconic, low-cost and carb-filled student experience is to be regretted, that project points to what an LGPS fund can do to support local development when it puts its mind to it.

Isn’t it this sort of thing that the government is seeking to encourage with the idea in the Levelling Up White Paper that each LGPS fund should have a plan to deploy up to 5% of its assets towards projects broadly supportive of the “levelling up” agenda, with the accompanying idea that the Scheme Advisory Board produces an annual report on such activity?

Yet, as a community we seem resistant to this. The reluctance is not just for the understandable reason that this is government interfering in our internal decision-making processes, something that historically has not ended well (Gordon Brown’s RDA-led regional funds anyone). There is also a strong undercurrent in the debate that investments of this sort will inevitably have lower returns, even if the fundamental conflicts of interest apparent in local investment can be overcome.

These are arguments about rules and process. Conflicts of interest can be addressed by, for example, giving delegated responsibility to fund managers or through having rules that prohibit investment in a scheme where the host council is involved. Equally, the point about returns, which to some extent demonstrates a lack of faith in the local area, can be addressed through having clear return hurdles that have to be achieved before a project goes forward.

There is a strong undercurrent in the debate that investments of this sort will inevitably have lower returns, even if the fundamental conflicts of interest apparent in local investment can be overcome.

Impact investing

But all of this misses the point. If we look at the white paper, including the six forms of capital and the levelling up missions and targets, what becomes clear is that the government is encouraging us to focus part of our portfolio on impact investing. The target geography is the UK and not our particular place, although in South Yorkshire we would want at least some of our allocation to be genuinely local.

becomes clear is that the government is encouraging us to focus part of our portfolio on impact investing. The target geography is the UK and not our particular place, although in South Yorkshire we would want at least some of our allocation to be genuinely local.

There is no prescription about how we should invest and there are a number of highly successful and reputable fund managers who are already active in raising and deploying funds that will have an impact on some of the levelling up missions.

At this point, I hear the widespread cry “but what about fiduciary duty?” In simple terms our fiduciary duty can be expressed as achieving a return, a margin of safety, over the actuary’s assumed discount rate so that we can have funds available to pay pensions when needed. If a “levelling up” type investment meets this criterion, there is, subject to it falling within the terms of the Investment Strategy Statement, no block on undertaking it.

So, if all these objections can be overcome, what’s the blockage? Certainly, scheme members I talk to would like to see us doing more in this space, although they also accept that we cannot invest the whole fund in this way.

Is it a concern about concentration? Surely not, if this is only ever going to be a relatively small part of the overall portfolio and the genuinely local element a part of this relatively small whole. And isn’t the logic for investments of this sort that they find returns in different places, which, in the current economic and market environment when most traditional asset classes seem to be going the same way, is surely a good thing.

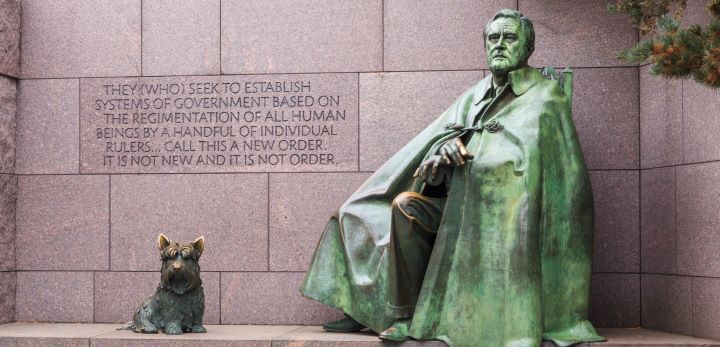

So, to quote Franklin D Roosevelt, if “we have nothing to fear but fear itself”, there isn’t anything stopping us from taking hold of this agenda and investing in achieving impact or “levelling up” (or whatever you want to call it) in the right way.

George Graham is director of the South Yorkshire Pensions Authority.

FREE weekly newsletters

Subscribe to Room151 Newsletters

Room151 LinkedIn Community

Join here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel