For professional clients only. Capital at risk.

By James Sparshott, head of Strategic Client Team, Distribution, and Robert Pace, senior solutions strategy manager at LGIM

With LGPS funding levels improved and US equities near all-time highs, what options do LGPS funds have to guard against potential equity market falls?

Given average equity allocations of c.50% and limited fixed income allocations, LGPS funding positions are at historically high levels. Many LGPS funds are now considering how best to maintain these improved funding positions without overly compromising on expected returns ahead of the the upcoming triennial valuation on 31 March 2025 for England and Wales.

In Scotland (where the valuation was 31 March 2023), LGPS funds will be finalising their valuation results and considering strategy implications given significantly higher funding levels.

Where are we now?

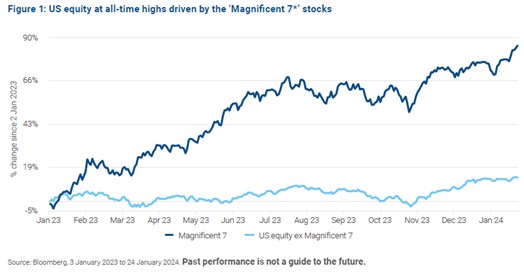

LGPS funds have increasingly adopted more global allocations to equity. With US equities accounting for the majority of global equity indices, we believe investors are likely to have benefited from the dominant performance of US equity and specifically the handful of US stocks that have driven returns.

The flip side of this coin is that any structural outperformance of US equity markets and the technology sector may, unchecked, leave equity allocations as an increasingly concentrated ‘bet’.

*For illustrative purposes only. Reference to a particular security is on a historic basis and does not mean that the security is currently held or will be held within an LGIM portfolio. The above information does not constitute a recommendation to buy or sell any security.

Where from here for equity markets?

Qualitative considerations

As always there are strong cases that could be made for a continued rally in equity markets or indeed a correction (or worse). For instance, in our view, it is now looking increasingly likely that the Fed can engineer that rare outcome of a ‘soft landing’ which could give equities room to perform. The upside case for equities could then feed from improvements in technology and productivity gains.

On the other hand, there are concerns around regulatory risks faced by many of the large technology stocks. On top of this, a trigger could come from geopolitical risk with a knock-on impact on supply chains or energy shocks. Furthermore, with so much of the world going to the polls this year, elections represent a political risk factor for equities.

What does history tell us?

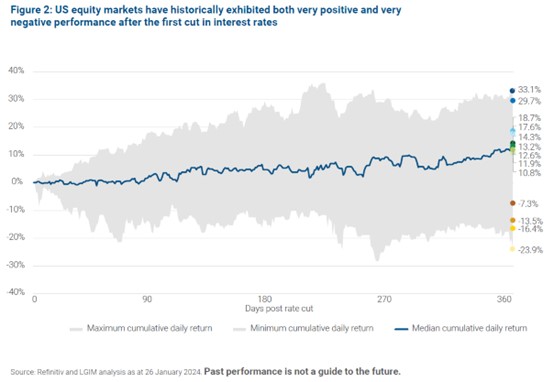

The first rate cut priced into US markets is around June or July 2024. The following chart shows how equity markets have performed after the first rate cut in historic cycles dating back to 1971. What is clear is that a large range of possibilities exist, ranging from the potential for very positive equity performance over the next 12 months all the way to large falls in equity markets.

What can LGPS funds do?

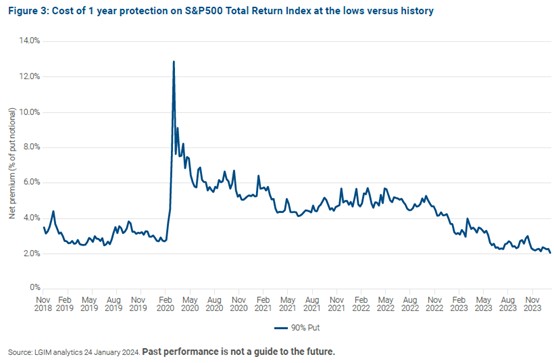

Evidently, predicting the exact outcome for equity markets with any certainty is very difficult. However, we can observe that current market pricing remains sanguine around the possibility for future equity volatility.

We believe that this means that there is potentially an attractive opportunity for LGPS funds to seek some risk mitigation against falling equity markets, and in doing so seek to provide stability to their funding position with minimal outlay.

Given average equity allocations of c.50%, this would imply the impact on total portfolio return could potentially be achieved with only a very modest reduction in the expected return of 1% or less.

The next chart shows pricing for 90% put options (‘puts’), which seek to protect against a fall in equity market returns over 10%. We believe this can be an effective way of looking to take advantage of current market dynamics because of the low level of implied volatility and relatively high level of interest rates.

Equally, it is possible to also sell away some potential equity market upside to reduce the premium. This may be deemed a good strategic fit for LGPS funds if higher funding levels mean that it is not necessary to have quite as much upside potential from equities as historically.

In order to determine a suitable strategy, we believe it could be useful to think about how you would feel given certain scenarios. For example, if upside is sold above, say, 15% then would there be a large amount of regret if returns ended up at, for example, 20% but the scheme only earned 15%?

Key risk: The value of any investment and any income taken from it is not guaranteed and can go down as well as up, and investors may get back less than the amount originally invested.

Drawing strategic conclusions

In conclusion, while we observe the potential bullish case for equities, there are also notable downside risks which investors can seek to mitigate. In our view, strategies seeking equity protection offer pension funds a potentially attractive way of preparing for more uncertainty in 2024 by seeking to:

- Take advantage of the current low levels of option pricing

- Where appropriate, retain notable upside exposure in the event that equity markets rise significantly

- Simultaneously provide more stability in scheme funding levels ahead of the next valuation cycle

Key risk: The value of any investment and any income taken from it is not guaranteed and can go down as well as up, and investors may get back less than the amount originally invested.

Disclaimer

Key Risk Warnings

The value of investments and the income from them can go down as well as up and you may not get back the amount invested. Past performance is not a guide to future performance. The details contained here are for information purposes only and do not constitute investment advice or a recommendation or offer to buy or sell any security. The information above is provided on a general basis and does not take into account any individual investor’s circumstances. Any views expressed are those of LGIM as at the date of publication. Not for distribution to any person resident in any jurisdiction where such distribution would be contrary to local law or regulation. Please refer to the fund offering documents which can be found at https://fundcentres.lgim.com/

This financial promotion is issued by Legal & General Investment Management Ltd. Registered in England and Wales No. 02091894. Registered office: One Coleman Street, London EC2R 5AA. Authorised and regulated by the Financial Conduct Authority.