Because we are doing a broad, multi asset strategy, there are lots of opportunities to choose from. Just to pick out a few of them, we know that there is a huge supply demand imbalance in social- and affordable housing and retirement living is a potentially attractive area for consideration. I think there is also a place for a wider property regeneration exposure where part of it could be housing as part of a much larger regeneration project.

When I think about infrastructure, that includes sectors llike local digital infrastructure, social infrastructure around education or hospitals or transport. When we get into corporate financing, this is the growth and venture capital at the higher end of the risk spectrum, the SME lending at the lower end of the risk spectrum.

I’ve mentioned university spinouts, the UK ranks fourth in the global innovation index, but there is a limited ecosystem to enable these companies to grow at scale. What it is probably lacking is getting those ideas from concept stage to commercial development to growing that business to IPO’ing that business, hopefully in the UK. There is a gap there where we can help to develop that ecosystem further. A lot of that intellectual property coming out of our universities often disappears overseas before it is commercially scalable.

We would also like to do social bonds. That is an investment which has a more explicit link to impact. We are going to be very selective in that space because there are certain bonds where returns may be sacrificed in return for impact. As we are very much investment-led, we are going to make sure that these bonds offer suitable compensation for the risk we are taking. I’d like to do more in social bonds, but it is a relatively small market at the moment, hopefully it will grow over time so that we can deploy more capital.

Do the partner funds invest in a particular asset class (say real estate within UK opportunities) or do they allocate to the entire UK opportunities portfolio?)

No, they allocate to the entire UK Opportunities portfolio which is a multi-asset strategy.

Normally, your partner funds decide on their asset allocation. But within these multi-asset strategies, are you able to adjust the allocation to certain asset classes, for example invest more in credit / real estate etc?

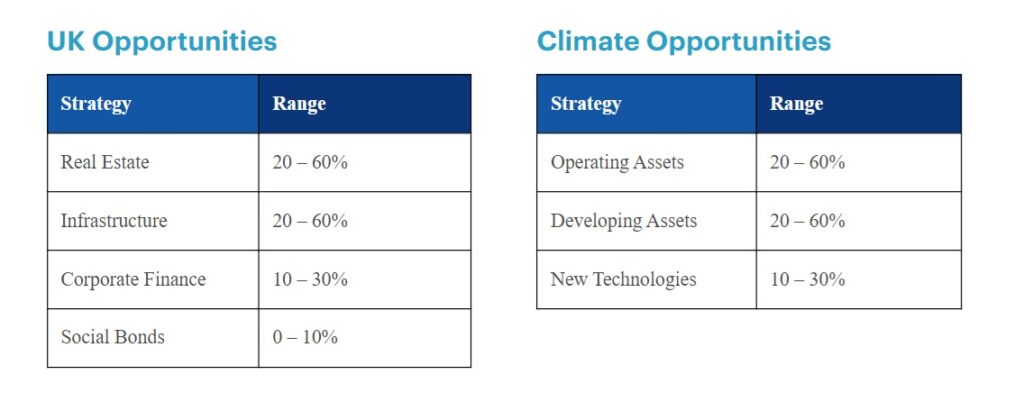

Yes that is correct, for the multi-asset strategies we can adjust the allocation across the different asset classes depending on the relative attractiveness of the opportunity set. Our partner funds determine their asset allocation to the more traditional private market strategies such as private equity or infrastructure, but we also have discretion to tilt these portfolios towards the more attractive sub-sectors. For all of our private market strategies, we agree the risk parameters with partner funds, provide indications of where we expect to invest, and discuss a detailed pipeline so that they get a sense of where the capital is likely to be allocated, but we do have the ability to change that asset allocation when we see the opportunities arise.

Would you describe your approach within these multi-asset strategies as more top-down or bottom up?

It is bottom-up. We are looking for the right managers to execute these strategies and are conscious that we are operating within agreed ranges. We may have a view that a certain part of the market is more attractive than another part of the market, but we are not making big asset allocation decisions here, they are very firmly within the parameters that have been agreed with our partner funds.

How much of your portfolio is invested directly and how much is invested through third party managers?

There is a bit of a nuance in private markets in that all of the investments we do are generally through funds managed by external managers, but it is not in the same way as you would appoint an external equity manager to run an equity portfolio and they go off and do it. We are very much focused on finding the right manager and blending them together as part of our portfolio construction.

Something like Climate Opportunities will have around 15 separate investments in there, this means there are multiple managers we are doing due diligence on. But when we are doing that due diligence, we are reviewing the entire market, we look at a strategy and at managers who are fundraising at the time.

We also invest in co-investments alongside those managers, following the same detailed due diligence process but perhaps with greater access to information on underlying investments. We want to execute these co-investments alongside the manager because we benefit from their skills in research and sourcing and if something were to go wrong, we have the benefit of their operational capability to resolve any issues.

Co-investments come with a significant cost-saving because they are typically fee-free, and it helps us develop those strategic partnerships that we have with some of our managers where we are investing in multiple strategies alongside them. This has resulted in the creation of a number of bespoke co-investment funds.

How many people within Border to Coast are working on these new strategies, is this picked up by the portfolio managers covering different asset classes such as real estate or do the Opportunities strategies have their own designated teams?

Everything will be managed within our alternatives team; we have a real estate team but they manage different real estate assets. Real estate within UK opportunities will be managed by the alternatives team. For all our strategies we will have a lead portfolio manager who will do the overall portfolio construction while others will feed in and work on the underlying due diligence. For Climate Opportunities we have a lead and a number of portfolio managers who work on due diligence. Our private equity specialist will look at the private equity aspects of the UK and Climate Opportunities strategies for example. We want to broaden this out across the team which helps with resource allocation and encourages a team-based peer review and challenge approach.

How does this fit within your wider net zero strategy, how are you working with the companies you invest in to improve transparency and reduce emissions?

Unfortunately, it is not yet possible to include private markets in our net zero plan because of issues around data availability and data quality. We are members of the ESG Data Convergence Initiative, which is working to develop common reporting metrics. We think that is the best way to get the industry to coalesce around a standardised methodology. We don’t make it a requirement, but we strongly recommend that any manager we work with considers joining the initiative. That means once we have agreed on the methodology, most of the managers we work with will have that data available.

We started our private markets programme in 2019 and, of the £16bn of commitments, £6bn is invested. It will take time to establish an appropriate baseline against which we can set net zero targets, but we are targeting inclusion in our net zero plan within the next 3 years or so. The private markets industry appears to be moving more quickly than listed markets were at the beginning of their journey. We are seeing some positive movements, but it is still going to take some time before we can report the data.

So only £6bn of your private market strategy has been invested?

We have £16bn of commitments from our partner funds, we have made commitments to underlying investments and managers of £12bn and just over £6bn is cash that has been drawn down and invested.

Are you worried about dry powder within private markets?

We are not overly concerned. When we are doing due diligence on managers, one of the key things we look out for is if they can deploy this capital in a sensible manner. Obviously, the level of dry powder has increased but in terms of our capital being deployed, we track this against what we would expect in terms of historical deployment data. We are ahead of where we would expect to be but are not concerned that capital is being deployed too quickly. By doing co-investments, the capital is fully invested from day one. We do also invest in Secondaries funds where the capital also gets deployed a bit more quickly.

Also, some of our managers can have quite established seed assets. So dry powder is something we look at but not something we are overly concerned with.

Finally, where do you expect your private market portfolio to be at in five years’ time?

Good question, we have obviously seen significant growth from the partner funds in the early years, I don’t think that trajectory can continue forever, it will start to plateau, and we will get to a stage where new commitments will be replacing capital returned back from previous commitments. This is likely to happen over the next 3-4 years. Obviously, if partner funds make material changes to their asset allocation, that outlook could change.

In May, it reported an additional £3.6bn in commitments to its private market programme including its new UK Opportunities offering and second Climate Opportunities offering, bringing its total private market commitments from partner funds to £16bn. Room151 sat down with deputy CIO Mark Lyon to investigate how this money will be deployed.

In May, it reported an additional £3.6bn in commitments to its private market programme including its new UK Opportunities offering and second Climate Opportunities offering, bringing its total private market commitments from partner funds to £16bn. Room151 sat down with deputy CIO Mark Lyon to investigate how this money will be deployed.