Michelle Doman looks at the impact of inflationary pressures, the war in Ukraine, climate risk and Covid-19 on employer contributions.

At the start of 2022, for Local Government Pension Scheme (LGPS) funding, the mood was one of cautious optimism. After fund officers and committees had worked exceptionally hard to deliver to members through unprecedented circumstances during the pandemic and fund investments had rebounded and gone on to deliver healthy investment returns, funds and employers were hoping for a period of relative stability.

Although rising inflation was a concern in the near term, the longer-term consequences of the pandemic were unknown and the climate emergency was rightly on people’s minds, a stronger balance sheet for many LGPS employers had provided a buffer to manage any additional costs emerging. For some employers facing material budget pressures, the conversation had turned from crisis management to exploration of contribution reductions to ease the situation.

With the first quarter behind us, the outlook is now much more challenging. Investment returns over Q1 began to decline even before the crisis in Ukraine and despite recovery in some markets since the start of the crisis, material volatility remains alongside potentially significant inflationary impacts.

The crisis is first and foremost a humanitarian tragedy and our heartfelt thoughts are with the people of Ukraine. However, the crisis also has potentially significant implications for the global economy, investment markets and pension funds.

We held a webinar on 1 March to discuss the 2022 valuations, five days after Russia’s invasion began. Representatives from 32 local government pension funds were in attendance.

[There will be] difficult conversations between funds focusing on stability and intergenerational fairness, and employers considering reduced contributions.

Challenging conversations

Speakers pointed out that the outlook for LGPS funds was already more uncertain than some had believed. They predicted difficult conversations between funds focusing on stability and intergenerational fairness, and employers considering reduced contributions.

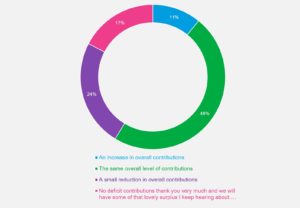

Poll 1: In your view what are employers generally expecting in relation to contributions emerging from the 2022 valuation?

A poll of attendees showed 41% expecting employers to ask for a reduction in contributions. Only 11% expected an increase in contributions and 48% thought contributions would be unchanged.

Anecdotally, we think pressure on contributions from an employer affordability perspective will be at least as great as the poll shows, even though this will increase the risk that contributions are not sustainable further down the line.

The outlook

Funding health declined over the first quarter even before the crisis. However, the crisis has caused correlational effects across the full risk spectrum. The immediate market shock reduced fund asset values. Alongside this, the crisis has led to significantly increased inflation concerns, which could mean a lower outlook for future investment returns, putting pressure on valuation discount rates (and therefore liability valuations).

Taken together this ultimately increases pressure for employers to pay contributions at a time when public sector employer budgets are under more strain due to the cost-of-living crisis and the general economic outlook.

With the UK Consumer Price Index hitting a 40-year high of 9% in April, double-digit inflation during 2022 is now on the agenda which could mean the 2023 pension increase awarded could be the highest seen since the 1970s.

Inflationary pressures

Inflation was already a concern at the turn of the year for a number of reasons but was expected to be more transitory then persistent over a long period. High inflation requires greater increases to scheme benefits which increases pension liabilities. It also can erode the value of future investment returns, which are needed to meet the cost of the benefits. Inflation will also squeeze employer affordability by pushing up salaries and other operational costs.

The current consensus is that the inflation impact is likely to be higher and last longer than was expected before the crisis, which has increased the risk of a stagflationary environment of high inflation and lower growth. With the UK Consumer Price Index hitting a 40-year high of 9% in April, double-digit inflation during 2022 is now on the agenda which could mean the 2023 pension increase awarded could be the highest seen since the 1970s.

We calculated that the cost of benefit increases for members would be of the order of £12bn for LGPS funds in England and Wales even if inflation “only” reached 7% in 2022 and then immediately reduced back down to more “normal” levels. It now seems inevitable that this cost will be much higher.

Poll 2: How long do you think high UK inflation will persist?

Our poll of LGPS attendees showed half expected high inflation to last 1-3 years with the other half expecting inflation to stay elevated for three years or more.

With such a challenging outlook, funds should ask themselves whether their investment portfolio is resilient enough to react to this and deliver the required returns to sustain a reasonable level of contribution requirements. Looking at this in a holistic way should be central to the valuation discussions this year.

Climate risk and Covid-19

Climate risk and the implications of the pandemic also need to be examined in an integrated way to understand the correlation of risks across the spectrum.

Many funds have rightly focused on investment strategy in their work on climate change and transition risk, but the impact on funding and employer affordability is yet to be explored. For the 2022 valuations, it is expected that funds will be required to carry out analysis to consider the potential implications for funding of different climate change transition scenarios.

Alongside this, funds should be mindful of the potential implications of climate change transition for different types of employers in the fund – for example, the cost of making regulatory changes linked to climate change and investment more generally to improve energy efficiency and change the way services are delivered. This is happening now with implications for affordability and longer-term covenant.

The crisis in Ukraine and the rising cost of living also have potential consequences for the outlook for climate change. On the one hand, the crisis could accelerate efforts to reduce reliance on oil and gas and invest in renewables. On the other hand, there are signs of political pushback in the UK against green measures that increase short-term costs for households.

For the 2022 LGPS valuations, Covid-19 impacts continue to be an important consideration for the funding strategy. A key aspect to consider with your fund actuary will be the potential impact on life expectancy and ill-health for pension liabilities. However, as for the other areas discussed in our webinar, the pandemic has also had consequences for the broader economy with the potential to affect future investment returns and employer affordability. For example, due to an increased need for, and cost, of social support.

Managing the message

While we often talk about the position for funds as a whole, in practice they comprise many individual employers, each with very different individual characteristics. This means employers in the fund will be impacted differently by the issues above.

We noted in our webinar that while larger employers are likely to have seen strong improvements in balance sheets since the 2019 valuations, other employers, such as academies, with typically younger members, could be facing pressure to increase contributions. This creates challenges in communicating the funding position to employers and those difficult conversations are likely to be even more problematic as a result of this increased uncertainty and rising pressures.

Poll 3: How are you planning to communicate with employers as part of the 2022 valuation?

Our third webinar poll found that only one in five funds had started discussing potential outcomes with employers.

It’s important to start the communication process now having conducted the right analysis of potential impacts to different types of employers so that the valuation outcomes can be managed effectively.

The 2022 valuations were never going to be as straightforward as initially expected but they will be made more challenging due to the inflationary environment we are facing.

Managing uncertainty

Given the challenging outlook, in considering strategy and valuation outcomes, funds should also ask their fund actuary to prepare scenario analysis to test resilience to downside scenarios. Key questions include:

- What if inflationary pressures are sustained for longer than expected?

- What if life expectancy improves faster than expected?

- What could different climate change transition scenarios mean for future funding levels?

Funds should consider the answers in the context of how employer affordability may also be impacted under the same scenario.

In this way, funds will have better insight into the resilience of their strategy and can seek to engage the larger employers – particularly those seeking contribution reductions – in a two-way dialogue about funding outcomes and sustainability of contributions beyond the 2022 valuation.

The key aims for LGPS funding are for stable and affordable contributions taking into account intergenerational fairness between current and future taxpayers.

The 2022 valuations were never going to be as straightforward as initially expected but they will be made more challenging due to the inflationary environment we are facing. Balancing sustainability of contributions and employer affordability – both now and over the longer term – and communicating the position with employers is paramount to achieving the right contribution outcomes.

Funds should make sure they enter the challenging conversations with the right information and focus to ensure that this tricky period can be managed in an effective way.

Michelle Doman is senior LGPS actuary at Mercer.

—————

FREE weekly newsletters

Subscribe to Room151 Newsletters

Room151 LinkedIn Community

Join here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel