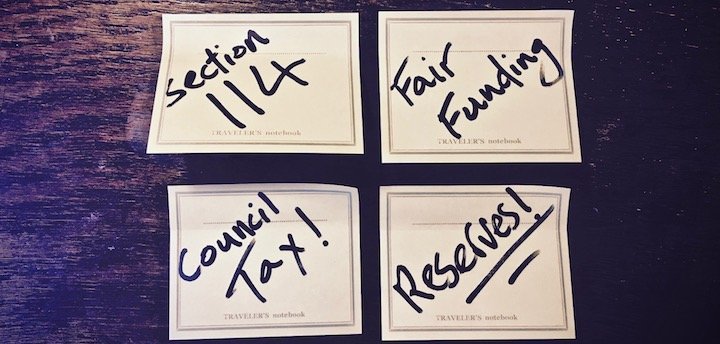

In the space of two weeks, five councils have warned that they face potential section 114 notices. Aysha Gilmore explores how this could impact the local government sector and why so many are unfolding in quick succession.

The authorities which have warned that they face issuing a section 114 notice in the near future include Kent, Guildford, Hastings, Southampton and Bradford. This is as a result of the dire financial situation that they currently face.

Of the councils mentioned, the most likely candidate for an s114 and perhaps government intervention is Southampton, according to Richard Harbord, former chief executive of Richmond and Hammersmith & Fulham councils. He argues that a key indicator for this is that the authority is already having discussions with central government over their financial situation.

Looking at the wider picture of local authorities’ accounts for 2022/23, it would seem these councils are not alone, and as the year unfolds it will not be surprising if more authorities warn that they are also at risk.

The spate of warnings of trouble ahead follows on from the high-profile financial failure of Woking Borough Council, which was put under government intervention in May and issued an s114 in June. This was an issuance which many people have argued will have ramifications for the whole of the local government sector.

So, in the wake of Woking’s s114, and if all five of these councils – and/or others – do end up issuing a section 114 notice, what does this mean for the future of local government?

Restricting the power of councils?

Nathan Elvery, founder and managing director of Imagine Public Services, says that this could potentially influence more controls being placed on the sector and the government restricting the power of councils. A spate of s114s could mean that services are removed from local government and placed elsewhere.

Talking to Room151, he said: “More commissioners being sent into councils are likely, and more locally agreed solutions negotiated with each council.

“We have seen already the government’s solution to this with the councils that have already issued an s114, so more of the same is likely in the short term. I think the government knows it has lost the next general election, so they will be in a holding pattern until they can be in opposition.”

However, Elvery stated that this could be an even greater concern for councils as “a government on the way out is a dangerous thing as they still have enough time to change things for the sector”.

More government intervention

Elvery’s opinion was also shared by Joanne Pitt, local government policy manager at CIPFA, who suggests that more government intervention could be likely.

“The recent spate of s114s being issued is deeply troubling for the local government sector. Looking ahead, it is highly possible that other councils are also at risk – but it is important that we recognise the different reasons that sit behind these cases and use this knowledge wisely.

“Inevitably it will be the taxpayer that is left to foot the bill if the government is forced to intervene and support the council. Intervention is costly and weakens the reputation of the sector,” she explains.

What is driving councils to s114s?

So, following on from Pitt’s point, what are the reasons behind local government being driven to the s114 cliff edge?

In the case of Woking, the authority issued a section 114 notice due to its unaffordable level of borrowing, which was taken out to support its investments in commercial property.

Dan Bates, director at LGimprove, highlights that analysis of the 2022/23 accounts has shown that some councils are in financial trouble due to their high level of borrowing, which is exposed to continuing interest rate increases.

But he also argues that another key reason is that local authorities’ reserves are “depleting at an unsustainable rate”. This could be linked to the lack of sufficient funding from the government and its failure to undertake a fair funding review.

Michael Hudson, president of the Society of County Treasurers and executive director of finance and resources at Cambridgeshire County Council, argues that although interest rates are impacting costs, the main reason for these five councils facing financial difficulty is underfunding.

Talking to Room151, he stated that for years government funding has been “well below the pressures we [local government] face”. “As a result, a number of councils are facing difficult choices against a backdrop of continued use of reserves to manage these pressures,” Hudson says. “A funding review delayed for nearly six years with no end in sight is starting to have an effect.”

Therefore, Hudson argues that for this reason the recent spate of local authorities warning that they could face s114s is a “very different kettle of fish” to the situations that the likes of Woking, Slough and Thurrock found themselves in.

15th Annual LATIF & FDs’ Summit – 19 September 2023

250+ Delegates from Local Government & Investment

Councils in trouble due to lack of fair funding

Bates adds that the fair funding review is unlikely to happen in the next two years and therefore he expects to see more councils in financial difficulty, “particularly those whose spending power has fallen behind since the government abandoned its funding formulae over ten years ago”.

He states that LGimprove’s analysis is starting to show links between financial health and the existing funding system.

“Smaller local authorities and those with increasing needs and/or low tax bases will be worried not only by their financial position but at the limited prospects for improvements to funding in the near future,” Bates explains.

Therefore, according to Bates and Hudson, the reason behind the recent spate of potential s114s is due to a lack of fair funding within the local government sector. Something that can only be addressed by central government.

Pitt also suggests that while funding is a major issue, “it is not helped by weakness in areas such as governance, which is preventable”.

“Long-term stable funding from central government, good financial management, strong governance and following the Prudential Code are all important parts of the jigsaw,” she says. “With all these pieces in place, local authorities will be in a stronger position to manage future risks – however that is not to say in all cases it will be enough.”

Ultimately, it looks like the repercussions of the government delaying the fair funding review for councils are starting to become much more evident. And unfortunately, it looks like local authorities and taxpayers are paying the price.

—————

FREE weekly newsletters

Subscribe to Room151 Newsletters

Follow us on LinkedIn

Follow us here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel