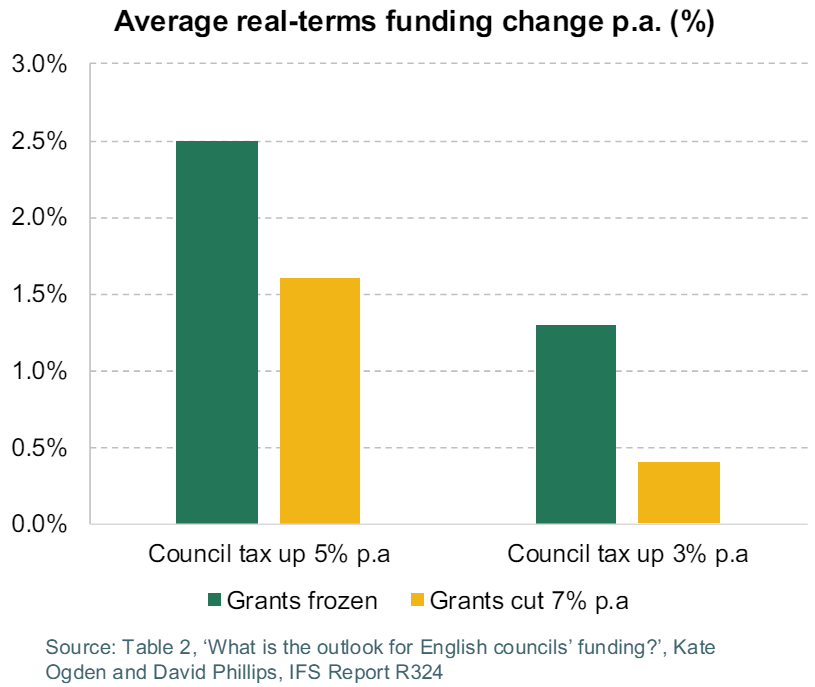

Even the most optimistic scenario for a real-terms funding increase of local government in the next parliament will fall well short of that needed to maintain service provision, according to analysis conducted by the Institute for Fiscal Studies (IFS).

With grants frozen and council tax up 5% per annum, a real-terms funding change of 2.5% per year, might be expected, the IFS said. This compares to the 4.5% real-terms increase the Local Government Association estimates will be needed if spending pressures continue to rise as quickly as in recent years.

The most pessimistic scenario outlined by the IFS suggests less than half a per cent year-on-year growth, however.

At a press briefing in London today (24 June), the IFS also noted that both Labour and the Conservatives had proposed to expand support for adult social care in their manifestos – but funding announced in 2021 has been reallocated, meaning it is no longer in baseline figures.

The IFS estimated that parties’ social care plans would need at least £4bn a year extra in funding.

At the briefing, the IFS suggested that the next government – whichever colour it is – appears to be relying on optimistic growth forecasts to avoid having to address an inevitable shortfall in the funding of public services.

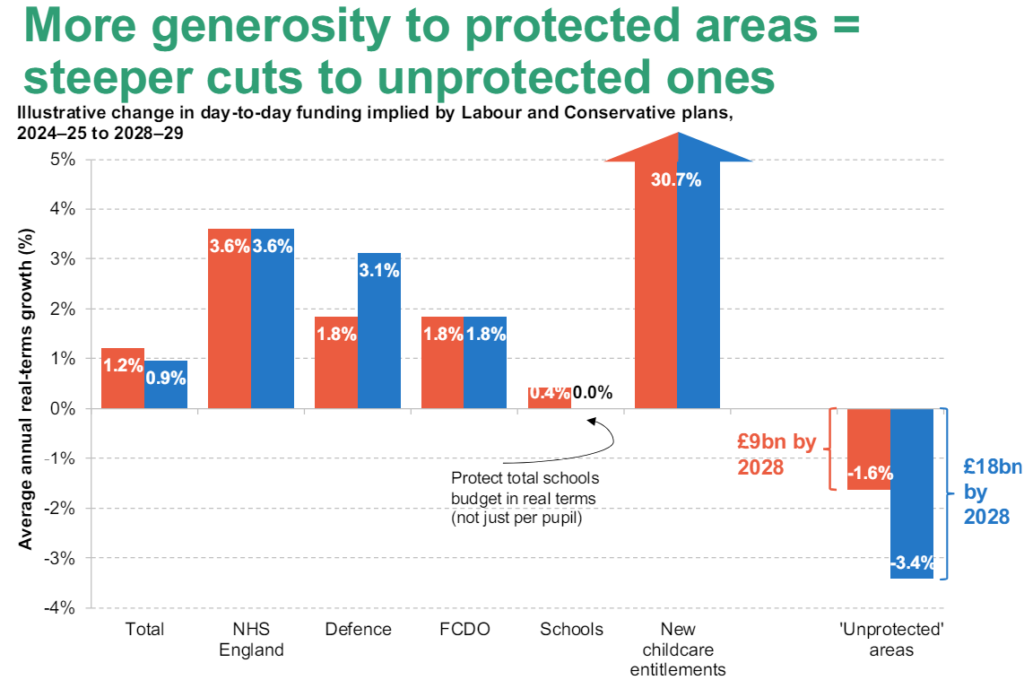

Local government and other unprotected areas of spending could lose out given plausible settlements for the NHS, defence, and childcare, with likely cuts of “somewhere between £10 and £20bn a year”.

Last week, the IFS revealed that existing overall spending plans as outlined in manifestos imply these ‘unprotected’ services could be cut by 1.9–3.5% a year in real terms between now and 2028–29.

Adding more detail, the IFS said today that the main parties’ manifestos leave us with “not a clue” for how the next government would address a potential crisis in funding of local government, and no sense of how far up or down the list of priorities local government – or any other sector – is.

While both main parties pledge multi-year funding settlements, their manifestos are “silent” on how much funding will be provided.

OBR growth forecasts plus 0.5% would potentially mean the government avoiding £30bn in cuts, the IFS analysis found.

But should those forecasts not materialise, the government would likely have to increase taxes or break its fiscal rules. OBR forecasts minus 0.5%, which would be in line with Bank of England forecasts and some financial consultants, would weaken public finances by £30bn.

And any growth and resultant benefits by way of “better and stable” policies would take time to emerge, the IFS added.

“A key question to ask of those seeking our votes on 4 July is how would they respond to such bad economic news. Put taxes up by more? Deepen those cuts to spending? Or push back the date at which debt is forecast to fall? We have not been told. And a clear lesson of the last Parliament is that bad shocks do happen. Is it so unreasonable for us to be given a hint of how they would prioritise before polling day?” asked IFS director Paul Johnson.

He described a “conspiracy of silence” that had been maintained by all parties. “Regardless of who takes office following the general election, they will – unless they get lucky – soon face a stark choice. Raise taxes by more than they have told us in their manifesto. Or implement cuts to some areas of spending. Or borrow more and be content for debt to rise for longer. That is the trilemma,” he said. “What will they choose? The manifestos have left us guessing.”

Johnson concluded that the manifestos left voters “guessing” over policy on tax and spending, with plans to improve public services “essentially unfunded”.

“On the big issues over which governments have direct control – on how they will change tax, welfare, public spending – the manifestos of the main parties provide thin gruel indeed. On 4 July we will be voting in a knowledge vacuum,” he said.

“If – as is likely – growth forecasts are not revised up this autumn, we do not know whether the new government would stick roughly to the day-to-day and investment spending totals set out in the March Budget, or whether they would borrow more or tax more to top them up. If they were to stick to spending plans we do not know what would be cut. If taxes are to go up, we do not know which ones. We certainly don’t know how they would respond if things were to get worse.

“The choices in front of us are hard. High taxes, high debt, struggling public services, make them so. Pressures from health, defence, welfare, ageing will not make them easier. That is not a reason to hide the choices or to duck them. Quite the reverse. Yet hidden and ducked they have been.”

See Room151’s Municipal Missions Manifesto series for articles from local government sector voices on resetting the relationship between national and local government under the next administration. All articles in the series so far can be viewed here.

—————

FREE bi-weekly newsletters

Subscribe to Room151 Newsletters

Follow us on LinkedIn

Follow us here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel