The government’s spending watchdog has urged the government to review the regime governing councils’ capital spending, concluding that their activity in the commercial property market raises questions about whether it is still fit for purpose.

The National Audit Office today published its report into the practice of councils using cheap borrowing from the Public Works Loan Board to undertake revenue-raising real estate deals.

The report said that the recent trend for such activity raises “fundamental questions” about aspects of the prudential framework, which was introduced in 2004 to give councils greater freedom over their capital spending.

According to the NAO report: “When the framework was created, borrowing was intended primarily to be used to support service provision directly rather than to generate income.

“The capacity of an authority to borrow was restricted by the affordability of the resulting debt costs given their income from local tax and government grants.

“Now, where borrowing (non-housing revenue account) is frequently for property purchases that generate a return that meets the debt costs, the duty to set an affordable limit for borrowing, which lies at the heart of the framework, is no longer a constraint in the same way.”

Thus, it said, the duty to consider affordability underpinning the framework “is no longer effective in constraining each authority’s overall borrowing by keeping it linked to their ability to fund borrowing costs from government grant or local tax”.

It pointed to some authorities which it said were taking on general fund debt “in high multiples of core spending power and view it as affordable because of the income their commercial property investments generate”.

The permissive nature of the framework is now being tested by council activity, the NAO said.

“The experiences of recent years have shown that in the context of sustained financial pressure, some authorities, perhaps inadvertently, will test the limits of compliance,” the report said.

“The position set out in this report raises questions about the extent to which the department (Ministry of Housing, Communities and Local Government) and HM Treasury can rely on the prudential framework in its present form to support value-for-money decision-making in the current legal and financial context.”

To address the issue, the MHCLG, working with the Chartered Institute of Public Finance and Accountancy, “should review the prudential framework, its oversight and intervention arrangements, and underpinning data to ensure they remain fit for purpose in the context of an increase in local authority commercial activity”, the report said.

This review should examine whether “varying interpretations of the authorities’ borrowing and investment powers in the sector are having an impact on the resilience of the prudential arrangements”, it said.

The NAO also said that the nature of the framework means it can be slow to change, and questioned the impact of revisions to the investment code and guidance introduced in 2018.

It said that “levels of commercial property acquisition remained largely unchanged up to September 2019, 18 months after the first elements of the new guidance came into force and six months after the last elements came into force”.

However, it said that although the scale of investments made outside a local authority’s own area had stayed roughly stable, “these acquisitions are now more likely to be in-region rather than out of region”.

To protect against risks to future value for money, the MHCLG should “strengthen framework oversight and develop methods for more timely, flexible and targeted intervention when required”, the NAO said.

Responses to the NAO report from the sector

“Councils are responsible for managing their finances and must properly consider the risks and opportunities when they make commercial decisions. We will carefully consider this report in our work as stewards of the local government finance system.”

MHCLG spokesperson

“While the avoidance of all risk is neither appropriate nor possible, councils should have regard to the CIPFA Prudential Code to ensure they do not take on an inappropriate amount of risk when exercising their powers. There remains a question for the sector about what happens in the few cases where councils do not have regard to the code, which the government will likely address at some point.”

CIPFA chief executive Rob Whiteman

“To address funding cuts and future funding uncertainty, it is right that district councils seek new sources of revenue to plug funding gaps through prudent investments that manage risk, protect local services on behalf of their taxpayers and help achieve the wider ambitions for their places. Unless districts secure alternative sources of revenue, essential services that our local communities rely on face being cut back or stopped altogether.”

Sharon Taylor, District Councils’ Network finance spokesperson

“When making investments, councils follow the strict rules and assessments to ensure they invest wisely and manage the risk of their investments appropriately.”

Richard Watts, chair of the Local Government Association’s resources board

“Given local authorities have faced such big cuts, it understandable that many might take part in risky investments to get more money in. However, a fourteen-fold increase in spend on commercial property raises serious alarm bells. Most of these acquisitions by value are being made by a small number of authorities, and activity is concentrated in the South East. The department needs to take stock and ensure that there is protection for local taxpayers from local authorities acting as investment bankers.”

Meg Hillier MP, chair elect of the Committee of Public Accounts:

Key report data

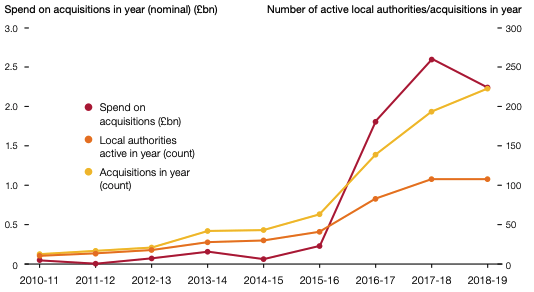

- The NAO estimated that councils spent £6.6bn on commercial property between 2016/17 to 2018/19 – 14.4 times higher than the preceding three years;

- A maximum of £6.0 billion (91.2%) and a minimum of £2.5 billion (38.5%) of this was funded through prudential borrowing;

- 80% of the total spending was made by just 49 local authorities;

- Authorities in the South East accounted for 52.9% of acquisitions by value over the three years;

- 105 authorities (29.8%) spent at least £10m on commercial property over the period;

- 47.9% of all acquisitions by value in 2018-19 were outside local authorities’ own boundaries.