The Conservative Party has promised a new review of business rates to level the playing field between digital and “analogue” businesses.

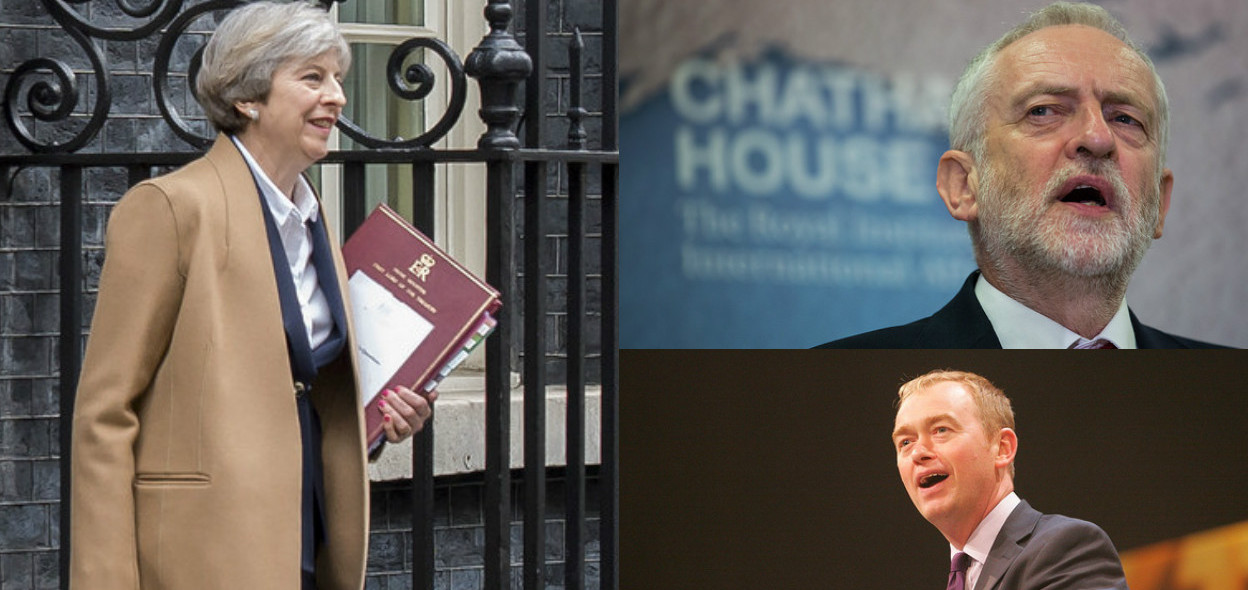

In its 2017 general election manifesto, released today, the party said that, in the wake of the furore caused by the recent revaluation process, it will take a root-and-branch look at non-domestic rates.

The move comes following growing concerns that digital businesses, which tend to have smaller property footprints than traditional firms, are not paying their fair share of local tax.

The manifesto said: “We will make sure that revaluations are conducted more frequently to avoid large changes to the bills that businesses face, and explore the introduction of self-assessments in the valuation process.

The manifesto said: “We will make sure that revaluations are conducted more frequently to avoid large changes to the bills that businesses face, and explore the introduction of self-assessments in the valuation process.

“To ensure the system is sustainable for the future, we will also conduct a full review of the business rates system to make sure it is up to date for a world in which people increasingly shop online.”

The Labour Party, currently trailing in the polls, also promised a review of business rates, along with council tax, in its manifesto, released earlier this week.

It said that it would, if elected, “consider new options such as a land value tax, to ensure local government has sustainable funding for the long term”.

Meanwhile, the Liberal Democrats also promised a shake-up of business rates, making small businesses the priority for future business tax cuts.

The party’s manifesto said that it would focus on “prioritising reforms that recognise the development of the digital economy, lessening the burden on smaller businesses, and ensuring high streets remain competitive”.

In addition, it would also consider the implementation of land value taxation.

On the thorny issue of funding for social care, the Conservative manifesto pledged to include the value of family homes to be taken into account with other assets and income when calculating care costs.

On the thorny issue of funding for social care, the Conservative manifesto pledged to include the value of family homes to be taken into account with other assets and income when calculating care costs.

In addition, any future Conservative government would raise the means test threshold from £23,000 to £100,000.

In contrast, Labour would increase funding for social care by a further £8bn over the life of the next Parliament, including an extra £1bn for the first year, as well as creating a National Care Service.

The Liberal Democrats would impose a 1p rise on the basic, higher and additional rates of income tax to raise £6bn additional revenue, which would be ringfenced to be spent only on NHS and social care services.

The Liberal Democrats would impose a 1p rise on the basic, higher and additional rates of income tax to raise £6bn additional revenue, which would be ringfenced to be spent only on NHS and social care services.

In addition, it would create a cross-party convention to look at the long-term funding for the system.

The areas of business rates and social care are not the only promises by the three main political parties that would affect council finances.

Other highlights include:

Conservative Party

- Beefed up powers for local enterprise partnerships, city regions and combined authorities, including responsibility for co-ordinating local industrial strategies.

- Greater clarity on devolution so that “all authorities operate in a common framework”.

- “Borderlands” growth deal for councils in the North of England and south of Scotland.

- Shared Prospertity Fund to o reduce inequalities between different parts of the country.

- Legislate to allow employees to mutalise, where appropriate, in the public sector

- Increase the overall schools budget by £4bn by 2022

- Publish operational performance data of all public-facing services

Labour Party

- Create a new National Transformation Fund to invest £250bn over 10 years.

- Require suppliers to local government to meet new standards covering worker rights, the environment, prompt payments and training.

- Establish a National Investment Bank aimed at bringing in private capital finance to deliver £250 bn of “lending power”.

- Create a network of regional development banks and locally accountable energy firms.

- End the public sector pay cap.

- Scrap 2014 TUPE changes.

- Removal of restrictions that stop councils building homes and scrap the Right to Buy.

- Ensure there is no drop in European structural funding as a result of Brexit until 2019/20.

Liberal Democrats

- Establish a government process to deliver greater devolution of financial responsibility to English local authorities.

- End the 1% cap on pay rises in the public sector.

- Move towards single place-based budgets for health and social care by 2020.

- Reverse all cuts to front-line school and college budgets.

- New direct spending on housebuilding to help build 300,000 homes a year by 2022.

- £5bn of initial capital for a new British Housing and Infrastructure Development Bank, using public money to attract private investment.

- Drastically reduce the powers of central government ministers to interfere in democratically elected local government.

- Invest £2bn in innovative solutions to ensure the provision of high-speed broadband across the rural UK, working with local authorities to provide grants.