Kate Ogden writes the government has addressed most of the short-term Covid-19 financial pressures facing English councils, but problems loom in 2022-23 and the years following.

As we enter the second year of the Covid crisis, we look back at the financial effects on councils, and forward to the future given the plans set out by the government in the chancellor’s recent budget.

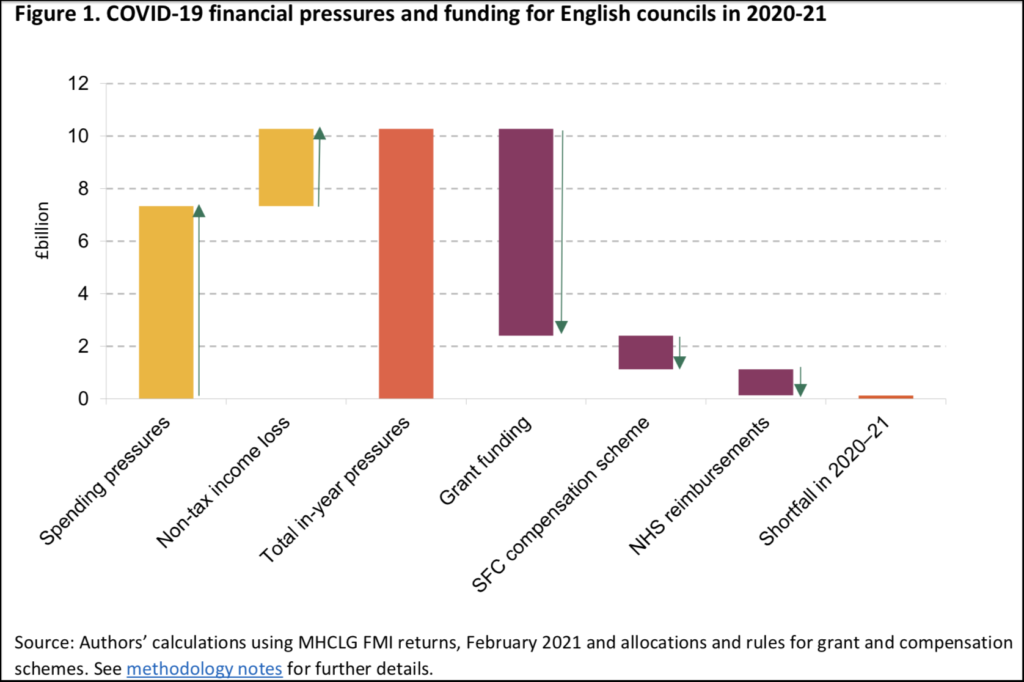

In February, councils were forecasting that they would have spent £7.3bn this year responding to the pandemic, and meeting rising costs and demands for existing services. Along with forecast losses of £2.2bn in sales, fees and charges (SFCs), and £0.7bn in commercial and other income, this means a massive pressure on budgets this year of £10.3bn—one fifth of pre-crisis annual revenues.

Councils will have received £4.6bn in general-purpose grants from MHCLG, and a further £3.3bn in other grants by the end of the financial year. This includes £0.7bn from the start of January for outbreak management during the third national lockdown. They’ll also have had some adult social care costs reimbursed by the NHS, and we estimate government will compensate for around £1.3bn of SFCs losses. This brings total support in 2020-21 to £10.1 billion. Across the sector as a whole, therefore, government support broadly matches the latest forecasts for pressures, with a remaining aggregate funding gap of just £100m.

Rosy

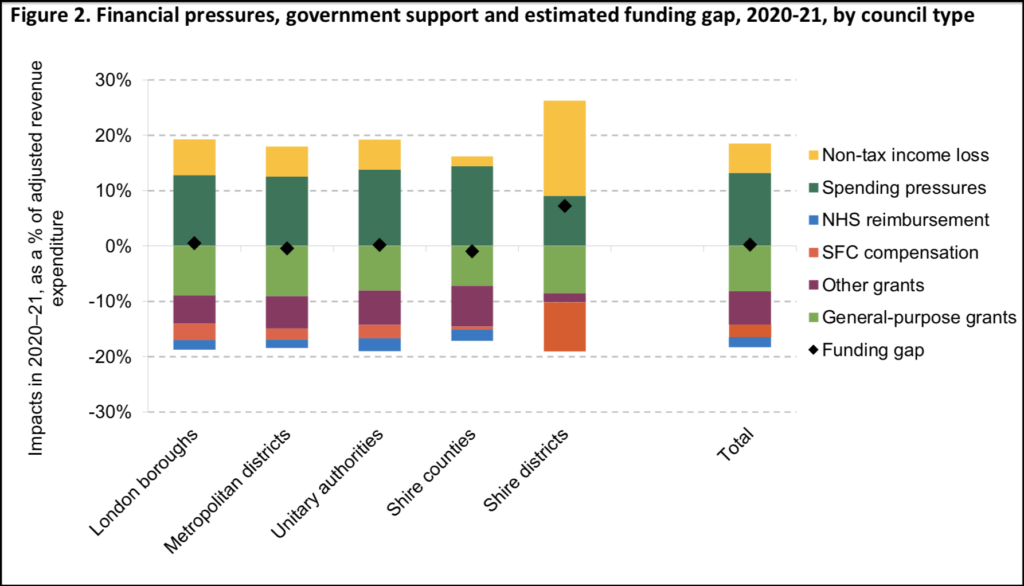

Of course, the uneven financial pressures mean the view from some town halls will be much less rosy. Three out of ten councils can expect to receive more funding in 2020-21 than their forecast for in-year pressures. That leaves 233 which are collectively ‘under-funded’ by a total of £800m— equivalent to 3.2% of their pre-crisis revenues.

Those councils will have to draw down reserves (if they have them), request special borrowing powers from the government, or seek savings. More than half of councils, responding to a National Audit Office survey, had already made in-year savings from service budgets.

Shire districts are particularly likely to find themselves in this situation. They are the only type of council which, in aggregate, have a notable remaining funding gap, of around 7% of pre-crisis revenues. They have faced much larger relative falls in income from SFCs and commercial activities, for which the government is only providing partial compensation. And while other types of council have faced greater spending pressures, these have been largely met through specific Covid grants.

Turning to the coming financial year, the government is providing significant funding for Covid-19 pressures—around £3.5bn—albeit far less than over the last year. And MHCLG argues that allowed council tax rises and a £300m rise in non-Covid grant funding at the settlement represent a further £2.2bn rise in funding.

In reality, the increase is likely to be at least several hundred million pounds smaller. Not all councils will make use of the full 5% council tax increases allowed—recent estimates from CIPFA suggest the average increase will be 4.3%. And the council tax base is unlikely to be as large as MHCLG has assumed, as rising unemployment pushes up the cost of means-tested council tax discounts.

Even so, if the pandemic largely abates by the summer, the funding provided in the coming financial year may be sufficient to address the pressures from Covid. If it is not—if it takes longer to bring the pandemic under control, or spending on PPE and test and trace remains high—there’s scope for government to dip into its remaining Covid-19 reserves.

Pressures

But the outlook for 2022-23 and beyond looks very challenging. The government has not yet allocated any funding to address longer-term impacts of the Covid-19 crisis on the demand for and cost of public service provision.

Evidence from past economic crises suggest rising levels of ill-health and child abuse will increase pressures on a range of council services. And this isn’t an ordinary economic crisis, with lockdowns impacting mental health and education, and the risks from “long Covid” still poorly understood.

Moreover, local government income may be depressed in the long-term if changes in shopping and commuting habits persist. And all this comes on top of existing financial pressures.

The budget earlier this month doesn’t provide much reassurance. As explained by a colleague, day-to-day funding for unprotected departments, which includes MHCLG, is set to fall by 3% in real-terms between 2021-22 and 2022-23 under current plans. And compared to pre-Covid plans set out in March 2020, funding will be around 8% lower in 2022-23 and beyond.

Unless the chancellor chooses to top-up his spending plans at the coming spending review, the next few years therefore look very challenging. Even if MHCLG finds the cash to increase grant funding in line with inflation, council tax rises of at least 5% would be needed to meet underlying cost and demand pressures with any longer-term Covid-19 pressures coming on top.

Councils in poorer areas may face particular problems: their populations are more vulnerable to the longer-run effects of the crisis; and they are less able to raise revenues themselves, especially from council tax, than richer areas.

These issues mean councils’ financial future will be highly dependent on not only the spending review but also the fair funding review, aimed at updating and improving the method for allocating funding between councils.

Uncertainty about how the Covid-19 crisis will affect the spending needs and revenue-raising capacities of different councils will mean completing this review over the next year will not be easy. But a system for ensuring funding is allocated sensibly across councils will be even more important if the sector is to face austerity again.

Kate Ogden is a research economist at the Institute for Fiscal Studies.

__________

CCLA/ROOM151 IMPACT AWARDS INFORMATION

Read about the awards here.

Read about the seven categories here.

For submissions click here.

To read case studies of finance team impact, click here.

__________

FREE monthly newsletters

Subscribe to Room151 Newsletters

Room151 Linkedin Community

Join here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel