The Conservatives’ ‘Family Home Tax Guarantee’, unveiled by chancellor Jeremy Hunt, “would mean perpetuating the increasingly absurd situation” of basing council tax on 1991 values.

David Phillips, an associate director at the Institute for Fiscal Studies (IFS), said urgent reform of council tax was needed, not a situation where band revaluation will not take place.

Urging Labour and other parties not to “follow suit”, Phillips said Hunt had “made it harder to deliver growth-enhancing reforms to the tax system”.

The ‘Family Home Tax Guarantee’ definitively rules out revaluing and reforming council tax in England, and includes a pledge not to increase stamp duty land tax, paid when properties change hands.

The idea is to prevent any tax rises on the home, with Hunt challenging Labour to similarly rule out property tax increases. The Welsh government is considering council tax reform, but any changes have been delayed until 2028.

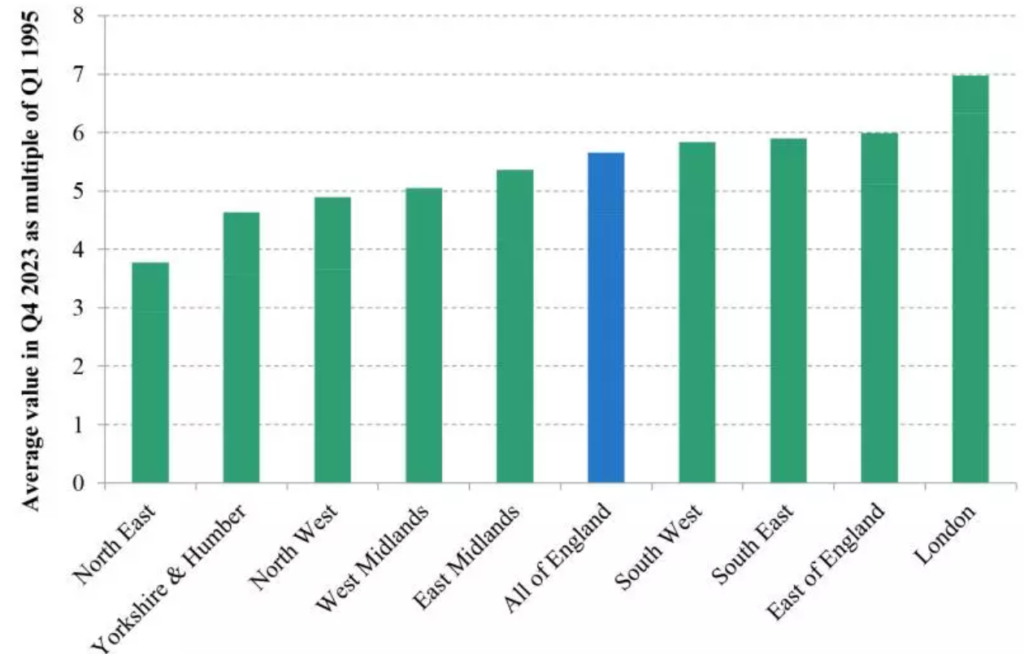

Phillips said that since 1991, house “values have increased by massively different amounts around the country, meaning that at least half are now effectively in the ‘wrong band’. Households in the North and Midlands are often in too high a band – and pay too much – while those in London and its environs too low a band – and pay too little – compared to what they would under a modernised tax.”

In short, he argued, “in its current form council tax works against levelling up”.

However, Phillips said the Conservatives’ pledge not to increase stamp duty land tax was “sensible”. He added: “It is one of the most economically damaging taxes levied by the government, significantly increasing the cost of moving and gumming up both the housing and labour market. It should not be increased – rather it should be reduced or, ideally, abolished.”

Noting that the revenue from stamp duty would be “very hard to give up”, Phillips said a “good package” would be one that “combined the abolition of stamp duty with a revaluation and reform of council tax”.

“Raising less from high-value properties via stamp duty and more from a revalued-and-reformed council tax would be fairer and better for growth,” he said. “Fairer because the tax system would no longer penalise people who move more, or whose properties value has not kept pace with the rest of the country. And better for growth because it would no longer hinder people from moving to better suit their circumstances and for work.”

—————

FREE bi-weekly newsletters

Subscribe to Room151 Newsletters

Follow us on LinkedIn

Follow us here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel