Croydon is the latest local authority to issue a section 114 notice. Experts Dan Bates and Christian Wall look at the trends underlying the council’s woes.

Christian Wall

Croydon’s section 114 notice should be put into perspective: it is only the third in 20 years and is not bankruptcy, but to prevent bankruptcy. Few industries have shown the financial resilience of councils, so local government should remain proud.

However, there are striking parallels to Northamptonshire and Hackney, suggesting lessons are not being learned. Yet again, a council has demonstrated an inability and reluctance to deliver savings. There is no excuse for the level of overspends and it is unforgivable the council found itself including already budgeted for savings in an emergency budget; a clear sign of malfunctioning financial controls. Wider failings cannot be overlooked: poor industrial relations have made savings difficult.

The council’s property investments are a factor and many will question the council’s wisdom and its skills. However, Croydon had a bevy of advisers and consultants to assist.

If there is a moral to this tale, advisers should not be incentivised through success fees and councils should be sceptical of their advice. If some councils have paid over-the-odds for properties, and they have, advisers have either been complicit or caused that to happen.

The very clear message, one that cannot be repeated often enough, is that financial management skills and oversight must be improved across the sector. Few industries allow senior managers to abdicate budget responsibility and escape accountability for financial performance, but many in local government can. Commercial skills are essential for corporate finance teams, but remain uncommon.

If s114 notices are rare, why do lessons matter? The simple answer is other councils are distressed and the current pressures they face may be the tip of the iceberg. The economic situation is perilous and the government’s finances parlous. An economic crash allied with further austerity is a very real threat that cannot be ignored. It’s better to learn lessons sooner rather than later.

Chrstian Wall is a director at PFM.

12th Local Authority Treasurers Investment Forum & FDs’ Summit

NOW A VIRTUAL EVENT + ZOOM151 Networking

Jan 20, 21 & 22, 2021

Dan Bates

The recent Croydon section 114 was followed by the usual post-event wisdom and inevitable speculation about who might be next.

The impact of Covid-19 has heaped more pressure on local councils which were already struggling to cope with austerity and social care demands, and it is now more important than ever that we pay more attention to medium term financial health.

In the Croydon Public Interest report issued prior to the s114 declaration, Grant Thornton pointed to the council’s “unsustainably low level of reserves” which have “continued to decrease in each of the previous three years”. Not dissimilar to Northamptonshire a couple of years ago as the graph below shows.

Clearly an important measure for all councils, albeit a lagging measure and symptom of poor financial health, and one that the auditors felt Croydon’s management were “corporately blind” to.

The report points to governance failing in addressing issues which are fairly common to upper tier authorities including social care pressures, dedicated schools grant and effectiveness of transformation and saving plans.

These are areas where effective strategic financial planning, budgetary control and performance management are required. For me, in these times of uncertain funding, a more radical approach to budget setting is called for which means abandoning incremental budgeting in favour of an outcomes based approach (a whole different article).

Room151’s Monthly Online Treasury Briefing

November 27th, 2020

Money market funds and deposit accounts

Watch the recording here

Half the auditor’s recommendations focussed on key capital decisions and governance with issues raised in respect of the council’s wholly-owned housing subsidiary and with commercial investments. Issues such as MRP policy and affordability of borrowing, and the governance around such decisions, have been raised.

Capital health is an important component of financial resilience and one which is undeveloped. I am not convinced that prudential framework is as effective as it might be. There are potential measures that might assist an authority to better understand investment decisions in the context of comparative capital balance sheet health, over time and with similar authorities.

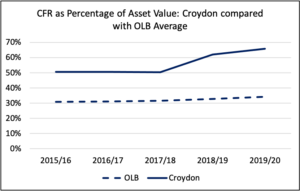

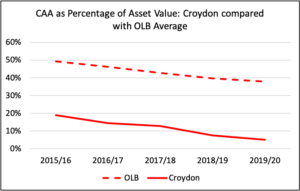

The graphs below show Croydon’s capital financing requirement (CFR) and capital adjustment account (CAA) balance as a proportion of capital asset values over time and compared with the outer London borough (OLB) average.

The capital financing requirement—which shows the amount of capital assets that are as yet unfunded— has risen sharply in recent years and is significantly higher than the OLB average. More worrying is the rapidly reducing capital adjustment account which effectively measures the equity stake in capital assets.

The significant reduction effectively means that assets are depreciating, or devaluing, at a faster rate than they are being funded, and a low and diminishing CAA balanced (coupled with increasing CFR) is an indicator of deteriorating capital health which will eventually impact on the revenue budget.

The trends in the three graphs in this article are not unique to Croydon and it is important that if the sector is to move forward then we must spend less time picking apart past failures but rather using them to improve how capital investments are made, managed and monitored.

Dan Bates provides the financial resilience service for Pixel Financial Management, a consultancy specialising in local government funding and financial management. He is also part of an expert consortium consultancy LGimprove, focussing specifically on local government excellence.

Photo: Michael Coghlan, Flickr

FREE monthly newsletters

Subscribe to Room151 Newsletters

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel