Bradford Council has increased its application for exceptional financial support by £22m from the £58m previously outlined.

The authority has previously stated that it would be forced to issue a section 114 notice if it does not receive exceptional financial support from central government in both 2023-24 and 2024-25.

15th LATIF North | York | 19 March

According to Bradford Council, the £80m now being applied for in exceptional financial support in 2023-24 reflects the “absolutely essential need for the council to maintain its reserves in this financial year” in what it described as “exceptionally challenging financial times including the continued rising pressures of children’s social care, adult social care and inflation”.

The council has applied for £140m in exceptional financial support for 2024-25, which it said would allow it “to set a balanced budget and finance the changes the council is planning to ensure its long-term financial sustainability”.

Earlier this month, savings proposals for the 2024/25 financial year were outlined as part of a three-year £40m cost-cutting programme. These included 113 staff redundancies, £60m of asset disposals, closure of a children’s outdoor centre and three household waste recycling sites, funding cuts to libraries and leisure services, and increasing council tax to 4.99%.

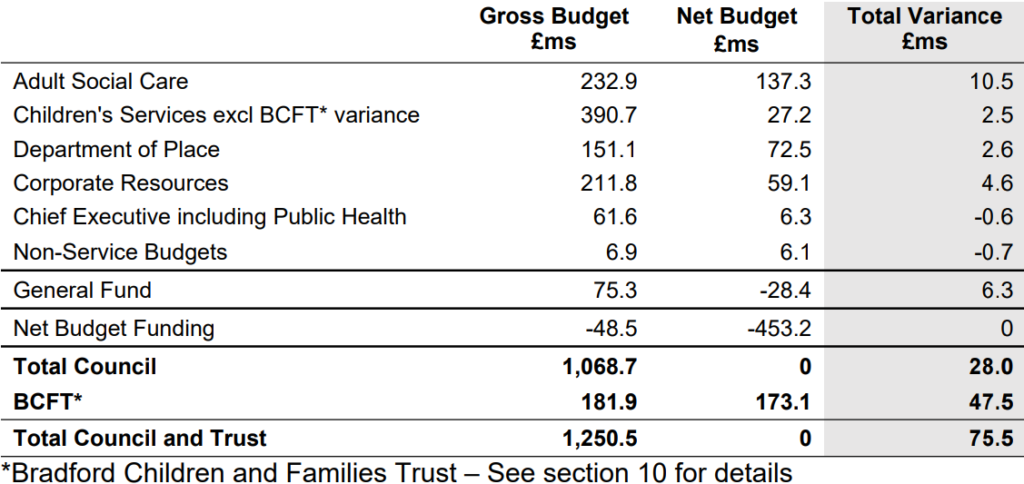

A Q3 finance position statement for 2023-24, to be discussed at a meeting of the council’s Executive on 6 February, showed that Bradford is now forecast to overspend its £453m net revenue budget for 2023-24 by £75.5m at 31 March 2024, based on forecasts calculated at the end of December 2023. The overspend is c£7.7m higher than the £68m reported at Q2.

The statement also showed that the council’s 2023-24 budget is being supported by £48m of one off reserves, so the structural gap in 2023-24 is consequently c£120m.

In an update on the council’s financial position, the need for “significant changes and financial savings” was outlined “in order to reach overall financial sustainability”.

Bradford said this would be achieved through building up reserves to an “appropriate level” along with selling assets, reviewing and reducing the capital programme, making services more efficient, and “evaluating the level at which they will be provided combined with a review programme of all council functions”.

Susan Hinchcliffe, leader of Bradford Council, noted the particular impact of children’s and adult social care demand and cost pressures, with projected spend on these services this year equivalent to 87% of the budget agreed for 23/24.

“We have been clear that the council’s finances, like many others across the country, are really challenged due to social care costs. We have asked government to invest more, particularly in children’s social care, nationally,” she said.

The additional £500m of new funding for councils to deliver social care announced recently by the government would “mean just another £5m for Bradford and for one year only”, Hinchcliffe added. “This is far lower than councils require to fund the rising levels of social need.”

She stated that exceptional financial support was “therefore the only route open to councils” and this was being negotiating now with government.

“The Children’s Trust are telling us they need £244m to run children’s services this year, yet we only raise £233m in council tax. It’s no good just plugging the financial gap though,” Hinchcliffe commented.

“The government want to see councils become smaller and employ fewer people. Ironically, to make the council smaller and more financially sustainable we have to spend more in the short term. That means spending more on digital technology for example.

“At the same time, we are being forced to look at all the services that we provide and make extremely difficult decisions about what we can continue. Inevitably these will have an impact on our residents. We have tasked officers with working on a five-year plan to move to a more sustainable financial position and we will share this as it is developed.”

—————

FREE bi-weekly newsletters

Subscribe to Room151 Newsletters

Follow us on LinkedIn

Follow us here

Monthly Online Treasury Briefing

Sign up here with a .gov.uk email address

Room151 Webinars

Visit the Room151 channel